Investors love dividends! Last year, investors in U.S. companies received a record $574.2 billion in dividends, according to the Janus Henderson Global Dividend Index.

And we especially appreciate dividends. In 2022, dividends around the world increased by 8.4%, while companies in the U.S. boosted their dividends 7.6%. The U.S. was one of 12 countries seeing record dividend growth.

[text_ad]

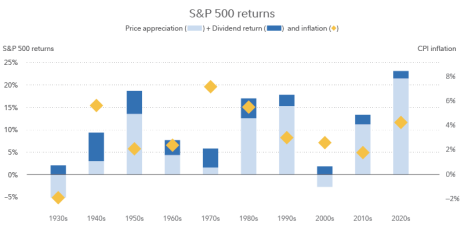

The aggregate dividend yield for the S&P 500 was 1.78%, up from 1.31% in the prior year. And for investors, that bit of cash flow growth adds immensely to their portfolio growth. In fact, according to Fidelity, dividends have accounted for 40% of stock market returns since 1930 and 54% during decades when inflation has been high.

Source: Fidelity

Dividends are so important to investors that many choose to invest in an ETF or fund that only buys Dividend Aristocrats, companies that have raised their dividends consistently for at least the past 25 years. Currently, about 67 companies meet those criteria.

I like to see companies rewarding their shareholders with dividend raises. And this year, there have been plenty of headlines noting some very nice dividend boosts from these financial institutions:

· Wells Fargo (WFC), 16.7%

· Goldman Sachs, 10%

· JPMorgan (JPM), 5%

· Citigroup Inc. (C), 3.9%

· Morgan Stanley (MS), 9.6%

· State Street Corp. (STT), 9.5%

· Bank of New York Mellon Corp. (BK), 13.5%

But banks aren’t the only companies in the dividend-boosting business. These increases to dividends were announced by:

· Greenbrier Companies (GBX), 11.1%

· United Security Bancshares (UBFO), 9.1%

· Worthington Industries (WOR), 3.2%

· John Wiley & Sons, (WLYB), .07%

· General Mills (GIS), 9.3%

· Korn Ferry (KFY), 20.0%

· Security National Financial Corporation (SNFCA), issued a 5% stock dividend

For investors who own stocks with rising dividends, there’s nothing you need to do other than sit back and collect your cash. But for an investor who doesn’t already own the shares of a company that is raising its dividend, the question becomes, “Is this a good time to buy?”

The answer is, “It depends.”

Dividends are paid from company profits. If a dividend increase is due to improved cash flows, it can be a positive sign that the company is performing well. But it may also mean that a company’s growth trajectory has slowed, and rather than using its excess profits to reinvest in more expansion, it chooses to pay a portion of them out to its shareholders. There are other reasons that a company may increase its dividends, including:

1. Maintain its dividend growth record.

2. Provide support for the stock price by increasing its dividend yield.

3. Maintain existing investors. Investors notice when a company fails to boost its dividends since most businesses do so on a regular basis.

4. Attract new investors.

Whether or not you invest in a company with an increasing dividend “depends” on your investment goals. If you are content with the reasons behind the dividend rise, and the company is fundamentally strong, then go ahead and buy in.

Meanwhile, to satisfy my curiosity, I ran all of the above companies through my model to see which ones looked attractive to buy. I came up with seven that looked interesting. And after further analysis, I found three that made my “Strong Buy” list. Here they are:

| Company/Symbol | Price ($) | P/E | Dividend Yield (%) |

Worthington Industries (WOR) | 62.26 | 10.7 | 2.08 |

JPMorgan Chase & Co. (JPM) | 148.45 | 9.55 | 2.84 |

| Security National Financial Corporation (SNFCA) | 7.66 | 6.61 | N/A |

Worthington Industries (WOR) offers value-added steel processing, manufactured consumer, building, and sustainable mobility products in North America and internationally. Its second-quarter earnings of $2.06 per share beat the analysts’ estimate of $2.04 and were higher than the $1.61 posted a year ago.

JPMorgan Chase & Co. (JPM) is the largest U.S. bank, and one of 23 that cleared the 2023 stress test, which indicates that banks “have sufficient capital to withstand a severe economic downturn.” The bank, along with Wells Fargo (WFC) and Citigroup (C) were the only S&P 500 banks whose stocks appreciated in the first half of the year.

Security National Financial Corporation (SNFCA) is in the life insurance, cemetery and mortuary, and mortgage businesses. The company does not pay regular dividends, but I included it on this list as this is the 35th consecutive year that the company has declared a stock dividend. That means existing shareholders have received more shares for 35 years, without paying for them! SNFCA joined the Russell 3000 Index earlier this year, which should boost its exposure to investors.

As always, please make sure that these stocks meet your personal investing criteria and portfolio goals. Happy investing!

[author_ad]