Until now, retail investors as a group were anything but optimistic on the broad U.S. stock market outlook for months on end. A combination of high consumer prices, a weakening real estate market and fears of an economic recession served as a blight on financial market sentiment.

But in just the past two weeks, the widespread apprehension that prevailed for the last few months has swiftly vanished and has been replaced by a newfound bullishness and optimism for equities.

[text_ad]

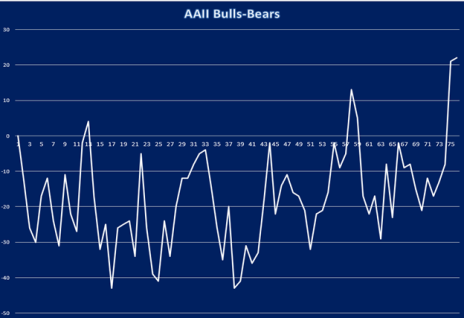

Consider the investor survey released each week by the American Association of Individual Investors (AAII). For 70 of the past 73 weeks, the AAII poll revealed more bearish than bullish sentiment. To see anything remotely close to that level of persistent bearishness, you’d have to go all the way back to the credit crisis years of 2008-2009!

Starting last week, however, a remarkable shift took place in the AAII sentiment poll. In fact, the last two surveys revealed that a whopping 45% of respondents (a high percentage by AAII’s standards) have been bullish on the stock price outlook compared with just 23% bearish. That type of dramatic opinion reversal is seldom seen; but when it happens, it always carries profound consequences for the intermediate-term (six-to-nine-month) market trend.

While it’s true that last year was a tough time for investors, stocks changed character in October and gave birth to a new bull market—a point that can be seen in the persistently strong performance of the tech-heavy Nasdaq 100 index in the eight months since then. Why then did so many participants remain so pessimistic for so long despite tech sector strength? And what accounts for the sudden change in their opinion?

The “why” part of this question is easy to discover and likely concerns some of the factors mentioned above (namely inflation, plus worries over real estate and the economy). As for what caused the dramatic sentiment shift, that’s a matter for conjecture, and there’s really no easy answer. Investor psychology is notoriously unpredictable on a short-term basis, but it has been observed by behaviorists that it often takes several months for the average investor to recognize a trend reversal—for whatever reason.

The most important takeaway, however, is that bullishness has made its return, and this is likely to have a significant impact on the market’s performance in the coming months.

In the past two decades, whenever AAII investor sentiment was mostly negative for at least six consecutive months and then suddenly reversed, the S&P 500 index was able to rally by an average of 24% over the next few months before the upside momentum waned. (This includes a 10% S&P rally even in the midst of the 2008 credit crisis!)

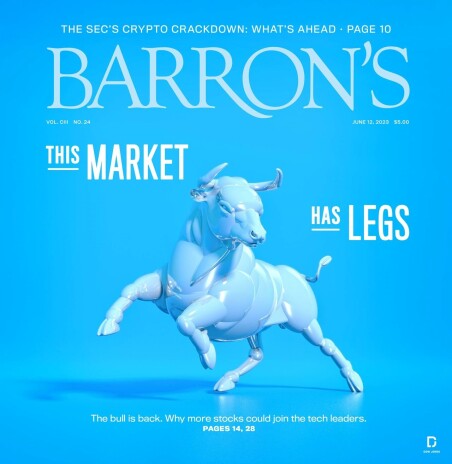

That said, many participants worry that the sudden reappearance of optimism may invite a bear raid. To make that point, they note that investors’ newfound enthusiasm was on full display in last week’s cover of Barron’s, which featured a majestic white bull on the front cover.

Normally, the appearance of a bull on the front cover of any financial news publication is treated as the proverbial “kiss of death” by market contrarians, who fear that bullish sentiment has gone to an extreme too quickly—and is therefore vulnerable to an equally quick reversal.

But history shows once again that whenever the mainstream investment outlook has been subdued for months on end before quickly turning positive, the S&P has typically outperformed in the subsequent months. (Instances of this include past Barron’s bull covers from April 2013 and February 2018, in which the S&P rose by 20% and 8%, respectively, in the seven months following the bull’s appearance on Barron’s cover.)

While it’s possible this time around the market could run into a period of heightened volatility in the very near term, the statistical approach we’ve discussed here suggests investors shouldn’t fear the bear’s return anytime soon.

What’s more, a sharp, sudden reversal from a multi-month period of negative investor sentiment to a positive outlook more often than not implies an increased willingness on the part of informed investors to embrace more risk. Smaller investors, by contrast, are usually late to the party.

All told, if history is any guide, participants should focus on opportunities to buy fundamentally sound stocks that are displaying relative strength versus the S&P, as the bull market that began last fall is still young.

[author_ad]