Some of the most important investing lessons stem from conversations about particular stocks. Four of them came to mind late last week during a conversation I had with a long-time subscriber about Netflix (NFLX); he was curious what I thought about the stock now that it’s off its lows. It went something like this:

Subscriber: “So what do you think of Netflix now? Is it a buy?”

Me: “Tough call. I like the buying volume off the recent low, but overall it’s basically just in the middle of its range from the past couple of months. I guess if you really want in you could nibble, but I wouldn’t say it’s set up properly here.”

Subscriber: “But it’s above the 50-day moving average now.”

Me: “True, which is a plus, though I wouldn’t say that means the stock is a high-odds play to go higher.”

Subscriber: “Wait, so you don’t like it?”

Me: “I wouldn’t say that, I just think the stock is still in a consolidation phase—the past two weeks were good, and hopefully that’s the low. But I can’t really conclude that yet. More neutral than anything at this point.”

[text_ad]

Subscriber: “Yeah, the good time to buy was down at 310 or 320, I guess.”

Me: “Well, sure, from today’s perspective, but nobody knew the buyers would show up there. And we still don’t know if the stock hits lower lows from here or gets going on the upside.”

Subscriber: “What about the news I just read that Netflix is set to release a bunch more shows in September—shouldn’t that help the stock?”

Me: “I guess it could, but bigger news would be if Netflix wasn’t going to release any new shows—it’s expected at this point.”

Subscriber: “I guess I meant that the new shows could boost subscriptions and profits—analysts are still bullish, yes?”

Me: “Not sure what they’re saying, but in terms of earnings, yes—analysts are looking for Netflix’s earnings to more than double this year and rise 62% next year, so business remains in good shape.”

Subscriber: “So, with that sort of earnings growth, you’d think shares will probably eventually get going, yes?”

Me: “Well, I would say the longer-term trend of the stock and the business are still up, as well as the market, so yes, the next major move is likely up. But whether that starts now or NFLX chops around for another few months I have no clue.”

It was just a two-minute conversation, but there were a few investing lessons in there I wished I could have espoused on a bit more. So I’ll do it here!

Netflix Investing Lessons

Investing Lesson #1: Be sure to focus on factors that count. These days especially, investors can easily get overwhelmed by information and end up spending a lot of time and effort studying things that, at the end of the day, don’t really help them make money (and often cause losses).

In this case, the news about new shows from Netflix really doesn’t mean anything—the obvious rarely means much in the market. And, chart-wise, just because a stock has gone from below the 50-day line to above it doesn’t necessarily mean anything (sometimes it does, sometimes it doesn’t); 50-day lines are more meaningful during a strong trend, as it’s an intermediate-term area where big investors often buy or sell. In a trading range, moves above/below the 50-day line aren’t as reliable.

What’s more important is the overall basing structure after a big run.

Investing Lesson #2: Avoid coming to conclusions based on the recent past. Saying that NFLX is a good buy near its recent lows is obvious as we’re looking backward; hindsight is 20-20. But more broadly, I hear from a lot of people that make decisions based on what happened the last time around.

For instance, if someone held four stocks through earnings reports and three got whacked, guess what? They’re likely to bail out ahead of earnings next time around, often micromanaging their way out of some gap-ups. In NFLX’s case, just because it found support in the 310-320 area this time doesn’t mean much going forward—it’s just one data point.

Investing Lesson #3: The company is not the stock. Does Netflix have a good business with rapidly rising earnings? Yes. Does that mean the stock has to go up? No. What counts is both the fundamentals and investor perception of those fundamentals.

Check out this chart of Ulta Beauty (ULTA)—back when the stock topped in June of last year, and the firm had earned around $7 per share in the prior four quarters.

Today, even after a positive earnings reaction last Friday, the stock is 17% lower than that peak, and yet earnings over the past year have totaled nearly $10 per share. Perception has decreased! The opposite was true during the stock’s 2014-2017 advance, of course, with earnings rising 94% during its advance but the stock cranking ahead by 167%.

The lesson here is that fundamentals are vital—we don’t just buy good stock charts—but the chart does tell you when perception by big investors is beginning to fade. I don’t think that’s happening with NFLX here (the major trend is still up and this looks like a normal base-building effort to this point), but as with any stock, I’m not ruling it out.

Investing Lesson #4 (and maybe most important): You don’t have to have a strong opinion on every stock. I do this for a living, watching a bunch of stocks for Cabot Growth Investor and Cabot Top Ten Trader, running screens a couple of times per week and even keeping an eye on names from some of my peers that run other advisories at Cabot. But that doesn’t mean I have a super-strong opinion on every stock at all times, even if it is a name I’m keeping an eye on.

When it comes to Netflix, my thoughts are simple: Longer-term, the trend remains up, both for the stock and for the business. But intermediate-term, it’s more of a question mark—the earnings-induced breakdown in July caused enough damage (26% correction) and came after such a big run (the stock more than doubled from the start of year through mid-July!) that it’s possible shares need more time to consolidate. But then again, there’s a decent chance shares have hit their low and will round out a base from here.

Thus, I don’t have a strong opinion on NFLX during the next few weeks—I’m not betting on NFLX right now one way or the other. If it sets up a proper entry point down the road, I’ll consider buying. Otherwise, I’ll watch. It’s as simple as that.

One Retail Stock that Caught My Eye

On to the current stock market, I’ve been growing more bullish as the evidence has improved in recent weeks—more stocks are hitting new highs, very few are hitting new lows and the major indexes are more or less in gear. Throw in a bunch of recent breakouts and I’m optimistic.

Sentiment-wise, I will say that late August seemed to usher in some anecdotal (and some chart-based) signs of giddiness, including a few stocks that look short- and even intermediate-term extended.

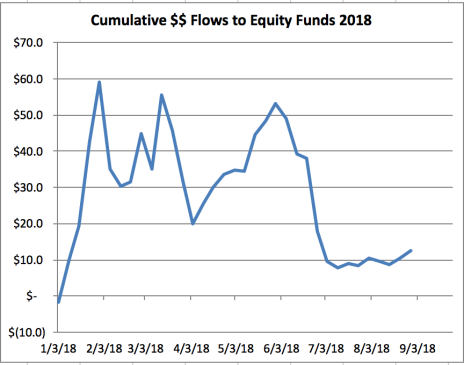

That said, looking across the market, the average investor isn’t piling into stocks. Here’s a chart I tweeted out (you can follow me @MikeCintolo) that tracks cumulative money flows into equity funds (including ETFs)—despite the market’s rally, hardly any money has come in, which is likely a positive contrary sign.

Thus, I’m still keeping my eyes peeled for individual growth stocks with big potential that aren’t far from support. One that appeared in Top Ten this weekend that caught my eye: Wayfair (W), the fast-growing (but unloved—about 17% of the float is sold short!) online furnishings retailer. Here’s a cut of what I wrote about the stock in this week’s Cabot Top Ten Trader:

“Wayfair sees the market for online sales of home products doubling during the next five years and doubling again in the five years after that! (While 34% of consumer electronics and 28% of apparel are bought online, just 12% of home furnishings currently are.) Wayfair is grabbing a big chunk of that growth thanks to its best-in-class website (very visual, can search with photos, with room planning ideas, personalization and idea boards) that helps it sell a variety of its own brands (Wayfair, Joss & Main, AllModern, Birch Lane and a ton of smaller home brands) that target the mid- to upper-end of the industry. The company is taking the Amazon approach to growth, investing in its systems, distribution and logistics, expanding its offerings (including a new design service offering for customers) and expanding into Germany, Britain and Canada. Wall Street approves, as EBITDA and free cash flow aren’t far from breakeven and key sub-metrics (number of active customers up 34% in Q2; repeat customers make up 66% of all orders) look great. It’s a big idea.”

The stock actually fell a total of 20% from June of last year through April of this year, but W changed character at that point, rising 10 weeks in a row to new highs (a sign of persistent institutional accumulation) and, after a dip to its 10-week line, has bounced to higher highs. It’s an intriguing story with a strong chart to consider.

Do discover what other intriguing stories with strong charts I like in today’s market, click here.

[author_ad]