Today, insurance—both health and life—are much more complicated than they were when I entered the workforce. Back then, most insurance was employer-paid. Today, the majority of us has to pay the lion’s share of premiums, and the options are seemingly limitless. And wading through all the minutiae of a life insurance policy is more than most people want to do or have the time to investigate.

So, let’s try to sort through the most common insurance offerings, and help you determine which life insurance policies you may need—at each stage of your life—and which ones you don’t need or should avoid.

There are scores of different types of life insurance policies—some that terminate when you reach a certain age, others whose premiums rise as you get older, many that offer cash value options, and additional products that combine insurance and investment strategies.

[text_ad]

Most people don’t have a good understanding of life insurance. Yet, 54% of everyone in the U.S.—according to the Life Insurance Marketing and Research Association (LIMRA)—actually owns a life insurance policy. And 85% of companies offer that benefit to their employees.

Through the first part of my career, I had life insurance benefits at each of my jobs, and I just took them for granted. It wasn’t until I became self-employed that I began researching and understanding life insurance (among many other types of insurance that I didn’t know about)!

First, let’s talk about why you may need a life insurance policy.

You May Need a Life Insurance Policy If...

- You are married, or plan to wed

- Have children, or are planning to become a parent

- Owe money on student loans

- Have excessive debt

- Are fully or partially responsible for supporting your aging parents

- Are self-employed

- Have a high-risk job or dangerous hobbies.

For people who fit the above categories, life insurance can enable your heirs and those for whom you are financially responsible to maintain the lifestyle to which they are accustomed, if you should pass away.

Unfortunately, most people don’t think about life insurance until later in life. But—just like investing—the younger you are when you start, the more financial sense it makes. In investing, of course, compound interest, accruing over decades, will give you a nice nest egg when you retire. And in the case of insurance, the younger you are when you buy it, the cheaper it is—in terms of premiums.

Consequently, if you fall into one of the above categories, the best time to begin buying life insurance is when you are young, preferably in your 20s.

Now, let’s look at who doesn’t need life insurance.

You May Not Need a Life Insurance Policy If...

- You are retired

- Have no dependents

- Have plenty of assets that will cover your death costs as well as any debts that will outlive you.

There are many types of life insurance, but the two most common types of life insurance policies are term and whole life.

The Two Most Common Types of Life Insurance

Term insurance is the most common, as it fits most families’ needs. These policies are written for a specific number of years, generally one, five, 10, 15, 20, 25 or 30 years. It is designed to help your family should you pass away during your income-producing years. You can buy coverage up to millions of dollars. With level premium term life insurance, your rate is locked in for the length of the policy.

Annual renewable term life is a renewable, one-year policy that is often used for policyholders who have short-term debts or need coverage for a specific and short period of time. If you die before your term expires, the insurance pays out to your beneficiaries. If you outlast the time period, the policy expires, and there is no payout.

Whole life insurance policies are in force as long as you live, provided your premiums are paid up. In general, the premium stays the same throughout your life, you receive a minimum guaranteed rate of return based on the cash value of the policy, and the death benefit remains constant. The good thing about whole life is it does build cash value, but be aware that it is also more expensive than term life insurance.

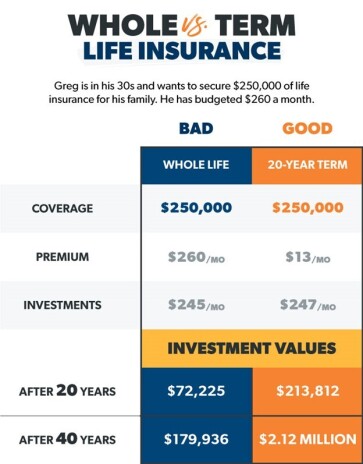

Now, many financial advisers don’t recommend insurance with cash value. Most agree that the purpose of life insurance is to provide security, protection and peace of mind for your family upon your death. Further, they believe that insurance is insurance and investing is investing. And truthfully, if you took that money you put into a cash value policy and actually earmarked it for investing, you would be better off.

The following is a chart from financial guru Dave Ramsey, which demonstrates this point.

Source: Dave Ramsey

However, I say, “Never say never,” as many folks who would buy life insurance are never going to invest or save money. Also, there are times in people’s lives when a cash value policy comes in handy.

While these are the two most common types of life insurance policy, there are many others available, and the best policy will be whichever most closely aligns with your own needs.

This post has been partially excerpted from a previous issue of Cabot Money Club Magazine. To learn more about the broader array of insurance offerings, and personal finance more generally, consider subscribing today.

[author_ad]