In the current bear market, there are a lot of stocks that look cheap. Large caps, mid-caps, small-cap stocks – you name it – there are attractive opportunities.

But there is an obvious opportunity, but you are going to have to go down the market cap spectrum to access it.

Small-cap stocks are historically cheap today.

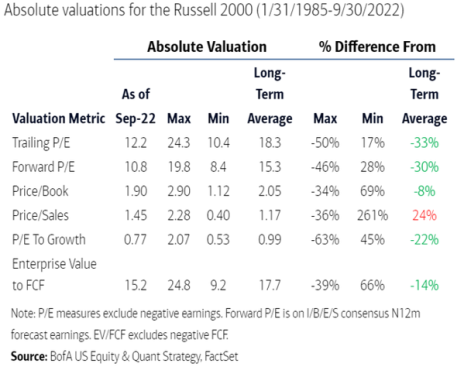

According to data calculated by Bank of America, small caps have historically traded at a long-term average trailing P/E ratio of 18.3x. Today, they trade at 12.2x.

On a forward P/E basis, small cap stocks typically trade at 15.3x. Today, they trade at 10.8x.

See the chart below for full details.

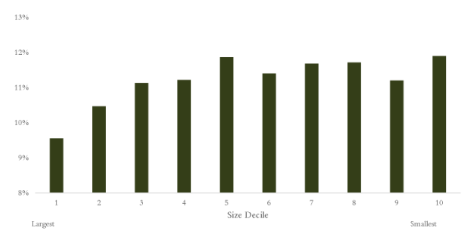

Historically, the smaller the company, the greater long-term performance.

[text_ad]

The below chart with data from 1926 to 2020 shows this pattern nicely.

Source: Carlson Cap

While you could buy the index, for example, the S&P 600 small cap index, through an ETF, I would recommend just picking stocks that look cheap yet have attractive valuations.

I’m going to give you three examples of names that are just too cheap.

Before we get into the names, I want to warn you that these stocks are micro-caps.

The definition of a micro-cap isn’t precise, but I generally define them as stocks with market caps of less than $250 million.

Micro-caps are illiquid and hard to buy. You have to be patient.

When buying a micro-cap, be sure to use a limit (never enter a “market” order!).

All right. With that out of the way, let’s discuss three stocks that are absurdly cheap.

I will go in alphabetical order.

Dirt-Cheap Small-Cap Stock #1: Cipher Pharma (CPHRF)

Cipher is a cheap, Canadian specialty pharma company that has a promising pipeline. Insiders own over 40% of shares outstanding ensuring that incentives are aligned.

Cipher’s biggest product is an acne medication (sold in the U.S. as Absorica and in Canada as Epuris). Canadian sales are growing while U.S. sales are shrinking. However, taken together the business is stable.

But the exciting part of the Cipher story is its pipeline.

It has two drugs progressing to phase III trials. (MOB-015 for nail fungus and Piclidenoson for psoriasis).

These drugs could be worth multiples of the company’s current valuation.

Despite this potential, Cipher trades at just 7x free cash flow or just 4.8x if you back out net cash on Cipher’s balance sheet.

Dirt-Cheap Small-Cap Stock #2: RediShred (RDCPF)

RediShred is a Canada-based, leading document destruction services company.

Insiders own more than 30% of the company.

It has grown revenue at a 31% CAGR and EBITDA at an 80% CAGR over the past 10 years through organic and inorganic growth.

Future growth is poised to continue yet the stock trades at just 4.7x annualized EBITDA and 6.7x annualized free cash flow.

Dirt-Cheap Small-Cap Stock #3: Zedge, Inc (ZDGE)

Zedge is an app developer that is best known for its Zedge wallpaper and ringtones which are available primarily for Android phones.

Recently, Zedge announced the acquisition of a mobile game called GuruShots. The game is a photography contest game whose users primarily come from iOS.

Management believes strongly that it can increased growth and monetization for GuruShots and drive future upside.

Despite year-to-date revenue and EBITDA growth of 34% and 44%, respectively, Zedge trades at just 2x EBITDA.

This valuation makes no sense.

Management recently announced a share repurchase authorization for 10% of shares outstanding.

In summary, nobody knows when the bear market will end. But history suggests you will do well if you invest in small and micro-cap stocks over the long term, especially given the depressed valuations currently seen in the market.

To learn more about the small and micro-cap stocks I’m following, subscribe to Cabot Micro-Cap Insider today!

[author_ad]