The only good news about a market correction or downturn is that you usually get to see the wheat separate from the chaff—you can more easily spot the stocks that big investors are hesitant to sell and/or buying on dips, compared to the stocks and sectors that they’re aggressively selling on any minor bounce. While most look for the beaten-down “bargains” during a correction, if you’re more of a position trader (intermediate- to longer-term, etc.), you’re usually better off staying laser-focused on stocks holding up well. And right now, two familiar mega-cap tech stocks are outperforming again. I’ll get to those in a minute.

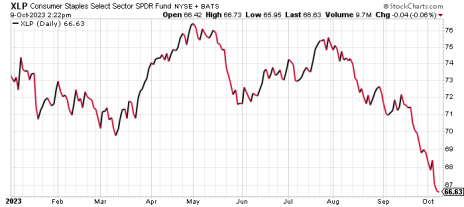

Many times the stocks that are holding up well are defensive-type names, so you’re still looking for great numbers and stories—but even so, that’s not the case today. Whether it’s consumer staples (XLP), defensive healthcare (XLV) or something else, they’ve arguably been some of the worst performers this time around.

When it comes to spotting relative strength during a downturn, it’s best when the major indexes have etched two or three different short-term lows. That’s what we’ve seen during this downturn—there was the leg down into mid-August, and after a rally, we entered another leg down to lower lows, though the upturn in the last couple trading sessions has been quite encouraging.

[text_ad]

That sets up an A-B-C relative strength test—simply put, you’re looking for growth stocks that (a) didn’t get completely taken apart in August, and (b) have been etching higher lows at the September and October lows. (The more important part is holding the August low—a lower Sept./Oct. low is meaningful but less so.) Of course, sometimes things that are holding up well now fall apart in a few days; that’s part of the process. The key is to keep up the list so that, when the market finally turns up (which it will), you’re on top of the most resilient names—many of which will take off in a hurry.

2 Mega-Cap Tech Stocks Stand Out

A perfect example of this is Tesla (TSLA), which had a great off-the-bottom rally in the spring that took shares to nearly 300 before the summer correction kicked in, pulling it down 29% to 212 or so. The August rally allowed the stock to get off its knees before the latest selling—but so far, TSLA has “only” dipped back to 235 in September and 245 or so this month. That doesn’t mean it’s ready to blast off tomorrow, but it does tell you that, despite a very broad, punishing decline, most of the sellers appear to already be out of Tesla.

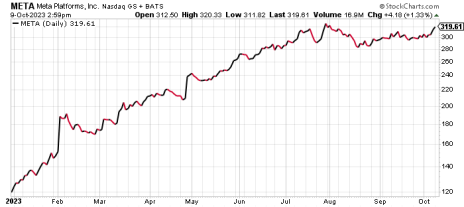

Another mega-cap tech stock name in a similar position so far in 2023 is Meta (META), which had a ridiculously smooth advance all year until the second part of July, topping at 326 before a quick 16% dip in August to 274. The August rally wasn’t amazing, but so far META has only been able to dip to 287 last month and 300 or so in October. Again, this could change in a couple of days, and if so, the relative strength story would be damaged a bit, but overall, it’s the type of action you want to see when the market as a whole is falling apart.

There are other names we’re watching with the same pattern—and the longer they hold up, the better the odds they can have great moves once the market turns up (which, by the way, it could be starting to do now). More broadly speaking, this sort of straightforward relative strength analysis should point you toward leaders of the coming sustained advance, so keep it in your toolbox not just for now but for future downturns as well.

[author_ad]