I don’t read print newspapers anymore so the cover of the Wall Street Journal in a gas station last week caught my eye. It had no less than three bearish headlines.

“Recession Fears Drive Down Stocks”

“Retail Selloff Spotlights Price Pain”

“Blue Chips, S&P 500 Suffer Their Worst Percentage Losses Since June 2020”

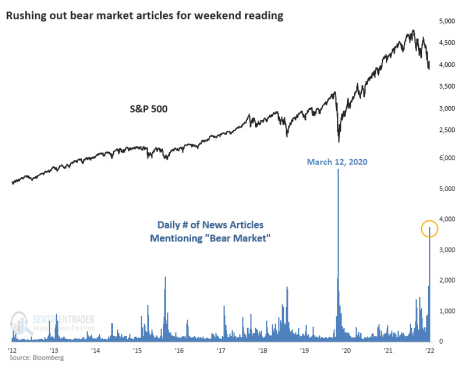

Those headlines aren’t out of the norm these days. As this chart from Bloomberg shows, one of the few bull markets out there right now is bearish articles.

Still, it doesn’t seem a lot of space has been given to small-cap stocks during this market retreat. So let’s try to fill that void, see how this asset class is holding up and try to get a sense of where it could go from here.

[text_ad]

Now in a Bear Market, What’s Ahead for Small-Cap Stocks?

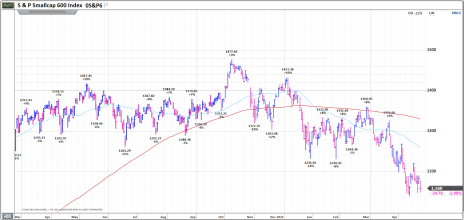

Technically, small caps are in a bear market. That’s assuming we use the typical definition of a 20% decline as defining such a market.

The S&P 600 Small Cap Index is currently 14.3% off its high of 1,478 from November 8. The index was down as much as 23% off the high on May 12.

This performance is slightly worse than that of the S&P 500 Index, which is 13% below its high. But small caps are faring far better than the Nasdaq, which is currently 24.5% off its high.

While stocks began sliding late in 2021, dissecting the year-to-date (YTD) performance in 2022 yields some insights into exactly what sectors of the market have really felt the pain, and which have not.

The data in the following chart comes from Standard & Poor’s and is YTD through June 6. As you can see, energy has been a standout performer in both large and small caps. But that’s really the only bright spot as all other sectors (save large-cap utilities and small-cap materials) have fallen. Small-cap declines have been led by discretionary, healthcare and technology.

| YTD Sector Performance by Index (through 6/6/22) | ||

| S&P 500 Large Cap Index | S&P 600 Small Cap Index | |

| Index | -13.50% | -10.70% |

| Energy | 59.90% | 72.10% |

| Materials | -3.80% | 3.30% |

| Utilities | 3.80% | -5.40% |

| Consumer Staples | -4.90% | -7.40% |

| Industrials | -9.60% | -7.70% |

| Financials | -10.80% | -11.80% |

| Healthcare | -8.10% | -22.70% |

| Communication Services | -24.30% | -16.20% |

| Consumer Discretionary | -24.70% | -22.60% |

| Real Estate | -15.90% | -17% |

| Information Technology | -20% | -17.30% |

Data: Standard & Poor’s

What about small-cap stock valuations?

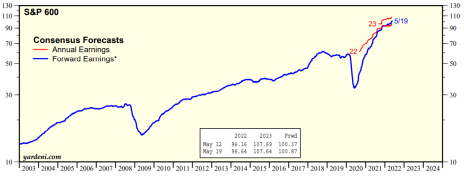

Believe it or not, analysts have been bumping up forward earnings estimates for both large and small caps. Both are now at record highs. Forward earnings for small caps rose for the ninth time in 10 weeks!

The chart below from Yardeni Research shows the trendlines for small-cap forward earnings (forward 12 months), full-year 2022 and full-year 2023. All have been heading higher (for the record, the same is true in the S&P 500). As of this reading, analysts see small-cap earnings up 13.7% in 2022 and up 11.4% in 2023. Both growth rates compare favorably to estimated large-cap earnings (+10% this year and next).

Are analysts smoking something? You’d think with everything going on in the market and around the world that they’d be slashing forward estimates. But they’re not (yet, at least).

One caveat – it should be noted that these estimates come on the back of a big earnings recovery coming out of the pandemic as companies have been beating estimates. They could easily be revised downward soon should the economy show signs of slowing. This is just what the data says at this point in time.

Cheap Small-Cap Stocks Abound

The impact of rising forward estimates and plunging stock prices combines to put considerable downward pressure on small-cap valuations.

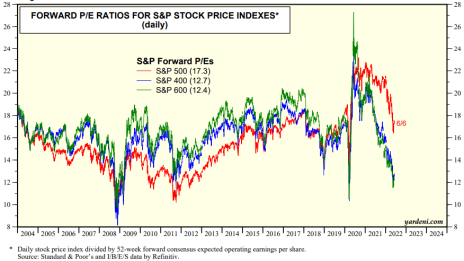

As of yesterday, the S&P 600 Small Cap Index is trading with a forward P/E ratio of just 12.4. That’s very inexpensive relative to history, as this chart from Yardeni Research shows (S&P 600 P/E is the green line).

Not only are small caps cheap, but they’ve been that way for a while, especially relative to large caps. That’s rare, as the asset class tends to trade at a premium (see how the green line in the chart above is typically above the red and blue lines).

Small caps have now traded at a discount to large caps for 92 weeks. They haven’t traded at a discount for that long since 1999 – 2002.

Moreover, the nearly 30% discount is about on par with the largest valuation discount since 2001.

So, with so many cheap small-cap stocks, where does this leave us?

To summarize, small caps are in a bear market, valuations have plummeted, the asset class is trading near a two-decade low in terms of discount to the broad market, and analysts are raising forward estimates.

Where do small caps go from here?

That’s the million-dollar question. My best guess is the market, and small caps, won’t make any significant and sustained move higher until we see hard data that inflation is easing AND get into the quantitative tightening (QT) process and can evaluate the impact on interest rates.

The Fed began the QT process in June. It will let $30 billion of Treasuries run off each month in June, July and August and do the same with $17.5 billion of agency debt and mortgage-backed securities. Those amounts double starting in September. When it ends is undetermined. A key concern here is if it propels interest rates higher than just rate hikes otherwise would.

One of the many wrinkles to higher interest rates is that they push up the cost of housing. That means higher rent/shelter costs, which has an outsized impact on the consumer price index (CPI), which really needs to come down for the Fed to achieve its goal of taming inflation.

The bottom line here is that we’re in a transition period with a lot of crosscurrents and the action in both small and large caps reflects the resulting uncertainty.

That’s not likely to change until markets are able to look forward with a bit more clarity. I suspect that won’t be until we get deeper into the QT process, so a few months anyway.

That said, if you step back and just look at small-cap valuations and relative performance, the asset class is trading at a discount. Cheap small-cap stocks are everywhere!

For those with a longer time horizon, that’s the time to be buying, even if just a little. While it may not feel great today and might not work out in the next week or the next month, it is almost certain to work over the coming years.

Any cheap small-cap stocks caught your eye of late? Tell us about them in the comments below!

[author_ad]