Before we get to a seasonal large-cap trade, I want to talk about what makes micro-cap stocks my favorite investing “playground.”

There are three primary reasons.

1) Performance.

Micro-caps have historically outperformed small-cap, mid-cap, large-cap and mega-cap stocks. And it’s not even close.

From 1927 to 2016, the smallest decile of stocks in the U.S. generated a 17.5% compound annual return, versus 9.2% for the largest decile of stocks.

2) Less Competition.

Almost all professional investors are prohibited from investing in micro-caps because they are too small.

Therefore, there is less competition. Even better, the best micro-cap investors eventually attract so much capital that they are forced to move on to bigger stocks. Famous investors, Warren Buffett, Peter Lynch, and Joel Greenblatt all started as micro-cap investors but eventually were forced to seek bigger opportunities.

3) Simple business models.

Micro-caps typically only have one line of business, so they are easy to understand and analyze.

While I usually tend to stay in my “micro-cap sandbox” sometimes I venture out of it.

The last week of the year might be a good week to venture out and invest in a large-cap ETF.

Let me explain…

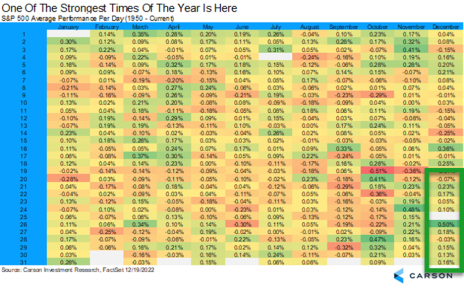

Typically, the return of the market or S&P 500 is quite seasonal.

Simply put, there are times when the market tends to perform very well and other times when the market tends to perform poorly.

For some reason, markets tend to perform well around holidays.

For example, the S&P 500 has generated an average return of 0.31% on average on July 3, the day before the 4th of July.

0.31% may not sound that impressive, but if the market returned 0.31% every day of its 252 trading days it would generate a 118% annual return.

The S&P 500 also tends to do quite well at the end of the year.

You may have heard of the “Santa Claus Rally” and rolled your eyes.

But the data suggests it’s a real thing.

Starting around December 15, the market starts to perk up.

Who knows exactly why.

Perhaps tax loss selling eases up.

Or maybe investors want to think about holiday parties rather than reasons to sell stocks.

No matter the reason, we know that returns – on average – are typically good.

The chart below shows that returns are typically very strong after Christmas and remain strong through the first five trading days in January. This makes sense as New Year’s Day is another holiday!

As such, a smart strategy would be to buy an S&P 500 tracking ETF such as the SPDR S&P 500 ETF Trust (SPY) after Christmas and hold it for 10 trading days.

This strategy won’t be profitable every year, but more often than not, it should make you money.

For those with a higher risk appetite, a higher potential return strategy would be to buy SPY call options. A smart strategy would be to buy deep-in-the-money SPY call options that don’t expire for at least a year.

Because these options would have a high delta which means that their value would move up (or down) almost dollar for the dollar with the ETF price.

But remember, this options strategy is only for those with a high risk tolerance!

To learn about my favorite micro-cap stocks, consider a subscription to Cabot Micro-Cap Insider today!

[author_ad]