With just three weeks left before the close of 2022, and the S&P 500 lower by 17% on the year, and the Nasdaq down a whopping 30%, it feels like only a Santa Claus Rally could save this year. Will it happen? It’s truly anyone’s guess. But here are my thoughts.

If I wanted to bet against a Santa Claus rally (which seems un-American!) I would point to a couple items, including:

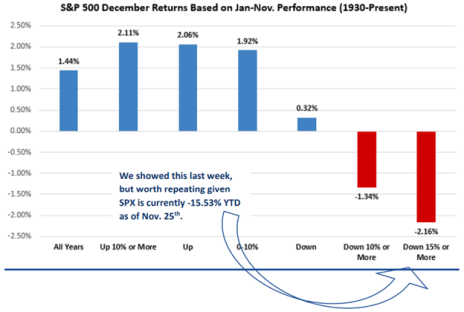

While December tends to be a strong month for stocks, interestingly, the performance for the S&P 500 in December historically is negative when the index is down 10-15% or more headed into the month, as seen below:

Also, on Monday, and then again on Wednesday of this week, options traders bet heavily against the financials and housing sector, via these put buys:

[text_ad]

Monday –

Buyer of 10,000 Blackstone (BX) February 70 Puts for $2.70 – Stock at 83

Buyer of 4,000 Blackstone (BX) March 80/65 Bear Put Spread for $4.40 – Stock at 83.5

Buyer of 10,000 Blackstone (BX) January 70/60 Bear Put Spread for $1.18 – Stock at 81.5

Buyer of 5,500 Morgan Stanley (MS) February 80 Puts for $1.73 – Stock at 90

Buyer of 6,500 Homebuilder ETF (XHB) September 60 Puts for $6.20 – Stock at 61

Buyer of 7,000 D.R. Horton (DHI) February 75/60 Bear Put Spread for $1.80 – Stock at 85

Wednesday –

Buyer of 5,000 Blackstone (BX) March 75 Puts for $7 – Stock at 78 (rolled down from March 80 puts)

Buyer of 10,000 Blackstone (BX) February 45 Puts for $0.45 – Stock at 79

Buyer of 3,000 Blackstone (BX) February 50 Puts for $0.80 – Stock at 78.5

Buyer of 8,000 Wells Fargo (WFC) January 42.5 Puts (exp. 2025) for $6.65 – Stock at 43

Buyer of 14,000 Bank of America (BAC) January 35 Puts (exp. 2025) for $6.35 – Stock at 33

I’m an “old school” trader, and when the financial and housing stocks and sectors are weak, my radar goes off that it’s time to get worried/defensive.

And given the items above, if I wanted to get bearish exposure to the market, I might look at this put buy:

Buy to Open the S&P 500 ETF (SPY) April 390 Put for $20.

Ok, enough with the bearishness …

There are some positives I’m seeing in the market as well, including:

Interestingly, while the “big boys” such as Apple (AAPL), Microsoft (MSFT), and other leading tech stocks have been weak, more and more under-the-radar stocks have been holding up and even advancing. For example:

Cabot Options Trader subscribers own positions in Starbucks (SBUX) and Las Vegas Sands (LVS), both of which are breaking out, and I have a long list of strong stock candidates to buy, should the market continue to strengthen, including:

TMUS, HOG, CAT, SLB, GILD, AXON, DXCM, ROST, and many more.

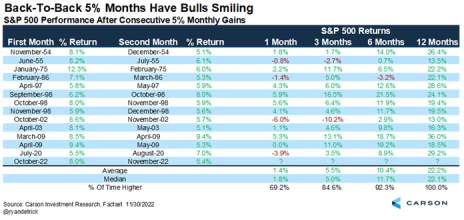

Also, as @ryandetrick on Twitter noted, “S&P 500 gains of >5% back-to-back months. This type of persistent strength isn’t the sign of a bear market rally, but likely the start of a new bull. Previous 13 times it happened? Higher a year later every time, and up 22.2% on average”

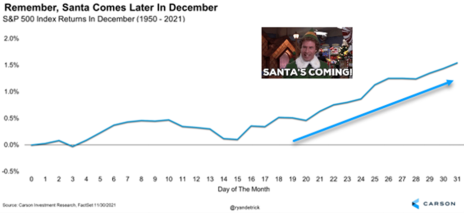

And one more graph from @ryandetrick that shows that the majority of December gains historically come from performance December 15th through the end of the year, as seen below:

With this bullishness in mind, if you wanted to play a bullish finish to 2022, and into 2023, you could look at this call buy:

Buy to Open the SPY April 400 Call for $21.

Stepping back, I could see a bearish OR bullish close to the year play out … it really is a toss-up.

However, I’m optimistic that the bulls will again take control in the weeks to come, and grant my Christmas wish for an end-of-the-year Santa Claus rally!

To learn more about how options trading basics, click here to download your free report. If you’d rather pair Cabot’s best growth stocks with my options trading strategies, subscribe to Cabot Profit Booster today!

[author_ad]