DraftKings Poor Man’s Covered Calls

There has been an abundance of high-beta growth stocks that have absolutely been crushed over the past six months.

One such stock is DraftKings (DKNG).

The stock is down roughly 70% from its record highs hit roughly one year ago. But the collapse, not only in DraftKings, but in many of the growth stocks that helped to push the market higher, has led to heightened levels of volatility. And inflated levels of volatility on low-priced stocks can offer some interesting options plays, especially if using a fairly conservative options strategy like poor man’s covered calls.

[text_ad use_post='261460']

But before I get to the trade lets discuss some of the basics of the strategy.

The Options Strategy

Many months ago I discussed the benefits of selling covered calls for monthly income. And while I am a huge proponent of using covered calls, my preference, particularly when dealing with higher-priced securities, is to use a strategy known as the poor man’s covered call strategy.

A poor man’s covered call strategy is essentially a long call diagonal debit spread that is used to imitate a covered call position, but for far less capital.

The main difference: poor man’s covered calls require far less capital. The strategy doesn’t require buying 100 shares of stock. In fact, no shares are needed. As an alternative to purchasing 100 shares, poor man’s covered calls require far less capital.

In most cases, it costs 65% to 85% less to use a poor man’s covered call strategy. The savings in capital required should be reason enough to at least consider using the strategy. And I’m certain after reading this you will indeed find the strategy appealing.

Like a covered call strategy, a poor man’s covered call is an inherently bullish options strategy. But again, rather than spend an inordinate amount of money to purchase at least 100 shares of stock, you have the ability to buy what is essentially a stock replacement. The replacement? An in-the-money LEAPS call contract.

LEAPS, or long-term equity anticipation securities, are options with at least one year left until they are due to expire. The reason we choose to use LEAPS as our stock replacement is because LEAPS don’t suffer from accelerated time decay like shorter-dated options.

Today, I’m going to focus on selling poor man’s covered calls on lower-priced stocks for monthly income.

The key is to screen stocks that have highly liquid options and a mid-to-high level of implied volatility.

Now I’m not going to get too picky here on stock selection as I am more concerned about teaching the concept of using a poor man’s covered call on a lower-priced stock. So, try not to get too fixated on my stock of choice.

And hey, if you think the stock I’m about to use for my example is about to crater, you can always use a poor man’s covered put, which I have discussed numerous times over the past few months.

Poor Man’s Covered Call

DraftKings (DKNG) is currently trading for 21.40 and has an implied volatility (IV) over 80%. The stock has a beta of 1.5. So, given the stats above, the stock is inherently volatile.

When looking at DraftKings’ option chain I quickly noticed that the 17.5 call strike has a delta of 0.76. The 17.5 call strike price is currently trading for approximately $9.80. Remember, always use a limit order. Never buy an option at the ask price, which in this case is $10.00.

So, rather than spend $2,140 for 100 shares of DraftKings, we only need to spend $980. As a result, we are saving $1,160, or 54.2%. Now we have the ability to use the capital saved to diversify our premium or income stream amongst other securities, if we so choose.

After we purchase our LEAPS call option at the 17.5 call strike, we then begin the process of selling calls against our LEAPS.

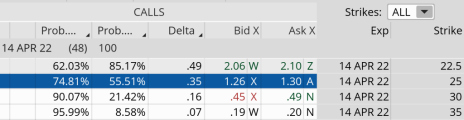

My preference is to look for an expiration cycle with around 30-60 days left until expiration and then aim for selling a strike with a delta ranging from 0.20 to 0.40, or a probability of success between 60% to 85%. However, with lower-priced stocks we often have to use a delta closer to 0.50 in order to bring in an acceptable level of premium.

As you can see in the options chain below, the 25 call strike with a delta of 0.35 falls within my preferred range. And the probability of success stands at 74.81%.

We can sell the 25 call option for roughly $1.27.

Our total outlay for the entire position now stands at $853 ($980 – $127). The premium collected is 13.0% over 48 days.

Poor Man’s Covered Call Trade:

- Buy DraftKings (DKNG) January 19, 2024, 17.5 LEAPS call contract for roughly $9.80

- Sell DraftKings (DKNG) April 14 calls (48 days until expiration) for $1.27, or $127 per contract

Static or Return on Premium: 13.0% over 48 days

Breakeven: $8.53 per PMCC, or $853

So, as you can see above, all things being equal, we have the potential to create roughly 13% every 48 days, or an astounding 80% a year using a DraftKings as our underlying stock of choice.

Realistically, we probably aren’t going to bring in 80% on an annual basis, but certainly we have the potential and more importantly, you can see the power of using poor man’s covered calls.

I also want to add that if DKNG pushes above 25 we still have the ability to make capital gains on our LEAPS contract, thereby increasing our overall return. Inherently the overall position is long deltas (0.76 – 0.35 = 0.41) so it would take a move that pushed the delta of the short call (0.41) at parity with the long call (0.76). Unlike a covered call the gains are not capped by the short call. The gains are capped when both the long call and short call have a delta that is the same. When this does occur, we simply take the position off, lock in our profits, or buy back the short call and continue to sell more calls. Either way, we are left with a profit.

Also remember, we have the ability to buy more LEAPS calls without selling calls against them to create an even higher delta on the trade. Those that are a bit more bullish might take on this approach, an approach I will discuss in greater detail in an upcoming post.

Quick Summary of Poor Man’s Covered Call Strategy

I like to take a diversified approach, using stocks that fall into different levels of IV, but risk is in the eye of the beholder, and I just want to make everyone aware of the choices out there so that we can make the most informed decisions possible given our own risk tolerance and investment goals.

As always, if you have any questions, please do not hesitate to email me or post a question in the comments section below. And don’t forget to sign up for my Free Newsletter for education, research and trade ideas.