About 18 months ago, my wife and I bought our first hybrid car. In spirit, we wanted to go fully electric – penance for the previous decade spent driving a gas-guzzling Toyota 4Runner – but in the end, a hybrid was a more practical compromise for navigating Vermont’s harsh winters. So, we bought a Volkswagen XC90 Recharge, a plug-in you can charge in your normal garage outlet overnight that gives you 30 miles of battery power in the winter and 40 in the summer – perfect for my wife’s 22-mile commute to her job five days a week (yes, it’s technically “her” car… sigh).

Sure, our home electric bills are higher due to all the overnight charging – powering up a car uses quite a bit of electricity, as it turns out – but that’s more than offset by the fact that we very rarely have to buy gas, at least for that car (my humble 2017 Subaru Outback is another story…). We couldn’t be happier with our new Volkswagen, and deciding to buy a hybrid was the best of both worlds.

[text_ad]

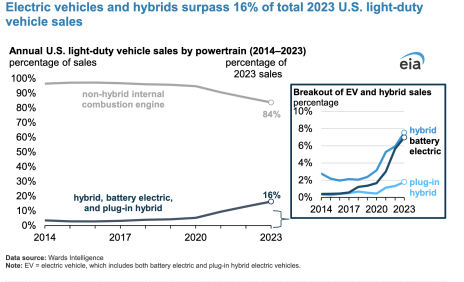

These days, many environmentally conscious Americans are making the same “split-the-difference” decision, as the chart below (courtesy of Wards Intelligence) demonstrates:

Sales of both battery electric vehicles (BEVs, i.e., fully electric cars) and hybrids have spiked in the last five years, but hybrids have maintained their lead, especially when you include plug-in hybrids like my XC90, as a more popular alternative to EVs as they are both a more practical and cheaper option. While Americans bought a record 1.2 million electric vehicles last year – up 46% from 2022 – hybrid sales surged 65%. When you include plug-ins, roughly 10% of all new cars purchased in the U.S. in 2023 were hybrids, vs. a 7.6% market share for pure electrics.

And while electric vehicle stocks were all the rage in 2020-21, they have since fallen out of favor, with everything from Tesla (TSLA) to Rivian (RIVN) still trading well below their late-2021 peaks as sales growth – while still quite robust – has slowed since the pandemic-era shopping spree. Hybrid sales growth has slowed too, but investors have started gravitating more to the companies that sell them. Invariably, those are well-established, big-name car companies made famous by many decades of selling internal combustion engine vehicles; most aren’t ready to fully abandon their roots but want to tap into the surging national (and global) appetite for electric, so – like my family did 18 months ago – are turning to hybrids as a compromise.

As a result, these once-stodgy car companies are tapping into new revenue streams, and their share prices are surging accordingly. Here are three auto stocks that are getting the biggest hybrid bumps.

3 Hybrid Car Stocks to Buy Now

Toyota (TM)

The Toyota Camry has long been the top-selling car in America. And starting next year, it will be a hybrid-only vehicle. Mind you, the Camry has been available as a hybrid since 2007, and Toyota has a history of being ahead of the environmental curve, dating back to its 1997 launch of the Prius. Soon, Toyota will have a hybrid version of every car in its lineup – the Supra, the GR86 and the aforementioned 4Runner are its only models left that don’t. This spring alone, Toyota plans to launch nine new hybrid-only cars, including one from its Lexus luxury brand.

It’s no wonder as to why Toyota is beefing up its hybrid fleet: Last year, the company sold more than 640,000 hybrids in America, 29% of its total U.S. sales. While hybrids comprise less than 8% of total U.S. sales, for Toyota, it’s nearly four times as much, a reflection of its fixture as a hybrid maker for more than a quarter century.

With hybrids now accounting for nearly a third of all Toyota sales – and set to top 40% in 2024, according to David Christ, general manager of the company’s North American division – Toyota is growing like it hasn’t in years, with sales up 13.6% in 2023, the first annual sales growth of greater than 9% in more than a decade. (Though sales were down 1.2% in the latest quarter.)

After a very strong start to the year, TM shares have pulled back from March highs above 254 to as low as 167 earlier this month. Now they appear to be gaining traction again, back up to 183 as of this writing. With the stock trading at a mere 8x forward earnings estimates and at just 0.78x sales, this looks like a great entry point into a resurgent company.

Honda (HMC)

The other Japanese automaker that dominates the U.S. market doesn’t yet produce as many hybrids as Toyota but is growing even faster – Honda’s hybrid sales nearly tripled in 2023, to 294,000 units. Its popular Honda Accord and CR-V sport utility vehicle models are now more than 50% hybrid in terms of sales. The result? Honda’s sales have grown by double digits in four of the last five quarters (they were “only” up 2.9% in the latest quarter) after four straight years of mostly declining sales. Similar to Toyota shares, HMC raced out of the gates to start the year, peaking above 37 a share in late March, but have since pulled back (the more muted second-quarter results hurt), trading at 32. But the stock is even cheaper than TM, trading at a mere 6.6 times forward earnings estimates and with a price-to-sales ratio of a measly 0.36. That combination of value and growth/momentum is rare, and Honda can thank its booming hybrid sales for it.

Hyundai (HYMTF)

Yet another eastern car company that has cracked the hybrid code in America (perhaps not a coincidence?), the South Korean automaker, maker of the Kia, is fully embracing hybrids, with plans to invest $12 billion in factories in Georgia and Alabama after achieving record U.S. sales in 2023. As Steve Center, CEO of Kia America, told the New York Times, a pure electric vehicle might not serve “a cowboy in Montana with a pickup truck,” but a hybrid could. Hyundai’s hybrid and electric vehicle sales (its new Ioniq EV has become a top seller) expanded by 77% last year. On the heels of another solid quarter (2.2% sales growth, 17.2% EPS growth), Hyundai shares (which only sell on U.S. markets as an American Depositary Receipt, or ADR, under the “HYMTF” ticker symbol) are up 12% in the last two weeks, rising from 55 to 62 since an early-August bottom. The stock is up more than 44% year to date – easily the best-performing of this group.

With a price-to-sales ratio of a paltry 0.26, there’s plenty more upside.

Like hybrid vehicles themselves, these three stocks are cheaper and more reliable alternatives to electric vehicle stocks. And right now, they’re outperforming their EV counterparts by a wide margin. Buying any one of these three “hybrid car stocks” would make for a smart long-term investment.

[author_ad]