When I woke up last Friday and checked the pre-market S&P 500 futures, I felt dread as I saw that the market was again indicated higher. Was I short selling stocks and upset that I was going to lose money? Nope, not at all! In fact, my portfolio was bullish, and I had added new positions in MGM Resorts (MGM) and Square (SQ) in just the last week. But that morning, I had a terrible case of FOMO. FOMO—Fear Of Missing Out—can be an important component of trading in a bull market.

One definition of FOMO is “a pervasive apprehension that others might be having rewarding experiences from which one is absent.” It’s also a problem in everyday life.

I see the FOMO with my young kids all the time. For example, last Saturday, my daughter had an amazing time at her best friend’s birthday party swimming all day, going down the big water slide and eating cake. But when she heard that she had missed out on tie-dying shirts with the swim team (because she was at the birthday party), she was upset that she had missed out.

[text_ad]

FOMO is also a problem for teenagers on social media. One of the reasons your kids/grandkids are constantly on Facebook and Twitter is because they fear missing out on status updates from their friends.

Back to the stock market, when the market is zooming higher and you aren’t fully invested, sold too early or own the wrong stocks, FOMO has the potential to push you to aggressively chase stocks higher and higher.

Think of the FOMO for the hedge fund manager who is short or underinvested in this bull market. As the S&P 500 races higher, he may become desperate to catch up to the returns of the indexes or his bullish competitors. His angst rises each day he sees the market rise higher. In response, he starts chasing. And Nasdaq stocks, which are up 21% year-to-date, see the most chasing.

On the other hand, when you see stocks like Shopify (SHOP) and Amazon (AMZN) go up 2% to 4% nearly every day, it’s hard to not think that some stocks are nearing an inflection point.

The Smart Way to Play This Bull Market

So if I was having a case of FOMO and wanted to participate in this bull market, but in a low-risk way in case the bubble bursts, how might I buy a stock like SHOP, which is up a staggering 128% year-to-date?

The answer is options trading! Instead of buying 100 shares of a stock like SHOP at 100, (total at risk: $10,000), you could buy SHOP August 105 Calls for $8 (total at risk: $800).

You can see that your capital at risk when you buy the call instead of the stock is dramatically different!

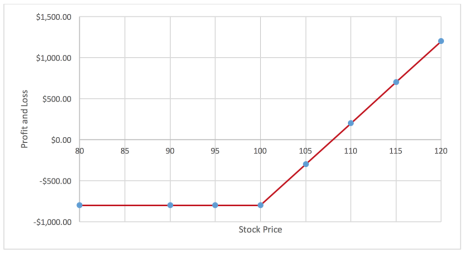

A call purchase is used when a rise in the price of the underlying asset is expected. This strategy is the purchase of a call at a specific strike price with unlimited potential for profits. The maximum loss on this trade is the amount of premium you paid.

For example, your purchase of the SHOP 100 strike call for $8 would only risk the $800 you paid. If the stock closes at $100 or below at expiration, your call purchase will be worthless. If the stock rises above $108, you will make $100 per contract purchased per point above $108.

Here is the profit and loss graph for the purchase of one SHOP August 100 Call for $8:

Other types of FOMO in investing are when you miss a trade, when you sell too early or when you don’t execute the trade perfectly.

For example, for the past two weeks, I’ve had a terrible case of FOMO about my Square (SQ) position. When SQ was trading at 21.25, I recommended a buy-write to Cabot Options Trader/Cabot Options Trader Pro subscribers. A buy-write is a slow and steady, low-risk trade, in which the upside is limited. And in this SQ trade, the most we could make was a yield of 5.15% in just over a month and a half.

By most standards, a low-risk profit of 5.15% in a few weeks would be a great trade. However, since my recommendation, SQ broke out to new highs, and if I had bought calls instead, we would have a home run on our hands.

Unfortunately, I’m mostly missing out on that home run as I watch the stock go higher nearly every day. But big picture, I know that a winning trade is something I should never regret.

Is the bull market getting overheated as traders feeling FOMO chase winners higher? Perhaps. But as Cabot Chief Investment Strategist Tim Lutts has said countless times, “Trends typically last longer and go further than most investors expect.”

If you like to find out more about how to trade options in any market for maximum gains, consider taking a trial subscription to Cabot Options Trader.

Get more details by clicking here.

[author_ad]