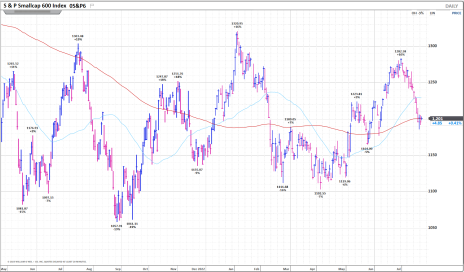

Small-cap stocks were off to the races in June and July.

From June 1 through the last day of July the S&P 600 SmallCap Index rose 13.5%. That’s almost 5% more than the S&P 500 Index.

But since August began the small-cap index is down about 6%, right back to its 200-day moving average line.

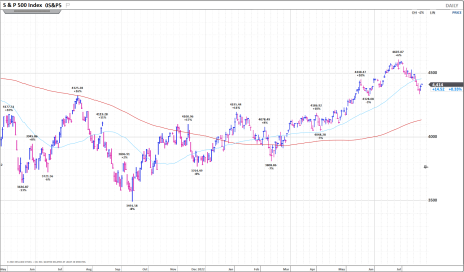

Large caps are down too, slightly less than 4%. The index has dipped below its 50-day moving average line, but the 200-day line is still 6% lower. Let’s hope it doesn’t get there.

What gives? And what’s it going to take to get stocks moving higher again for an end-of-year rally?

[text_ad]

Well, there are a number of reasons that small-cap stocks and the broad market have pulled back.

The main one is the recent rise in bond yields. Especially longer-dated bond yields, i.e., the 10-year.

Let me explain.

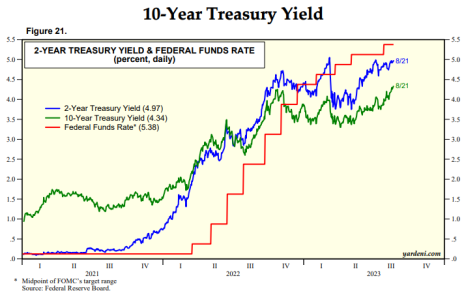

The yield curve remains inverted. This happens when the 10-year yield is lower than that of shorter-term bonds (i.e., the 2-year). This scenario tends to signal recession risk.

Since August began, the 10-year bond yield has been rising, closing the gap with the 2-year. The chart from Yardeni Research below shows this relationship, as well as the Federal Funds Rate.

This isn’t great because – all other factors remaining the same – higher yields tend to mean lower stock prices.

Moreover, the yield on the 10-year bond is at 4.3%. That’s about the high for this cycle, which was last struck on 10/21/22. It’s also about a 16-year high.

Not coincidentally the S&P 500 bottomed (intraday) at 3,492 just a few days before that, on 10/13/22. The index is up about 20% since, partly on expectations that the Fed is done hiking rates and that yields will flatten out and/or fall.

Back to the problem with the 10-year yield moving to a new high for this cycle ... there is rising chatter about default risk in commercial real estate (CRE) if CRE mortgage rates continue to climb with bond yields.

Moody’s downgrade of 10 U. S. banks on August 7 hasn’t helped. Neither does S&P’s recent downgrade of five regional U.S. banks as it flags concerns over exposure to office loans.

This isn’t great for financial stocks. And the S&P 600 SmallCap Index is really overweight financials, with a 17.4% weight. That compares to just 12.6% for the S&P 500. Smaller banks are also just riskier in general.

Beyond the rise in longer-duration bond yields, there has also been some grumbling about 2024 earnings expectations being a little high. Current 2024 consensus estimates for earnings in the S&P implies 11%+ y/y growth.

Goldman Sachs has been out saying it should be closer to 5% given that inflation and wage growth are still pretty high, even if they’re drifting lower.

This has put additional downward pressure on stocks lately, especially higher-growth names.

Finally, August isn’t typically a great month for stock market performance. There could be some seasonality going on now too.

This is all somewhat ironic because the U.S. economy remains resilient!

That’s good in many ways, like avoiding a recession. But it might not be great for signaling an end to the Fed’s higher-for-longer rate policy.

So, what could help small-cap stocks, and large caps for that matter, get back in the groove?

It would be great to move toward an eventual disinversion of the yield curve. That would lend credence to the no-recession outlook.

But definitely NOT by having the 10-year yield keep going higher to match, or exceed, the 2-year yield. A better scenario is for shorter-term bond yields to fall and move through the 10-year yield.

For that to happen we need signals that the Fed will begin cutting rates next year.

This isn’t some pie-in-the-sky scenario. The FOMC’s federal funds rate projections from June show the target rate at 5.6% this year, 4.6% next year and 3.4% in 2025.

That implies 100 basis points of cuts next year.

Since last week’s FOMC meeting minutes didn’t exactly convince investors, we’re now looking to Fed Chair Jerome Powell to dangle the carrot in Jackson Hole when he speaks at the 2023 Economic Policy Symposium on Friday.

Beyond Powell’s signaling, anything that helps return investor focus to the probability of a soft landing, upside potential to earnings growth in 2024, and the amount of cash in money market funds that could flow into equities would be good.

Also, now that stocks have pulled back, valuations are a lot less demanding. And we’re moving through the seasonally slow period for stocks.

Add it all up and there is ample potential for an end-of-year stock market rally.

Just tune your ears into what Jerome Powell has to say on Friday. His comments are likely to move bond yields, and therefore both large and small-cap stocks.

[author_ad]