The storied Dow Jones Industrial Average reached 125 years this week. And the index - and the Dow ETF that tracks it - is as strong as ever.

Just looking at the Dow’s history and the companies that have made up the index is a look back at American economic history.

The Dow Jones index began on May 26, 1896 with 12 companies, including the likes of American Cotton Oil and Distilling & Cattle Feeding. The storied index expanded to 20 stocks in 1916 and 30 stocks in 1928. It has increased an average of 7.7% each year, according to Dow Jones Market Data.

None of the original companies are represented in the average.

The last surviving member of the original 30, ExxonMobil (then called Standard Oil of New Jersey), was ejected from the index in favor of Salesforce, a company founded in 1999.

[text_ad]

The Dow represents a representative cross-section of America’s large-cap universe, including names such as McDonald’s, JPMorgan Chase, Walt Disney, Coca-Cola, Nike and Procter & Gamble. The Dow has accepted Nasdaq-listed companies since 1999, when Microsoft and Intel joined, but compared to our tech-heavy market and economy, the technology sector is clearly underrepresented.

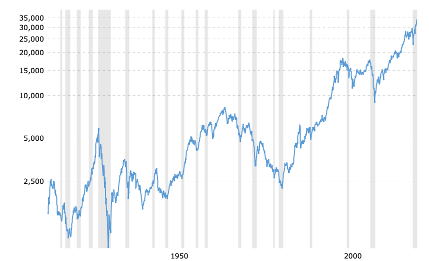

For many baby boomers and the generations that followed, it must seem to them that, except from time to time blowups such as the dot.com bubble and the global financial crisis in 2009, the markets almost always seem to go up.

This has not always been the case, though the long-term trend line is up, as you can see from the below chart.

The Dow climbed above 100 in 1906, reached 1,000 in 1972 and passed 10,000 in 1999. It had some tough periods, such as from 1930 through 1953, as the stock market struggled below 1929 highs. Another tough period was 1965-1982, when the Dow plummeted from 8,139 to 2,285.

What a run it has been since 1982. As my boss at Robert W. Baird used to say, “Let’s make hay while the sun shines.” There’s no reason to think that the market’s general upward trajectory will not continue, though hedging risk and diversifying into other financials and real assets is always smart.

2 Dow ETFs to Consider

Looking for an easy way to invest in the Dow?

There is an exchange-traded fund, or ETF, that tracks the Dow Jones index called the SPDR Dow Jones Industrial Average ETF Trust (DIA) that allows investors to access this basket of 30 companies in a convenient manner. This Dow ETF has $30 billion of assets and is up 12.9% in 2021, with an expense ratio of 0.16%.

How about a global Dow ETF (of sorts)?

Your best option is to go with the iShares Global 100 ETF (IOO) that tracks the performance of the world’s largest 100 companies by market value. This ETF has assets of just over $3 billion and is up 11.6% so far in 2021, with an expense ratio of just 0.40%.

Blending the two of these into a passive “gone fishing” portfolio is stress free though you will be missing the excitement and potential returns of investing in new and smaller companies.

Think about blending both approaches with a “core and explore” strategy. If you need help doing so, you can subscribe to my Cabot Explorer advisory, where I scour the globe looking for the world’s best – and often overlooked – investment opportunities.

So far it’s worked out nicely. The average return of the stocks in my Explorer portfolio is 210%!

[author_ad]