So, before I was Cabot’s resident growth stocks expert I used to be a big newshound in my younger days, often gobbling up whatever BIG HEADLINE news I could find. I still remember during the first two big market declines I followed (before I started at Cabot)—the 1997 Asian Contagion and the 1998 Russian Ruble/Long-Term Capital Management implosions—I was watching as much CNBC as possible and reading what they had to say in the newspaper’s business section. Even to this day I hop on Twitter a few times to quickly flip through what everyone’s talking about.

Today, I’m much less interested in all of that, partly due to time, but partly because I realized a long time ago that following the news doesn’t do anything to help if you’re using a growth investing strategy—and, actually, I found it usually hurt. Heck, in those two prior cases, the market was actually near a bottom when the news was bad and the headlines were big.

These days, of course, we’re dealing with a new set of headlines, with this month’s doozy being the inflation report. Unless you’ve been under a rock, you’ve seen the numbers, which came in faster than expected (led by food, rent and some other stuff), which in turn, crushed stocks, with the major indexes plunging 3% to 5%. I’m a trend follower, so nothing really changed with the news—my subscribers remain in a cautious stance, as they have all year, with nearly two-thirds of Cabot Growth Investor’s Model Portfolio in cash.

[text_ad]

However, as I’ve been talking about in my weekly videos (they’re free to view—you can view each week’s here or find them on YouTube) and, obviously, Growth Investor and Top Ten, the biggest thing to me isn’t the inflation report or Fed moves or interest rates or any of that.

To me, the most telling thing right now is the continued resilience of what looks like a new batch of leading, growth stocks—while the indexes are basically where they were back near the May low area, many of the fastest-growing stocks in the market are actually holding up now compared to back then.

I’ll always follow the evidence, but this is a big reason why, to this point, I continue to lean toward the view that (a) the bear phase may be ending, with most of the best growth stocks hitting their lows in May/June, but (b) obviously the bull hasn’t yet begun, with big investors doing little more than dipping in a toe here or there and waiting for some macro clarity.

Thus, I’m cautious now, but if you’re keeping your eyes open, there are more than a few high-growth stocks that look like they’re ready to go when the market does—possibly sooner than most think, such as during a typical four-quarter, year-end rally. Here are three that popped in Cabot Top Ten Traderrecently.

3 “Ready to Move” Stocks

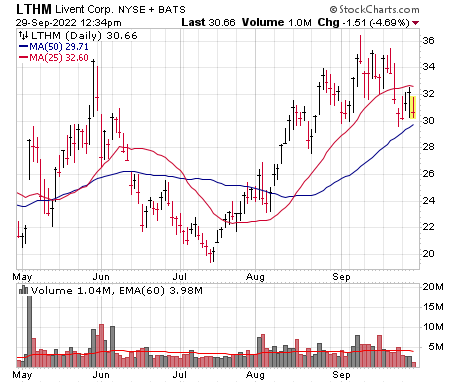

Livent Corp. (LTHM) is a mid-sized player in the lithium business, a material that’s going to be gold the next few years as the EV business ramps and battery demand goes wild. Firms are actually busy securing supply now, with General Motors inking a deal with Livent starting in 2025 but including an upfront $198 million payment. Livent is spending big to ramp supply, but sales and earnings are going wild from higher prices and there’s no sign of any letup. More impressive is the stock, which certainly looks to have bottomed—heck, it’s near new highs in this environment, which says something.

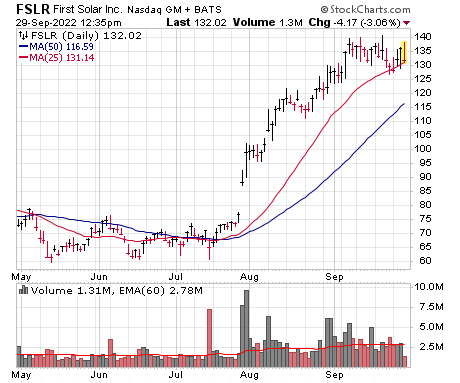

Then there’s First Solar (FSLR), which is certainly one of the liquid leaders of the solar group—which, in turn, could be the sector in pole position to lead the next bull market. The recent green energy bill promises to goose business in a big way, so much so that the company already announced a new $1.2 billion plant investment. The accumulation in this stock of late has been MASSIVE—and while that could easily lead to a rest, that power isn’t likely something that’s going away anytime soon.

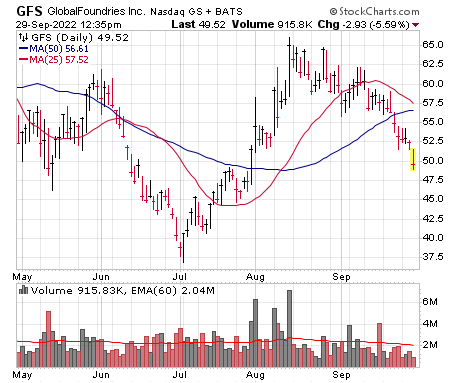

Lastly, there’s Globalfoundries (GFS), one of the largest chip foundries in the world and likely one of the biggest beneficiaries of chip onshoring back to the U.S., bolstered by the more recent CHIPS act passed by Congress. Smartphone-related business is the main piece here, which is actually a near-term headwind, but the attraction here is that Globalfoundries is expanding capacity quickly in concert with huge long-term commitments from clients ($24 billion of deals inked, including $3.6 billion of upfront payments!). Shares tried to get going in March, and after tanking with the market, soared back in July and August. More recently, shares have dipped below key moving averages but have remained well above their July lows.

Obviously, nobody is going to claim these growth stocks will start to soar higher while the market is grumpy—life just doesn’t work that way. But I think these and many others have a great shot to continue holding up … and as soon as the pressure comes off the market, having excellent runs.

[author_ad]