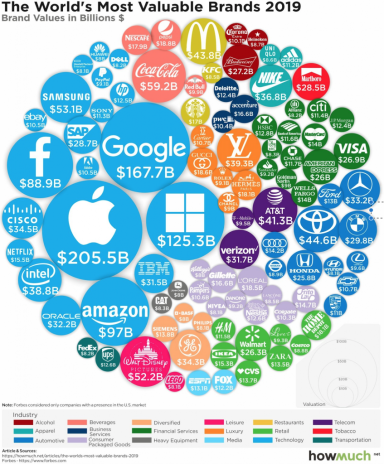

Forbes recently released its list of the world’s most valuable brands in 2019, illustrated in this colorful graphic.

The names at the top won’t surprise you: Apple (AAPL), Google (GOOG), Microsoft (MSFT), Amazon (AMZN), Facebook (FB). That’s a who’s who of the most recognizable brands in the world, so it makes sense that they’re the most valuable. For long-time investors, those public companies have been among the market’s best growth stocks. But that’s no longer the case.

You see, when a company becomes as universally recognized and valuable as the biggest bubbles on this graphic, that means their greatest period of growth is already behind them.

Apple stock isn’t going to rise 700% in three years again the way it did from 2009-2012; Google stock isn’t likely to quadruple in price over the next five years, the way it did from 2009-2014; and Amazon stock is unlikely to replicate the 426% gain it achieved in the last five years during the next five years.

[text_ad]

When so many people already use your products, your sales and earnings growth inevitably slow; similarly, when most investors already hold shares of your stock in their long-term investment portfolios, there are only so many buyers left to continue driving those share prices up.

It doesn’t mean those big brands are no longer good investments. On the contrary, those five stocks are up an average of 13.8% in the last year (with MSFT stock leading the way at +30%), more than doubling the 6.5% gain in the S&P 500. Chances are they’ll continue to outperform. But slight outperformance is not the ultimate goal as an investor.

You want home run hitters—the type of stocks that could double, triple or quadruple your money in just a few short years. We’re constantly on the lookout for the next Apple, the next Amazon or the next Google.

For the next generation of great growth stocks, let’s try looking at some of those smaller bubbles on the graphic above.

The New Best Growth Stocks?

Netflix (NFLX), eBay (EBAY), PayPal (PYPL), Home Depot (HD) and Starbucks (SBUX) are among the least valuable brands to crack Forbes’ list, all valued at less than $20 billion.

How have those stocks performed of late? They’re up an average of 23.6% in the last year, and that includes a 12.5% drop in Netflix stock. While those are all well-recognized companies in their own right, they’re growing faster than the most valuable brands. This year, those five companies are projected to grow earnings by an average of 17%. None of the five most valuable brands are expected to post better EPS growth than that in their current fiscal year; Apple and Facebook are on track for negative bottom-line growth.

On Wall Street, growth is king—especially earnings growth. The smaller companies mentioned above aren’t exactly spring chickens—every one of them was founded at least 20 years ago, though Netflix and PayPal didn’t become relevant until well after the turn of the century. But they’re still growing quite well, and have yet to surpass what we call “peak perception” the way Apple and Microsoft clearly have.

But I wouldn’t call them the market’s best growth stocks. Double-digit EPS growth and 23.6% returns (on average) over the past year are nice. But you can find better.

To find the next generation of great growth stocks, you need to think smaller. Any company that made this graphic is already too large. Small- and mid-cap stocks are the best place to start when searching for home-run stocks. Fortunately, we at Cabot have one of the best in the business at digging up small-cap winners: Tyler Laundon.

Tyler’s Cabot Small-Cap Confidential advisory portfolio boasts an average return of 68%. That’s 68% at a time when small-cap stocks have struggled; the S&P 600 Small Cap Index is down -2.5% in the last year. Clearly, Tyler has a knack for unearthing gems—even in difficult markets.

Put simply, Tyler is finding the market’s next best growth stocks. And you probably haven’t heard of most of the companies in his portfolio—they’re quite difficult to find on your own.

To make things easier, you could simply subscribe to Tyler’s advisory by clicking here, and let him do all the leg work for you.

The next Apple or Amazon may not be in Tyler’s portfolio. But life-altering, wealth-building returns already are!

[author_ad]

*This post has been updated from an original version.