Once red-hot, the popular ARK ETF has gone cold. But there’s a way to make money as it falls.

The stock market suddenly turned volatile last week, with across-the-board declines including a 2.4% drop in the blue-chip S&P 500 Index, and a nearly 5% slide in the technology-heavy Nasdaq 100. This sell-off weighed heavily on the red-hot ARK Innovation ETF and its founder, Cathie Wood.

ARK is an investment manager with a growing lineup of ETFs that has benefited in a big way from the uptrend in “disruptive technology” stocks such as Tesla(TSLA), Square (SQ) and Zoom (ZM) among others. This success has made Cathie Wood the investing world’s new superstar.

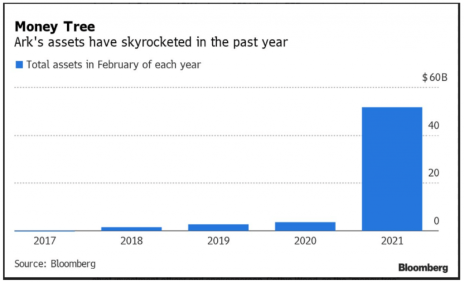

And as these disruptive stocks have outperformed the market, assets under management at ARK skyrocketed from just $3.6 billion a year ago to more than $50 billion recently, according to Bloomberg.

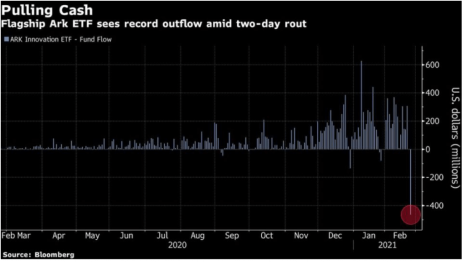

But what goes up, can also come down. And amid last week’s market turbulence, the ARKK suffered large ETF redemptions as skittish investors cashed out.

[text_ad]

In a single day last week investors pulled a record $465 million out of the flagship ARK Innovation ETF (ARKK). Plus, hundreds of millions more flowed out of several other popular ARK ETFs.

Across all five of ARK’s actively managed ETFs, there are 26 companies in which it holds more than 10% of the outstanding shares. Such large, concentrated positions in a few popular stocks could become a problem for ARK if redemptions grow larger.

It could create a negative feedback loop, where investor redemptions from its ETFs cause ARK to sell these stocks, putting more downward pressure on the shares, and in turn triggering more ARK ETF outflows—a potentially dangerous downward spiral.

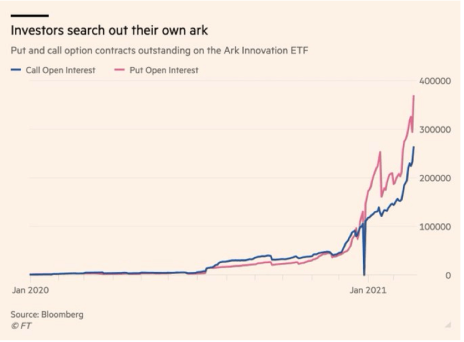

That’s why put buys on ARKK could deliver even larger potential profits as a hedge against a steeper market decline. The ETF has large holdings among the stocks which are arguably the most overvalued right now, and therefore the most at risk for a steeper decline.

And according to @jessefelder on Twitter, “The number of put options outstanding on the ARK Innovation exchange-traded fund – which pay off if the ETF’s price declines – has hit a high of 368,000 contracts.”

Stepping back, it’s hard to say a negative word about Cathie Wood or ARK’s track record as they have ridden countless disruptive stocks to new highs. Her results have been spectacular!

That being said, after months of seemingly endless upside in the markets, the last two weeks of market declines have been a wake-up call for investors reminding us all that, yes, stocks can go down too.

And if more stock market turbulence unfolds in the weeks ahead, there are several ways to hedge your portfolio.

The easiest way for an investor wishing to hedge themselves from a stock market decline would be to buy put options on any of the popular stock market indexes or ETFs that track them.

For example, you might consider buying an at-the-money put option on the Nasdaq 100 Trust ETF (QQQ) or the popular SPDR S&P 500 Trust ETF (SPY).

And if you want to get creative, buying puts on the wildly popular ARK Innovation ETF (ARKK) is one way an investor can bet against the hottest, and potentially most overvalued, stocks in the market.

[author_ad]