President Biden signed the $280 billion CHIPs and Science Act this month, which is good news for the best semiconductor stocks ... if they can navigate a growing problem.

This, by coincidence, follows American companies such as Intel (INTC) and Micron Technology (MU) announcing substantial investments in chip manufacturing in an effort to lobby for these subsidies.

Meanwhile, the best semiconductor stocks are struggling, as Micron became the latest chipmaker to fret over a slowdown in demand. Still, Micron announced that it will use “anticipated” government grants and credits to help it invest $40 billion by the end of the decade to build out U.S. semiconductor manufacturing capacity. Most of Micron’s production (chip fabrication) is now done in Japan, Singapore and Taiwan.

[text_ad]

Investors have been shunning the sector on concerns that chipmakers are heading into what could be a sales slump after pandemic years of strong demand. This is also impacting high-margin semiconductor chip designers like Nvidia (NDVA) and Advanced Micro Devices (AMD) and even the stocks of makers of the equipment critical to the production of chips such as Lam Research (LRCX).

This could be a great buying opportunity for the best semiconductor stocks if you do your homework.

Understanding microchips’ intricate and fragile supply chains is important for both policymakers and investors. The typical manufacturing and assembly scenario for a semiconductor chip goes from research and development in America, then base silicon ingots are cut into wafers in Taiwan or Korea, and finally, the microchips are embedded into end products in China.

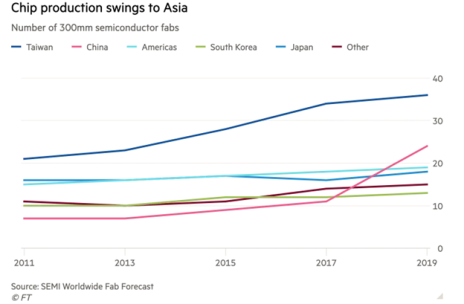

The chief concern is that while many advanced chips are designed in America, only around 12% of all chips are manufactured here and these tend to be the less advanced chips produced in older plants.

America is a leader in semiconductor equipment used to make and process wafers as well as test and assemble the final chipsets. According to the U.S. International Trade Commission, U.S. chip equipment firms, which have roughly 60,000 domestic employees, account for about half of global production. America is even more dominant in chip design software, though many firms are catching up.

Asian Production a Threat to the Best Semiconductor Stocks

The dilemma for America is that it wants to protect its lead in semiconductor technology while U.S. companies also want to continue selling advanced chips to China. Day by day, this makes China a more formidable tech rival across the board as it learns more about moving up the food chain.

Meanwhile, China’s total revenue from technology sales incorporating American technology exceeds $1 trillion.

U.S. semiconductor firms and their lobbyists in Washington emphasize that they allocate around 20% of revenues to research and development in order to maintain their technological lead over competitors in China, Japan, Taiwan, Korea and Europe. So if sales of U.S. advanced chips to China are curtailed or off limits, then revenue for R&D will be cut back and they will lose ground to competitors.

This is the dilemma facing the best semiconductor stocks.

One way to reduce America’s chip-making vulnerability would be to get Samsung or global-leader Taiwan Semiconductor (TSM) to invest more in U.S.-based fabrication plants.

As Asia’s dominating chip fabricator, TSM must execute a diplomatic balancing act it needs to strike between its sizable list of American, Chinese, Japanese and European clients.

The key reason that Taiwan Semiconductor is successful at smaller transistor sizes is because of its scale in building billions of chips for smartphones – vastly larger than the number of microchips needed for personal computers and data centers.

Taiwan Semiconductor’s chief Chinese rival is SMIC, the largest chip foundry in China. TSMC previously successfully sued SMIC over its alleged theft of trade secrets, and in 2009 this resulted in TSMC gaining an 8% stake in its rival.

TSMC had ten times more revenue than SMIC last year but SMIC receives Chinese government support equivalent to roughly 40% of its annual revenues, according to an Organization for Economic Co-operation and Development (OECD) report last year.

My Cabot Explorer advisory is not currently recommending a position in Taiwan Semiconductor (TSM), but to learn which of the best semiconductor stocks I’m following, consider subscribing today.

[author_ad]