Earnings, earnings, earnings! It’s that time in the quarter when you can’t turn on the TV without hearing about earnings—reported or forecasted. And like every other analyst, I avidly watch and listen, for one important reason: Earnings give me a reading on not just a particular company, but on its industry, as well as the overall health of the economy. And today, I’ll highlight three companies with the best earnings forecasts right now.

But first, I want to talk about the mechanics of earnings—and earnings season. You see, earnings of a business are the chief indicator of the performance of the company’s stock.

[text_ad]

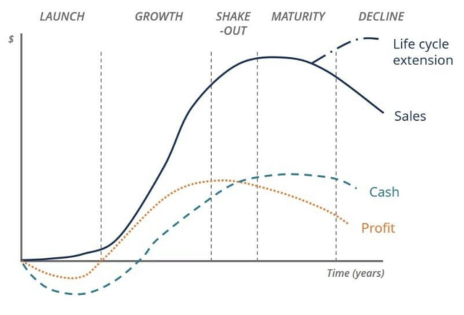

But earnings fluctuate with the life cycle of a business. As you can see from the following graph, a company—at the beginning of its life—will be growing revenues pretty rapidly, but earnings, or profitability, is more elusive. Most businesses aren’t profitable in the first few years.

Source: CFI’s FREE Corporate Finance Class

But investors often buy shares of companies during those non-profit years. Think of biotechs, or technology companies like Apple (AAPL), Microsoft (MSFT), and Intel (INTC). Investors buy/bought these shares based on anticipation of future earnings.

Here’s how the relationship between earnings and price works.

How Earnings Impact Share Price

Analysts look at a company’s earnings—its after-tax net income (also called net profits) on a quarterly and annual basis.

Earnings are used to determine a company’s profitability. The most common measure of earnings is earnings per share (EPS)—a company’s net income (or earnings) divided by the number of common shares outstanding. That ratio tells you how much a company earns for each share. And investors expect that number to grow, quarter by quarter (with a few exceptions, such as cyclical or seasonal companies, or newer businesses, as stated above).

And very importantly, the EPS is used in computing the price-to-earnings ratio (P/E) of a stock. To calculate the P/E, divide the stock price by the EPS. You can use the last four quarters of earnings (a trailing P/E), the total earnings for the year (a current P/E), or forecasted earnings for some future tie (a forward P/E). Just make sure when comparing your stock’s P/E to the P/E of other companies, that you are using a P/E ratio calculated using the same EPS numbers.

Typically, analysts see a higher P/E as an indicator that the stock has a higher value when compared to others in its industry. Look at it this way: The P/E ratio shows what the market is willing to pay today for a stock based on its past or future earnings.

A high P/E could mean that a stock’s price is high relative to earnings and possibly overvalued, or it could mean the market is pricing the stock based on the future earnings of a company, which appear to be growing rapidly.

Vice-versa, a low P/E may mean that a company’s price is undervalued relative to other companies in its industry, or it could just mean that the stock is a dog—the value of the stock is correctly priced.

Now, of course, businesses in their early years have no, or little, profits. So the P/E is often negative. But investors may still invest in the company—based on its projected earnings, as I mentioned above.

It’s important to note that the P/E ratio is not the only measure of a company’s profitability.

Additional Profitability Ratios

These additional ratios are used to evaluate a company’s ability to earn profits from its sales or operations, balance sheet assets, or shareholders’ equity. They tell us if the company is efficiently generating profits and value for its shareholders.

You’ll often hear the term, Gross profit margin. Companies will compare this number to previous reporting periods to let shareholders know if their “margins are growing,” meaning they are getting more dollars of profit out of each dollar spent. It is simply the difference between revenue and the costs of production—called cost of goods sold (COGS). Note that analysts also use two other profit margin ratios: Operating Profit Margin and Net Profit Margin. The Operating Profit Margin illustrates how much a company makes after deducting variable costs of production. And the Net Profit Margin considers all costs; it is the sales of a company divided by the net income, giving you the amount of net profit a company earns per dollar of revenue gained.

Return on Assets (ROA) measures net income relative to total assets. The higher the number, the better; it means a company’s assets are generating more income. And one would naturally assume that the more assets a company has, the more revenues and income it should produce.

Return on Equity (ROE) measures a company’s ability to earn a return on its equity investments. The calculation is net income divided by shareholders’ equity. Again, the higher, the better.

One caveat when using any ratio—it’s critical to compare apples with apples. For example, you wouldn’t compare a P/E ratio of a trucking company to that of a software business. When using ratios, compare each ratio to the historical ratios (3-5 years) of your selected company, as well as the P/Es of others in its industry or sector.

Earnings Growing at a Fever Pitch

Now, let’s talk about earnings—for the third quarter. According to FactSet, so far just 8% of the S&P 500 companies have reported. Of that number, 80% have reported a positive EPS surprise and 83% have reported a positive revenue surprise.

“Positive surprise” means the actual EPS number was higher than analysts had forecast. For the quarter, the blended earnings growth rate is 30%. If that number holds through the end of the reporting period, it will be the third-highest (year-over-year) earnings growth rate reported by the S&P 500 index since 2010.

That’s a pretty good return. And it results in a pretty lofty 12-month forward P/E ratio for the S&P 500. That P/E is 20.3. It surpasses both the 5-year average (18.3) and the 10-year average (16.4).

So far, real estate, information technology, and financials are producing the highest net profit margins for the third quarter, coming in at 34.4%, 24.1%, and 18.6%, respectively.

3 Stocks with the Best Earnings Forecasts

With those solid growth numbers in hand, I decided to search out some companies for which analysts are projecting big earnings growth in the next year.

Interestingly, I found pages of companies that had 30% or more EPS growth this year and are expected to report more than 30% EPS growth next year. I decided to narrow my search to find those companies that also were seeing more interest from institutions (usually a good indicator of coming momentum).

I came up with seven companies that met those criteria. I winnowed the list down to my top three:

Best Earnings Forecast #1: Taboola.com Ltd. (TBLA) provides artificial intelligence-based algorithmic engine platform in Israel, the United Kingdom, the United States, and other parts of the globe. It offers Taboola, a platform that partners with websites, devices, and mobile apps, collectively referred to as digital properties, to recommend editorial content and advertisements on the open web. In the past few months, coverage of the shares has been initiated with “Buy” ratings at five research firms.

Best Earnings Forecast #2: Xponential Fitness, Inc. (XPOF) operates as a boutique fitness franchisor in the United States and internationally. The company offers fitness and wellness workouts, including Pilates, barre, cycling, stretch, rowing, yoga, boxing, dance, and running under the Club Pilates, CycleBar, StretchLab, Row House, AKT, YogaSix, Pure Barre, STRIDE, and Rumble brands. As of March 31, 2021, it had 1,060 franchisees operating 1,775 open studios on an adjusted basis. Coverage of the shares has recently been initiated by five analysts with “Buy” ratings. The shares have also been upgraded to “Strong Buy” at Raymond James.

Best Earnings Forecast #3: JAKKS Pacific, Inc. (JAKK) develops, produces, and markets toys, consumables, and electronics and related products worldwide. The company operates through two segments: Toys/Consumer Products and Halloween. It offers action figures and accessories, such as licensed characters; toy vehicles and accessories; dolls and accessories, including small, large, fashion, and baby dolls based on licenses, as well as infant and pre-school products; private label products; and foot-to-floor ride-on products, inflatable environments, tents, and wagons. The company also provides role play, dress-up, pretend play, and novelty products for boys and girls based on brands and entertainment properties, as well as on its own proprietary brands; and indoor and outdoor kids’ furniture, activity trays and tables, room décor, kiddie pools, and seasonal and outdoor products. The company is expected to grow earnings by 149.4% this year, and by 63.55% next year.

Of course, there’s no guarantee that these earnings projections will result in higher prices. But the fundamentals (growth, cash flow, and strong economy) are all in place for price appreciation in these businesses.

Do you typically invest differently around earnings season? Tell us about your approach in the comments below.

[author_ad]