The Magnificent Seven stocks (Alphabet (GOOGL), Amazon (AMZN), Apple (AAPL), Meta (META), Microsoft (MSFT), Nvidia (NVDA) and Tesla (TSLA)) dominated both the financial media and the major indexes in 2023.

According to Goldman Sachs’ 2024 U.S. Equity Outlook, the Magnificent Seven claimed the largest market cap share ever (29%) for just seven companies, and the S&P 500 would have returned a paltry 6% in 2023 without them.

This is all well-trod territory. We’ve written before about their dominance (and in fact predicted their 2023 resurgence in this space a little over a year ago), about how, even if you’re primarily an index fund investor, you have more exposure to the Magnificent Seven than you may think, and how important it will be for other stocks to join the party if we hope to see a sustained bull market.

The question now is, what does 2024 have in store for the Magnificent Seven?

Certainly, (and as you’ll see in the charts below) the last few trading days haven’t been kind to them, as all seven have been trading lower heading into the new year and have continued to do so now that the calendar has flipped.

But, with the standard caveats about technical analysis not being predictive (my crystal ball is in the shop, etc., etc.), the technical picture looks very different for some of the Magnificent Seven stocks than others.

So, let’s take a look at each of the charts of the Magnificent Seven stocks below and see which of the bunch look the most technically strong heading into 2024.

Magnificent Seven Technicals

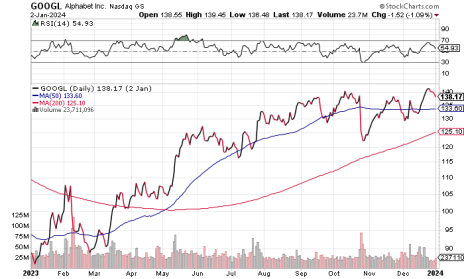

Alphabet (GOOGL) took a little longer than the other six to get started in 2023, but its bull run also lasted later in the year (into the fall). GOOGL consolidated some of the gains in the end of October and has since reentered a technical uptrend, setting higher highs and higher lows since the beginning of December.

Shares are currently trading near 2022 highs and within about 10% of all-time highs set in November of 2021, which would be the near-term target should the uptrend continue.

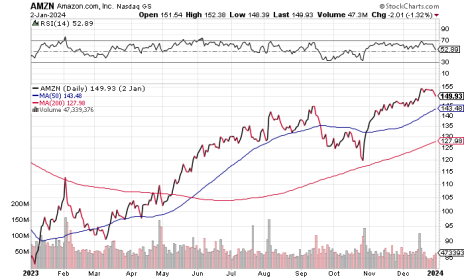

Amazon (AMZN) had a strong rally through the first nine months of the year before retracing a little less than half its gains (healthy). Like GOOGL, AMZN remains in a technical uptrend, setting higher highs and higher lows since the end of October.

Shares are trading above both the 50- and 200-day moving averages, which are both upward trending. The rising 50-day line is likely to coincide with September highs near 145 in the coming days (also coincides with December lows) which points to technically strong support at those levels.

Of the Magnificent Seven stocks, AMZN is second on my list of strongest technicals.

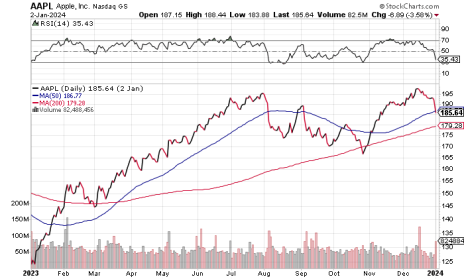

As you can see in Apple’s (AAPL) chart above, the first half of the year was a strong, consistent uptrend. Persistent overbought RSI readings (above 70) are a classical marker of a trending stock. The late-summer swoon in growth stocks was a period of consolidation for AAPL, with shares giving back about half of the prior run-up (healthy consolidation range) and then toying with their 200-day moving average in November.

Shares rebounded strongly in the last quarter of the year, setting new 52-week highs before what was likely end-of-year profit-taking or rebalancing brought shares back to their 50-day line. Given its role as loose resistance in the fall, loose support at or slightly below the 50-day line here could set the stage for AAPL to resume the uptrend. The 200-day line, tested twice in 2023, would be the major test for shares, should they continue heading lower.

Shares are not currently trending, but support at these levels combined with higher highs early in 2024 would mark a resumption.

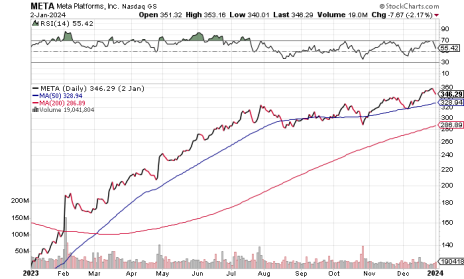

Meta Platforms (META) is actually the best-looking Magnificent Seven stock from a technical standpoint. It’s got the RSI overbought markers that AAPL enjoyed during the first half of the year, hardly gave back any of its initial run during its consolidation period (instead, it consolidated sideways from August through the end of October) and is also in the midst of a technical uptrend (since the end of October).

A peek at a longer-term chart (not pictured) indicates that there’s nothing but white space until shares test all-time highs (September 2021) if shares continue trending higher.

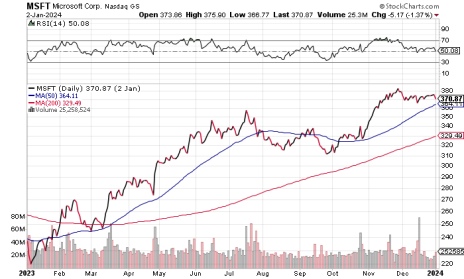

Microsoft (MSFT) has a lot of the signs of technical strength that META enjoyed (a strong run in the first half of the year before consolidating sideways via time, not down via price) but no overhang of prior-period highs (all-time high in November of this year). The reason it’s somewhere in the middle of the pack is the end-of-year performance.

MSFT is not in a technical uptrend, having failed to set higher highs after tagging lower lows in mid-December. The 50- and 200-day moving averages are both rising (bullish), but the share price isn’t.

MSFT appears to be in its own period of consolidation after setting those all-time highs; if it breaks out to the upside it enters a period of “price discovery” to see just how high it can go; if it breaks down, the hope is that it will hold its summer 2023 highs.

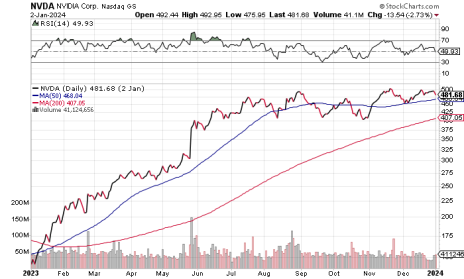

Nvidia (NVDA) is the best-performing Magnificent Seven stock in the last year, having returned over 230%. It’s also been gradually grinding higher since July, failing to really enter a technical trend. Highs in late August were followed by lower lows and lower highs until November when it broke out of a short-term downtrend to set modestly higher all-time highs.

Since then, it’s banged its head on resistance around the 500 level twice in December after tagging the 50-day to start the month.

NVDA is a good, if somewhat cautionary, representation of what MSFT could encounter should it also enter price discovery, a battle for every inch of new highs. Of course, NVDA has a lot of gains to digest, and a prolonged period of consolidation without giving much back shouldn’t be seen as a mark against it.

That said, NVDA is the name on this list most in need of a strong breakout to really get going.

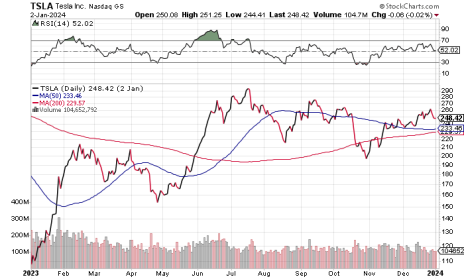

From a technical standpoint, Tesla (TSLA) is probably the worst-looking Magnificent Seven stock. Like AAPL, it poked below its 200-day, but unlike AAPL, that 200-day briefly turned into resistance in early November.

The 50-day line is also downward trending and is awfully close to the flat 200-day. Shares were in an intermediate-term downtrend for about half the year before breaking higher during the November rally. While some other names on this list consolidated via price or via time, TSLA has done both, moving with pronounced fits and starts.

The biggest mark against it is that, even should the nascent uptrend continue, TSLA will have multiple levels of overhead resistance to chew through before it can really get moving to the upside, namely, October, September, and July highs.

I remain of the opinion that investors in the Magnificent Seven stocks who are coming off a year of really impressive overperformance should consider tactically allocating some proceeds to smaller-cap stocks (which have been ignored for years), but setting aside fundamentals, META, AMZN and MSFT would be my picks – META and AMZN for their current trends, and MSFT for its upside potential.

[author_ad]