Slowly but surely, the market’s evidence has improved in recent weeks. No, this isn’t 1999, and the long-term trend remains clearly down (just about every index and most stocks are still buried below long-term moving averages), but believe it or not the intermediate-term trend is beginning to percolate. Granted, a lot of that is due to the market simply not going down over the past couple of months (as opposed to powering ahead), but it’s a step in the right direction.

That doesn’t mean you should be getting ready to cannonball back into the market’s pool, but you should definitely fine-tune your watch list—I predict nothing, but with the indexes down 10% to 20% from their highs and with the time factor (the Nasdaq peaked eight months ago) and with the possibility of lessening inflation (myriad commodities are down meaningfully in recent weeks), you shouldn’t rule out the next bull market move getting underway.

[text_ad]

If the next bull market does kick into gear, here are a few pointers and things to watch as stuff develops—and of course, if you want my up-to-date and stock-specific advice, you can subscribe to either one of my growth investing services (Cabot Growth Investor and Cabot Top Ten Trader).

5 Ways to Prepare for the Next Bull Market

1. You don’t have to be the first one in.

Don’t get me wrong, you want to be prepared should the buyers truly take over. But after such a big downmove, the first people in the door don’t always do the best—indeed, it’ll often take some time for the “real” leaders to emerge, possibly on their earnings reports in the weeks ahead. If you see something that is set up and looks great, go for it—but don’t force yourself into a bunch of so-so names.

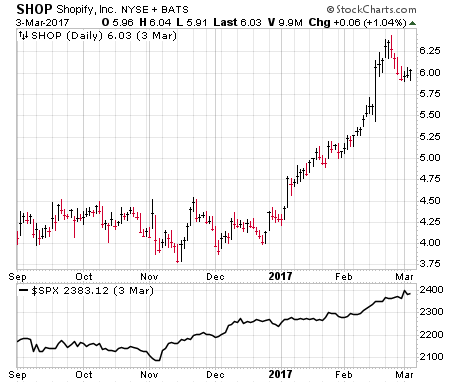

This was a different situation (the 2015-2016 bear was a wear-you-out affair, not a scare-you-out affair like the past few months), but back in November 2016, the market absolutely took off following the Presidential election, with the major indexes going vertical, led mostly by financials and old world outfits. (See bottom black line in below chart.) It wasn’t until the early part of January that Shopify (SHOP) staged its first breakout—we bought it a couple days later, and it was a huge winner for us that year.

2. Look for the best relative strength among stocks in the same group.

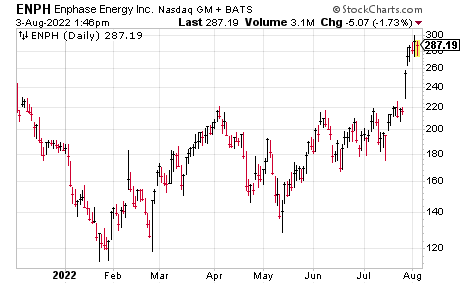

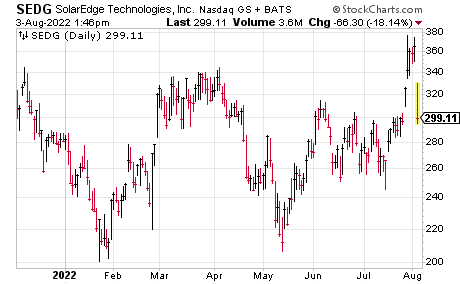

If you’re putting together your shopping list and you come across two or three names from the same group with similar stories, use the chart to pick the best one. For instance, right now there are two big players in the solar inverter market (their products are different, but the stocks do swim together): Enhpase (ENPH) and SolarEdge (SEDG). If you looked at the two charts, you’d see ENPH, while volatile, has clearly been acting better in recent months. With both having reported earnings (and SEDG responding poorly to a miss) odds favor that ENPH will work better if the group and market get moving.

3. Focus on new names …

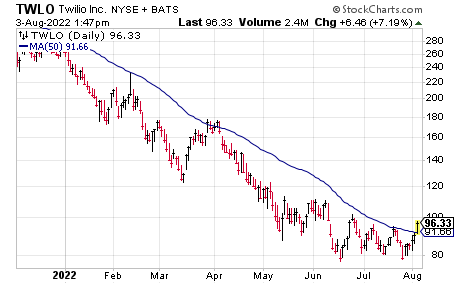

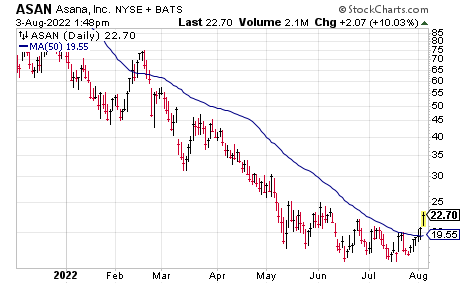

I’ve written this 1,000 times before, and will undoubtedly write it 1,000 times more. Yes, all of us still keep an eye on some old love affairs; for me, I look at names like Twilio (TWLO—owned a couple of times and made decent money each time) and Asana (ASAN—a shooting star we had late last year) here and there. But unless you’re a trader, the odds are very strongly against those names being real leaders of the next bull move. Heck, even today, as the market has perked up, these names look like splattered eggs on the floor.

Instead of those two software stocks, you’re better off looking for something new, be it in the same group or somewhere else—just like few people knew of Twilio four years ago, few today likely know the next big growth name in software.

4. … and stocks that have already been bottoming out.

This is really 3b. Buying familiar names that can’t get off their knees is probably the top mistake I’ve seen investors make coming out of past deep corrections or bear phases. Yes, some things will go from zero to hero, but your odds are far better with stocks that have at least bottomed out for a while and resisted the bear’s pull—and today, most of those are newer names.

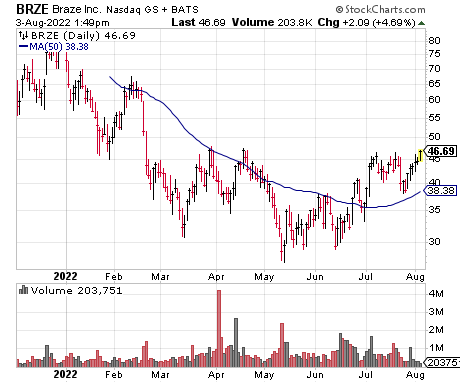

Take a look at Braze (BRZE), which was written about in Cabot Top Ten Trader a couple of weeks ago. It has a new, best-in-class customer engagement platform with tons of big clients, and the stock has effectively been bottoming out since March, with some solid action in recent weeks.

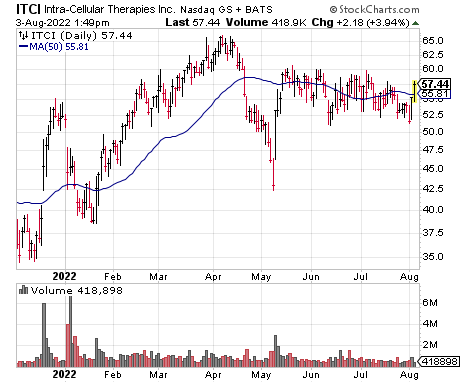

Or how about something like Intra-Cellular Therapies (ITCI), which is speculative (just one product on the market) but has actually been trading tightly in recent weeks and could break out if the market turns?

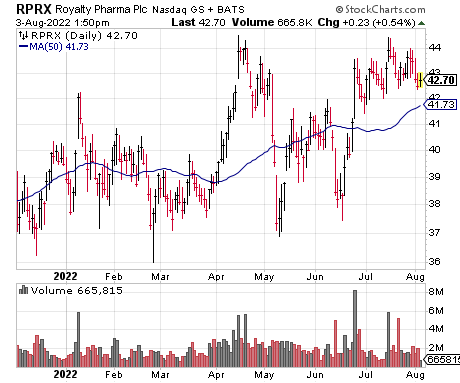

Or Royalty Pharma (RPRX), a British outfit that buys royalties in certain drugs; while not super powerful, the stock bottomed months ago and has let up a solid pattern of late.

5. Breakouts working will be the key.

This is really what I’ll be watching for, especially with earnings season revving up. While the overall evidence has improved, (a) there aren’t many stocks that are trying to break out above key, multi-month resistance, and (b) those that are usually see selling quickly show up.

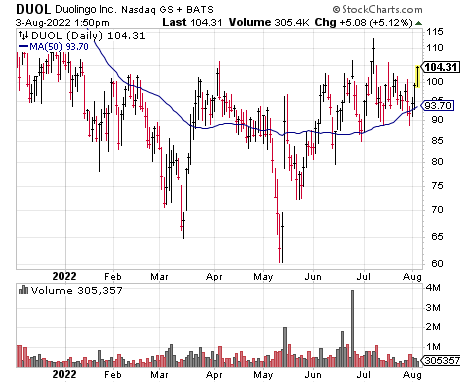

Look at Duolingo (DUOL), a software language firm that has a very, very good story, growth and great prospects—and overall, the stock isn’t looking too bad, as it’s been bottoming out for a while. But look what happened recently as the sock tried to get above resistance near 105: It did for a day, but quickly found sellers.

ENPH had done the same (see chart above), with tests of the 215-220 area leading to quick downdrafts until it resoundingly broke overhead resistance last week.

To be clear, this action is descriptive, not predictive—there’s nothing that says breakouts can’t start appearing in greater numbers over the next few weeks and that they’ll work great. But as with everything this year, I have to see it to believe it. How breakouts behave going forward will be key in determining when the next bull market truly arrives.

When do you think the next bull market will arrive? Next month? Next quarter? Next year - or later? Give us your predictions in the comments below.

[author_ad]