Except for the occasional wobble of a day or two, the sellers basically put up no fight from the start of November through early February—whether it was the major indexes or leading stocks of all stripes, the buyers were stomping anyone in their way.

About a month ago, that started to change, especially when it came to many “extended” leading stocks. (When I say extended, I’m mostly talking about time-wise, referring to names that broke out in November and ran basically without interruption for three months or more.) It was then that we started to see churning—lots of volatility without much price progress, which is a sign of subtle distribution.

[text_ad]

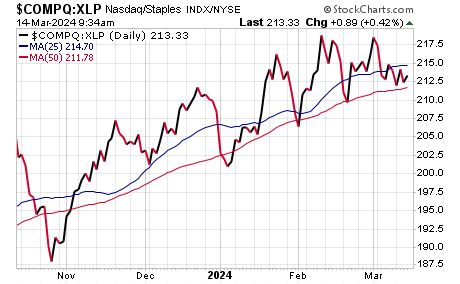

Indeed, we’re seeing some of that play out in our Aggression Index, the daily chart of which is shown here: After months of two-steps-forward, one-step-back action, the Index hasn’t hit a higher high since early February and is testing key support at the 50-day line.

Now, to be clear, the big picture continues to look fine, if not fantastic—as I wrote in Cabot Growth Investor last week, the S&P just finished a four-calendar-month stretch (November through February) in which it gained 20%, and since 1970, that’s only the seventh time it’s done that after starting below its 12-month moving average. (Translation: The market went from a long-term sluggish period to great gains over four months just six times.) Six months later, the market was up 15% or so on average, and a year later, up 22%, so strength begets strength—and this relatively simple study backs up many others that tell us the odds favor higher prices in the months down the road.

That said, while I’m always willing to switch my view if the evidence changes, right now there are more and more signs that point toward the big leaders of the post-October advance getting tired, short term, along with the Nasdaq itself.

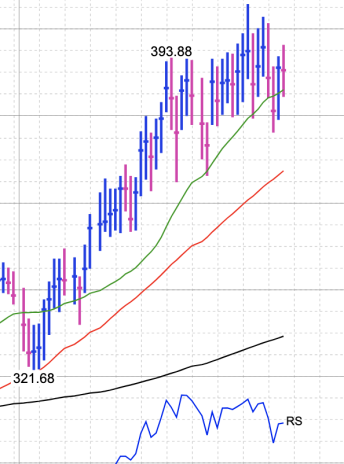

Going forward, I’m watching all my indicators of course, but I’m going to be laser-focused on leadership—in two different ways. The first is looking at things from a top-down perspective: Shown below is a chart of the IBD 50, an index that tracks stocks with strong relative strength and good sales and earnings growth (which is the pond that I fish in). You can see that the IBD 50 hasn’t done anything net-net during the past month and has pulled in of late—but remains near the 25-day line, so the uptrend is still intact.

Beyond just that broader index of leadership and monitoring the obvious AI leaders in chips, networking and the like, I’ll be watching whether money rotates into some new leadership areas—and, encouragingly, the past two or three weeks have shown some positive action on this front.

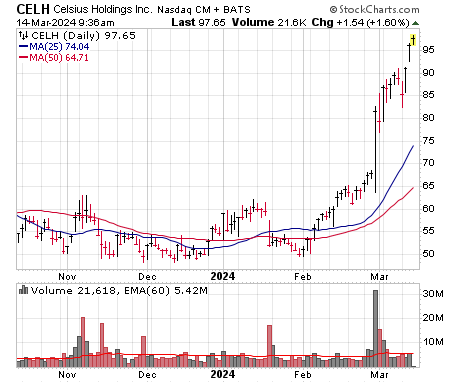

One sector to watch is retail and consumer stocks, a bunch of which meandered for a while during this rally, but now we’re seeing a few really pop. Old friend Celsius (CELH), which is aiming to be the next Red Bull or Monster Beverage, is certainly one of them—the stock never really kicked into gear for the first three months of the rally, but it perked up in February and blasted off on earnings near month’s end.

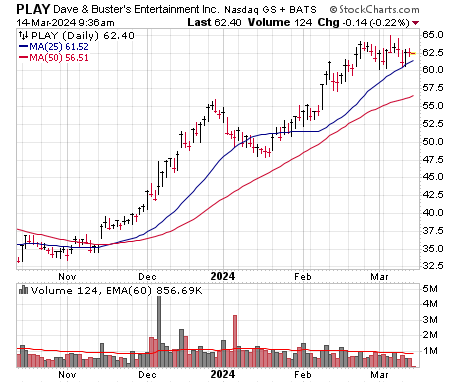

Dave & Buster’s (PLAY) is another retail-related name, and it looks like it’s finally gotten going from an endless, wide trading range of the prior few years. Cash flow is big (as have been share buybacks) and new management promises even better times ahead as they boost efficiencies.

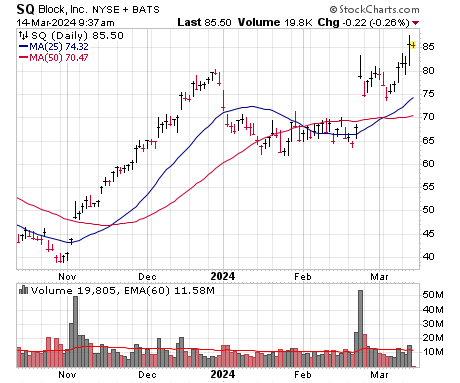

Beyond retail, don’t lose sight of payment stocks—usually these do well in a bull move with a new leader or two appearing. Old winner Block (SQ) recently popped on earnings and is sitting near two-year resistance at 80 (see chart), while up-and-coming names like Shift4 (FOUR) and Toast (TOST) perk up.

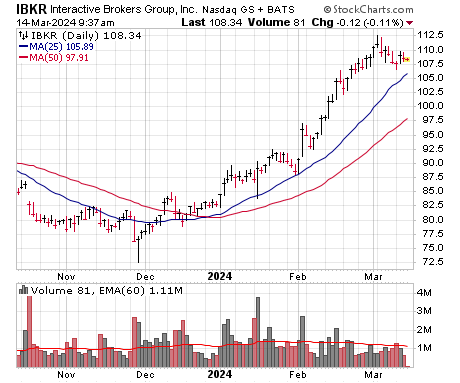

And don’t forget about bull market stocks—as mentioned above, the big picture looks very enticing following two-plus years in the muck, and rising asset prices (and possibly easier money from the Fed) should dramatically boost book values, recurring fees/income and payouts among the group. Apollo Group (APO) is one of the big players in asset management—it was just featured in Cabot Top Ten Trader this Monday—but names like KKR (KKR) look great, too, while brokerage stocks like Interactive Brokers (IBKR) are in fine shape.

Bottom line: While I’m hanging onto most of my winners from the past few months, for new buying, I’m seeing some earlier-stage names in other growth sectors that are perking up—and my guess is some of those can take the baton if the AI stocks do take a well-deserved rest.

[author_ad]