The energy industry (and by extension large and micro-cap energy stocks) has had an epic run over the past two years, making it one of the few attractive sectors out there.

But I think the strength is likely to continue.

The below chart, which compares energy stocks to tech stocks, suggests that the energy industry’s recent strength has room to run.

Typically, the best time to buy energy stocks is when earnings are depressed. When energy prices and earnings are depressed, investor pessimism is high and expectations are low.

[text_ad]

Depressed energy prices discourage drilling to find new oil and gas. So supply shrinks.

Eventually, demand rises again but by then there isn’t enough supply because nobody’s been drilling new wells!

As energy prices rise, companies are encouraged to drill new wells so capital expenditure increases.

Eventually, supply of oil and gas rises and outstrips demand and we have another bear market.

The cycle repeats.

So what’s different this time?

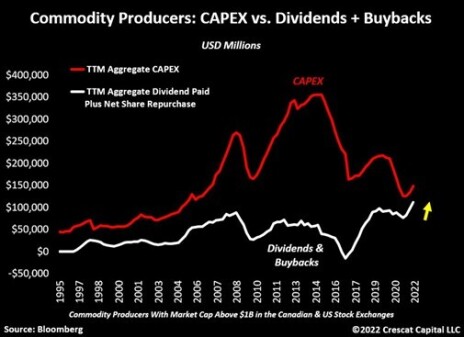

First, energy investors have been burned many times and are demanding that energy companies spend their money on share buybacks and dividends instead of increased capital expenditures.

Second, due to ESG concerns, few investors are interested in investing in energy companies. So capital is scarce.

As a result, capital expenditure (CAPEX) remains depressed despite high energy prices. This suggests attractive industry conditions will continue for the foreseeable future.

While there are many attractive energy stocks, there is one company that looks particularly attractive.

An Attractive Micro-Cap Energy Stock: Kistos PLC

Kistos plc (AIM: KIST) is an independent U.K.-based company focused on European energy, specifically with low carbon intensity credentials.

It’s focused on natural gas which is a “transition” fuel. It’s a fossil fuel but is much cleaner than oil and can bridge demand until renewable energy is plentiful.

The company was established in October 2020 by a management team that previously founded and eventually sold a company called Rockrose Energy.

Rockrose Energy was founded in 2016 and sold in 2020. It generated a 40x return for investors.

I think Kistos could be Rockrose 2.0.

Since raising capital in 2020, Kistos has made two acquisitions. Both are natural-gas-producing properties in the North Sea.

The acquisitions are going well and generating massive amounts of free cash flow.

Through the first half of 2022, revenue has increased 745% to €285MM while EBITDA has increased 768% to €261MM.

As a result of strong operational performance and high natural gas prices in Europe, Kistos has completely delivered its balance sheet and currently has net cash.

Despite strong growth and a fortress balance sheet, Kistos is dirt cheap.

It’s trading at just 0.7x EBITDA and 0.9x free cash flow.

Finally, we are well aligned as insiders own ~20% of shares outstanding.

Strong fundamentals and a cheap valuation give me high conviction in Kistos PLC.

Looking out over the next few years, I think the stock is easily a double.

To learn more about what I’m following beyond this great-looking micro-cap energy stock, subscribe to Cabot Micro-Cap Insider today.

[author_ad]