The recent failures of Silicon Valley Bank and Signature Bank have led to a groundswell of anxieties about the well-being of the banking sector, particularly the smaller regional banks. The banking sector anxieties, while in my opinion a bit overblown, have no doubt damaged the investor psyche over the near term and most likely the long term. But, as legendary investor Warren Buffett famously stated, “be fearful when others are greedy and greedy when others are fearful.” Buffett’s mantra comes directly from his mentor Benjamin Graham, who stated “the intelligent investor is a realist who sells to optimists and buys from pessimists.”

There is no doubt that scores of some of the most successful investors have taken the aforementioned mantras to heart making billions through consistently buying and investing in distressed debt and assets when the markets have appeared at their worst and most uncertain.

Thankfully for us, fear is palpable in the regional bank sector today, and while that spells obvious concerns among those directly involved, it also means potential investment opportunities are there for the taking. Which leads me to my discussion today.

Today, I want to discuss how I am using options to create my own options-based big banks ETF, to take advantage of the recent woes in the regional banking sector.

[text_ad]

One Man’s Trash Is Another Man’s Treasure (In the Big Banks)

There is no doubt that one of the largest beneficiaries of the recent regional banking woes has been the big banks. The big banks, otherwise known as “globally systemically important banks” or GSIBs, or as some refer to as “too big to fail” include Bank of America (BAC), Citigroup (C), Goldman Sachs (GS), JPMorgan Chase (JPM), Morgan Stanley (MS) and Wells Fargo (WFC). These banks have not only helped to fund at-risk banks but more importantly, they have seen an enormous surge in deposits as investors across the country move their money to what they perceive as a flight to safety.

In the days following the collapse of Silicon Valley Bank, Bank of America reportedly accrued $15 billion of new deposits. Obviously, those numbers have increased over the past week as other mega-banks like JPM, C, and WFC have all reported similar collections of new deposits.

How to Take Advantage of the Ongoing Banking Woes Using Poor Man’s Covered Calls

Today, I want to focus on how I build out portfolios using an options trading strategy that has performed incredibly well over the long term and is perfect for the current situation in the banking sector.

The strategy is one that all investors, not just options traders, should consider especially if you are a fan of covered calls. The reason is because the strategy I’m about to discuss allows you to reap the benefits of a covered call strategy at a fraction (65% to 85% less) of the cost.

Options Trading Strategy – Poor Man’s Covered Calls

Also known as long call diagonal spreads, a poor man’s covered call is similar to a traditional covered call strategy, with one exception in the mechanics. Rather than buying 100 or more shares of stock, an investor simply buys an in-the-money LEAPS call and sells a near-term out-of-the-money call against it.

By using a poor man’s covered call approach, we are able to save 65% to 85% of the capital required to buy 100 or more shares of stock. But more importantly, we are able to lower our cost basis every 30 to 60 days by continually selling calls against our LEAPS position.

LEAPS, or long-term equity anticipation securities, are basically options contracts with an expiration date longer than one year. LEAPS are no different from short-term options, but the longer duration offered through a LEAPS contract gives an investor the opportunity for long-term exposure.

The positions in the portfolios are delta positive. This simply means that each position is inherently bullish, and my goal is to make sure each position remains delta positive at all times. And even though the positions are delta positive, we still have the opportunity to make money if the market remains flat or even drops slightly, but the portfolio does best when the stocks that reside in the portfolio trend higher.

In my Fundamentals options trading service I use poor man’s covered calls on an All-Weather portfolio, Dogs of the Dow portfolio, Growth/Value portfolio, Yale Endowment Portfolio, Buffett portfolio and potentially several others in the near future, including a portfolio of big banks.

Here are the stocks I plan to use:

- Bank of America (BAC)

- Citigroup (C)

- JPMorgan Chase (JPM)

- Morgan Stanley (MS)

- Wells Fargo (WFC)

There are numerous ways to approach poor man’s covered calls. My preference is to use LEAPS that have at least two years left until expiration. Let’s focus on the step-by-step mechanics of the trade.

For example, let’s take a look at one of the big bank stocks, Morgan Stanley (MS).

As you can see in the chart below the stock is currently trading for 83.07.

Now, if we followed the route of the traditional covered call we would need to buy at least 100 shares of the stock. At the current share price, 100 shares would cost $8,307. Certainly not a crazy amount of money. But just think if you wanted to use a covered call strategy on, say, a higher-priced stock like Goldman Sachs (GS) or even an index ETF like SPDR S&P 500 ETF (SPY). For some investors, the cost of 100 shares can be prohibitive, especially if diversification amongst a basket of stocks is a priority. Therefore, a covered call strategy just isn’t in the cards…and that’s unfortunate.

So, it’s worth repeating, with a poor man’s covered call strategy you can typically save 65% to 85% of the cost of a covered call strategy. Again, rather than purchase 100 shares or more of stock, we only have to buy one LEAPS call contract for every 100 shares we wish to control.

As I said before, my preference is to buy a LEAPS contract with an expiration date of around two years. Some options professionals prefer to only go out 12-16 months, some even less, but I prefer the flexibility the two-year LEAPS offers.

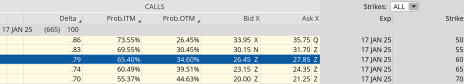

Again, I want to go out roughly two years in time. The January 17, 2025, expiration cycle with 665 days left until expiration is the longest-dated expiration cycle and would be my choice. And when my LEAPS reach 10-12 months left until expiration, I then begin the process of selling my LEAPS and reestablishing a position with approximately two years left until expiration, if I choose to continue to hold the position.

Once I have chosen my expiration cycle, I then look for an in-the-money call strike with a delta of around 0.80.

When looking at Morgan Stanley’s option chain I quickly noticed that the 60 call strike has a delta of 0.79. The 60 strike price is currently trading for approximately $27.15. Remember, always use a limit order. Never buy an option at the ask price, which in this case is $27.85.

So, rather than spend $8,307 for 100 shares of MS, we only needed to spend $2,715. As a result, we saved $5,522 or 66.5%. Now we have the ability to use the capital saved to diversify our premium amongst other securities if we so choose.

After we purchase our LEAPS call option at the 60 strike, we then begin the process of selling calls against our LEAPS.

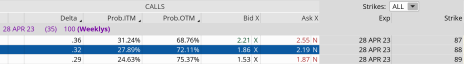

My preference is to look for an expiration cycle with around 30-60 days left until expiration and then aim for selling a strike with a delta ranging from 0.20 to 0.40, or a probability of success between 60% and 85%.

As you can see in the options chain below, the 88 call strike with a delta of 0.32 falls within my preferred range.

We could sell the 88 call option for roughly $2.00. The premium collected is 7.4% over 35 days or approximately 74% in premium collected annually. If we were to use a traditional covered call our potential return on capital would be far less than half, or 2.4%.

And remember, the 7.4% is just the premium return; it does not include any increases in the LEAPS contract if the stock pushes higher. Moreover, we can continue to sell calls against our LEAPS position for another 8 – 12 months, thereby generating additional income or lowering our cost basis even further.

An alternative way to approach a poor man’s covered call, if you are a bit more bullish on the stock, is to buy two LEAPS for every call sold. This way you can benefit from the additional upside past your chosen short strike, yet still participate in the benefits of selling premium.

Regardless of your approach, you can continue to sell calls against your Morgan Stanley LEAPS, or any other stock you choose, as long as you wish. Whether you hold a position for one expiration cycle or 12, poor man’s covered calls give you all the benefits of a covered call for significantly less capital.

I’ll be discussing this further, with actionable trades, in my Fundamentals trading service over the next week. If you wish to participate in the actionable trades, please take a look at my Fundamentals service where I run five different LEAPS-based portfolios, including the All-Weather, Yale Endowment, Dogs of the Dow (and Small Dogs), Buffett’s Patient Investor, and O’Shaughnessy’s Growth/Value portfolio.

[author_ad]