The best contrarian stocks often emerge from a place of serious, albeit temporary, scorn and ridicule.

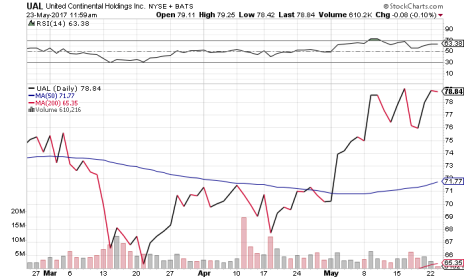

United Continental Holdings (UAL) is the latest example. Six weeks ago, United was toxic. The airline was getting universally panned for dragging a passenger off an overbooked flight after video surfaced of the violent, callous nature in which it was carried out. Predictably, a selloff in United stock followed, as shares fell from 71 to 67 in the ensuing week.

But I was confident the stock would be back. In fact, here’s what I wrote in this space on April 12:

[text_ad]

“Buying companies that investors have punished for bad news or bad PR (or, in United’s case, both) is a great way to find bargain stocks. And as of this writing, UAL stock trades at just 10 times forward earnings, is up more than 23% over the last 12 months despite Tuesday’s drop-off, and has beaten earnings estimates in each of the last four quarters. While United’s sales have been stagnant and earnings per share declined 51% last quarter, that hasn’t stopped United stock from gaining traction with investors.”

Fast forward to today, and United stock is trading at new all-time highs in the 78-79 range. Fueled by strong first-quarter earnings, UAL had recovered its post-scandal losses by the beginning of May. The string of embarrassing headlines and bad publicity lasted about a week, then Wall Street moved on to something else. Savvy investors likely pounced on UAL when it got knocked back, heeding Warren Buffett’s advice to “be greedy when others are fearful.” Those who did have been treated to about a 16% return in a little over a month.

It pays to always be on the lookout for contrarian stocks.

Those who invested in Chipotle (CMG) late last year after the stock got crushed in late 2015 and the first half of 2016 for an E. coli outbreak are being treated to a resurgence this year—CMG stock is up more than 26% in 2017. (CMG is a Cabot Benjamin Graham Value Investor stock.)

Netflix (NFLX) got pummeled in late 2011 and 2012 after the company’s failed attempt to split into two websites. The stock has since risen about 1,600%. (NFLX is a Cabot Top Ten Trader stock.)

Even Apple (AAPL) was being left for dead about a year ago after AAPL stock lost about one-third of its value in the 12 months prior thanks to some rare earnings misses and underwhelming product releases. It’s up more than 50% in the last year. (AAPL is a Cabot Benjamin Graham Value Investor stock.)

It’s hard to believe now, particularly in the case of the latter two, but all three were considered contrarian stocks at one point in the last five years. Now they’re three of the hottest stocks on the market, with an average return of roughly 29% year to date. With UAL, we can officially add a fourth stock to that list.

So keep your eye out for the next good publicly company making bad headlines. It could be a contrarian stock worth buying.

[author_ad]