After 18 months of bear markets and sideways chop, you’d be forgiven for looking wistfully back at the bull market of 2021. Somewhat lost in the shuffle of a year that saw a nearly 27% gain in the S&P 500 was a record-setting year for IPOs (which itself came on the heels of a previous record year in 2020).

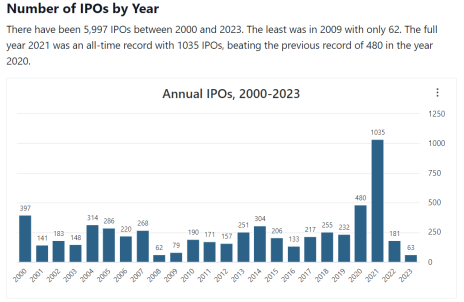

For a better sense of how big of a year 2021 was for IPOs, just take a look at the chart below, courtesy of StockAnalysis.com.

2021 saw the largest-ever number of IPOs by far, with a big chunk of those being executed via SPACs (special purpose acquisition companies). The 1,035 IPOs in 2021 represent a full 17% of all IPOs since 2000. 2021 averaged more than 4 IPOs per day; initial public offering activity has obviously slowed since.

But we all know what’s happened since the heady days of 2021. Low interest rates have risen significantly and the frothy energy of the bull market, which largely fuels the decisions of companies to go public, has faded into the ongoing bottoming process.

[text_ad]

With that in mind, let’s take a look at the five biggest IPOs of 2021 and see how they’ve performed since.

5 Biggest 2021 IPOs

1. Rivian (RIVN)

· IPO date: Nov. 10, 2021

· Money raised at IPO: $11.9 billion

· Valuation at IPO: $66.5 billion

Rivian priced at 78/share for its IPO and initiated trading around 106/share with a close on the day at 100. Shares of the electric vehicle manufacturer last traded at 13.76, which translates to a loss of more than 80% of its market cap. The company is not yet profitable but has been growing revenues and beating earnings expectations. The company delivered only 7,946 vehicles in the first quarter and faces increasing price pressure from Tesla, which has been lowering vehicle prices, as well as the loss of eligibility for EV tax credits due to battery sourcing.

2. Coupang (CPNG)

· IPO date: March 11, 2021

· Money Raised at IPO: $4.6 billion

· Valuation at IPO: $60 billion

Shares of this South Korean e-commerce company priced at 63.50/share before closing the day at 49.25, and they’ve gone on to lose more than 60% since as they’re currently trading at 17.50. Prospects certainly look brighter for Coupang, the largest online marketplace in South Korea, as they’re approaching profitability and are expected to reach it in 2024 or possibly later this year.

3. Lucid Group (LCID, via SPAC)

· IPO date: July 25, 2021

· Money raised at IPO: $4.6 billion

· Valuation at IPO: $24 billion

Shares of Lucid Group, another upstart EV company, went public via special purpose acquisition company (SPAC) on July 26, 2021, and began trading at 25/share before reaching a post-IPO high of 55/share in November that year. Like Rivian, Lucid is truly in the early innings, having delivered a grand total of 4,369 vehicles in 2022. The company announced an 18% reduction in its workforce in March and its low delivery count was a significant disappointment in its most recent earnings release. Shares have lost approximately 70% of their value since the SPAC merger.

4. Grab (GRAB, via SPAC)

· IPO date: Dec. 2, 2021

· Money raised at IPO: $4.5 billion

· Valuation at IPO: $40 billion

This Singapore-based delivery and ride-hailing company (pitched as the do-everything Uber of Southeast Asia) initiated trading at 13/share before closing more than 20% lower on the day at 8.75/share. Like other entries on this list, shares went on to shed 73% of their value since the IPO date and are currently hovering just above 3/share. The company is not yet profitable and is not expected to reach profitability this year or next, although Q1 earnings on May 18 could add more clarity there.

5. Didi (DIDIY)

· IPO date: June 30, 2021

· Money Raised at IPO: $4.4 billion

· Valuation at IPO: $73 billion

Shares of this Chinese ride-hailing company priced at 14/share before opening for trading at 16.65, but that was the end of the good news as shares were halved in less than a month when the Chinese government cracked down and removed the app from app stores. The company was ultimately forced to delist from the Nasdaq and faced a $1.2 billion fine from Chinese regulators for data and network security violations. The app has since been returned to the stores and Didi once again has permission to register new users, but that’s small comfort in the face of a 78% loss since the IPO date.

Of the five biggest 2021 IPOs, only Coupang looks set to reach profitability in the next few years (if ever for the other four), but none of these companies look particularly strong as each faces some degree of existential risk.

[author_ad]