First, let’s define secondary stock offerings. A secondary stock offering is when a company that has already made an initial public offering (IPO) tries to raise capital by introducing secondary offerings, such as securities that come from existing major stockholders, or from creating new shares.

Fairly straightforward, but I always find a fishing analogy helps with comprehension. And in the words of Steven Wright, “There’s a fine line between fishing and just standing on the shore like an idiot.”

I grew up in Vermont, and my parents had (and still have) a summer cottage on Lake Champlain.

One of the best ways to keep a group of kids out of trouble is to get them out fishing. So that’s what we do. It’s a great lake for fishing as there’s a healthy population of largemouth and smallmouth bass, as well as pike, walleye and lake trout, in Lake Champlain.

One of the most memorable and exciting parts of fishing is when you see a big fish follow your lure … and absolutely inhale it.

[text_ad]

It’s like you can see the entire aquatic environment around your bait get sucked into the fish’s mouth and disappear, as if it was never there to begin with.

We spent last summer at that house and the bass were just starting to get active. So I rigged up this “wacky rig” with a soft plastic worm. You’d never think this would work, but it does!

Here’s the proof. This smallmouth bass was a little sluggish with the water being quite cool, but by moving the bait slowly past his nose I was able to entice him to inhale it. It was one of many we caught.

A quick release and this fish was back in the lake (that’s one of my two sons holding the net). Now, obviously, taking a plastic lure doesn’t help this fish at all, but when they inhale wild bait, like crayfish and minnows, they get stronger and have more energy to pursue life-sustaining activities.

Secondary Stock Offering: A Bullish Growth Stock Buy Signal

The stock market analogy to a big bass inhaling a meal is a well-received secondary stock offering or a well-received convertible note offering.

In these scenarios, a company announces it will raise capital by issuing new shares to the public (secondary stock offering) or by issuing low-interest-bearing notes that can be converted into shares, usually within five to 10 years (convertible note offering).

The company completes the offering at an attractive price and the shares are quickly absorbed by the market.

In fishing terms, the market “inhales” the new shares. And the stock’s trend continues, more or less as it had been prior to the secondary offering. Management pursues growth initiatives with the new capital.

Both traders and longer-term investors view a well-received secondary stock or convertible note offering as a bullish signal. Check out this quick exchange I had a while back with Cabot Options Trader Chief Analyst, Jacob Mintz, on the topic.

Jacob doesn’t do a lot of bass fishing so he didn’t really get my analogy, the first time. But it’s since become something we both refer to regularly when these offerings come up.

The well-received secondary stock or convertible note offering is an especially strong buy signal for certain small-cap stocks and early-stage growth stocks. That’s because it signals huge demand for a stock that still has a relatively small public float and/or is growing rapidly.

If the market thinks a company is issuing shares to raise cash for good things, like attractive acquisitions, to fund new product development, to expand a sales team to meet demand, etc., then a stock can easily go up after the announcement.

In this bullish scenario, there are many investors who are eager to buy the newly issued shares (or notes). And they get inhaled by the market.

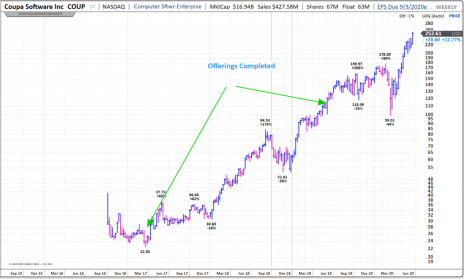

Check out this weekly chart of Coupa Software (COUP), a rapid-growth software stock that came public as a small cap in 2016 and has since been acquired for $8 billion.

This is the stock Jacob mentioned in our exchange.

Coupa’s first secondary offering was done way back in April 2017 at 25.25. Shares rallied in the weeks afterward and never revisited that offering price. Then in June 2019, Coupa completed a convertible note offering.

There’s little in the chart that tells you the company raised capital. And certainly nothing negative. The weekly chart shows that COUP continued to march higher for months after the secondary offerings before ultimately being acquired in an all-cash transaction.

Bottom line: The market inhaled these stock offerings and Coupa didn’t skip a beat in the bull market. There was nothing bad whatsoever about these offerings, they were just one of the logical ways for the company to raise growth-enabling capital.

Let’s look at another example.

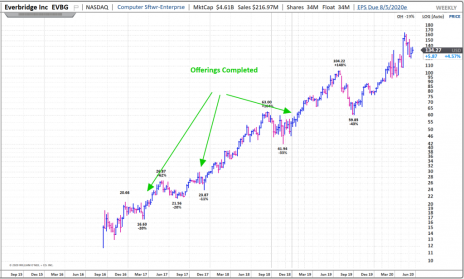

The chart below is for Everbridge (EVBG), which was taken private last year at a $1.8 billion valuation. Everbridge had completed numerous capital raises since it went public at 12 in September 2016. And it marched higher after every one. All were inhaled by the market, just like a lunker bass inhaling a crayfish! The intervening years weren’t quite as kind to Everbridge as they were to Coupa, as the bear market of 2022 and 2023 dragged shares down sharply before they were acquired by Thoma Bravo.

How to Find the Market’s Best Early-Stage Growth Stocks

Too many investors think a secondary stock offering from a growth stock is a bad thing. In some cases, they are.

There are far too many examples of companies that issue shares of stock just to keep the lights on and to meet payroll. These stocks, which are usually bad investments, usually trend down (or at best sideways) before, and after, the offering because management is destroying value.

But don’t assume all secondary offerings are bad just because some are.

There are also many examples of small-cap stocks and early-stage growth stocks that complete secondary stock offerings because it is the most efficient way to raise growth-fueling capital.

A more recent example is DraftKings (DKNG), a company I recommended in my Cabot Early Opportunities portfolio and which made my subscribers 27% in five months before we sold.

Some investors think a secondary stock offering is a bad thing. I don’t.

If you were on the management team, wouldn’t you want to raise capital when your stock is in demand? Not only do you get more bang for each new share issued, you’re not diluting existing shareholders by as much if the stock is strong, as opposed to weak. That’s a good thing, long term.

Bottom line: Secondary stock offerings are a net positive and a catalyst for share price growth. A secondary offering alone won’t convince investors to buy, but with the right stock, it can be just the thing to put it over the top.

[author_ad]

*This post is periodically updated to reflect market conditions.