As an analyst who’s always on the prowl for fresh opportunities in younger companies, it’s nice to see a little excitement in the IPO market again.

Yes, I’m talking about the high-profile debuts of social media platform Reddit (RDDT) and chipmaker Astera Labs (ALAB).

Both companies came public last week. And both have seen shares move considerably higher in their first few sessions.

To be perfectly clear, I’m not suggesting two high-profile deals signal that the IPO market is on fire and that we should all be jumping into surging stocks like RDDT and ALAB.

But they are definitely a step in the right direction. Partially because they represent a step up in deal size in what continues to be an IPO market dominated by relatively small offerings, and partially because their successful debuts should boost confidence for other companies considering going public this year.

[text_ad]

That translates into more opportunities for investors. Which will be a welcome change after a dismal stretch for the IPO market in 2022 and 2023.

For its part, Reddit raised $748 million in its IPO last week. The company’s initial market cap of $6.4 billion was based on a 34 offer price. The market cap has been over $11 billion this week given RDDT stock has traded north of 74.

Turning to Astera Labs, the company ended up pricing its shares at 36 last Wednesday, well above the expected range of 32 – 34. The share price topped 95 earlier this week, pushing Astera’s market cap north of $13 billion.

Like I said, it’s nice to see a little excitement in this market again!

A Horrid Stretch for IPOs

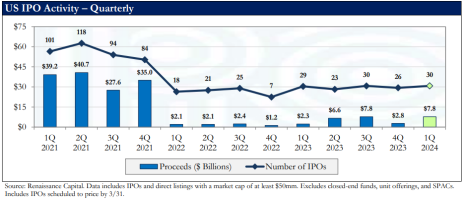

Last year (2023) was just awful for IPOs. Only 108 new names came public throughout the entire year, raising just $19.4 billion.

As bad as that was, it was even worse in 2022. Only 71 companies came public and a meager $7.7 billion was raised.

To put things in context, the only other year since 2015 when less than $20 billion was raised was 2016 ($18.8 billion raised).

In every other year since, north of $30 billion was raised, with 2020 and 2021 being exceptionally strong ($78 billion and $142 billion raised, respectively).

In other words, 2022 and 2023 were just pitiful when it comes to new issuances.

IPO Market Beginning to Thaw in 2024

History shows that IPO markets warm up slowly, not all at once.

Back in November, I wrote to subscribers of Cabot Early Opportunities, saying, “For things to truly begin to thaw out (in the IPO market) we’ll likely need to see interest rates come down and something of a real bull market take shape in the stock market. The latter could be happening now (not a prediction, just an observation) given that the stock market is forward-looking about six months.”

So far that bull market has continued to take shape. The S&P 500 officially recouped all its bear market losses on January 19.

In November I also theorized that bankers would start to test the IPO waters in the spring if market odds held steady, predicting June for the first cut to the Federal Funds Rate (FFR).

So far, this is how things have worked out. And in fact, after last week’s FOMC meeting, the odds of a June cut have gone up, from about 50% to roughly 70%.

In terms of new IPOs this year, through March 24 we’ve seen a total of 30 IPOs year to date, raising a combined $7.8 billion.

Interestingly, that’s roughly the same number of deals we saw in the first quarter of 2023. But deal size is way higher in Q1 of 2024. Proceeds are up by a factor of three, to $7.8 billion versus just $2.3 billion at this time last year.

The first quarter of 2024 is also better than the entire year in 2023. Progress!

When to Consider Buying IPOs

As a general rule I don’t like to jump into a super fresh IPO. These can be extremely volatile stocks and there’s often a bout of selling after an initial surge.

We typically see that volatility smooth out considerably after lockup expiration passes. After that point, insiders are free to sell. That’s usually 90 to 180 days after the company has come public. And we can often get a better feel for what the real demand for shares is once lockup expiration has passed.

Of course, the buzz from hot new IPOs is exactly what underwriters and company executives want to see when trying to time new offerings. So in that sense, the initial IPO pop and surge is a good thing!

Stepping back, the relative early success of RDDT and ALAB, as well as decent debuts from some other offerings this year, including BBB Foods (TBBB), Amer Sports (AS) and Kaspi.kz (KSPI), suggests that as we get deeper into the year more (and bigger) names will come to market.

That supply is exactly what we want to supplement the shopping list of opportunities that are already maturing on the public exchanges.

If you’d like to know more about which IPOs you should consider buying, when to buy, and why shares should do well, consider a subscription to Cabot Early Opportunities. I’ve already locked in 10 profitable trades for subscribers this year and am currently eying a high-growth company that just came public in 2023.

Details on that stock are included in the March Issue, which you can access today with a Spring Sale discount to a Cabot Prime Plus trial.

[author_ad]