No matter who wins the election in two weeks, stocks are likely to be just fine. But infrastructure stocks could get a nice boost if Joe Biden wins.

In the latest election poll, Joe Biden is ahead 52% to Donald Trump’s 42%. I’m not a big believer in polls, especially after the last election when the pollsters showed Hilary Clinton beating Trump. We all know how that turned out.

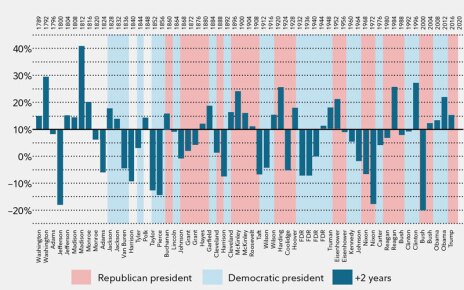

I shared the following graph in August in my Cabot Wealth Summit presentation, “How to Survive – and Prosper – after the November Election”. And, as you can see, statistically speaking—in the case of stock market returns—it really doesn’t seem to matter which party claims the White House.

Source: Fidelity.com

But it is fun to speculate! In the short term, we know that some industries will be affected more than others. And today, I’d like to focus on infrastructure stocks in particular.

Since Joe Biden is currently ahead in the polls, I thought it might be interesting to explore the sectors that have a good chance of benefiting if he is elected.

[text_ad]

Most pundits are speculating that stocks in the infrastructure, healthcare, climate, and education arenas will be the first to benefit under a Biden presidency—as government spending is bound to accelerate. It just makes sense that these areas will get a big dose of any new government stimulus.

We know that there will be a push for renewable energy, government-funded education, and healthcare.

But the area which is long overdue for some government intervention is our country’s infrastructure. In Trump’s 2016 election campaign, he promised $1.5 trillion to shore up our infrastructure, which didn’t happen. Our water systems and electric grids have been pitifully neglected, and are in crisis mode. If Biden is elected, some pundits are predicting an immediate stimulus injection of more than $3 trillion, with at least some of that pointed toward infrastructure.

The American Society of Civil Engineers says we would need to invest $3.6 trillion into U.S. infrastructure by 2020 just to bring our 1.6 million miles of aging water and sewer pipes to acceptable levels. That hasn’t happened yet, and the costs continue to pile up.

Here is the sad state of affairs, in detail:

-Every day, in North America, there are 850 water main breaks, which cost some $3 billion annually to repair. According to the EPA, the U.S. has 14,478 POTWs (publicly-owned treatment works, i.e. sewer systems) that serve 76% of the population. They have a 20- to 50-year life cycle. These pipes range from 15 to 100 years old, with some in older northeastern cities that are 200 years old.

-Our power grid—for the most part—was built in the 19th century and hasn’t seen a lot of upgrades since. We now create more than $400 billion of electricity a year across nearly 7 million miles of transmission and distribution lines. Utilities are making annual $100 billion investments to upgrade their aging grids. Climate change is wreaking havoc on transmission lines, as we saw with the 2017-2018 wildfires blamed on PG&E, California’s largest utility, which was forced into bankruptcy. At the same time, utilities are facing increasing competition from renewable energy, so demand is beginning to wane, and that means less profit for infrastructure investment. Between 2010 and 2018, annual wind and utility-scale solar additions averaged about 6.9 GW and 3.6 GW, respectively, and this year it was predicted that nearly 72 GW of wind and solar plants would come online, according to S&P Global Market Intelligence data.

-And our roads—yikes! According to the Transportation Research Board (TRB), our 54-year-old interstate highway system of 48,444 miles needs some desperate attention, due to the wear and tear from increased traffic and heavier loads. Our interstate bridges average 45 years in age and 27% of them need repair or replacement, with 56% of them in only ‘fair’ condition. The TRB repots that annual funding for interstate repair and replacement should be increased by two-and-a-half times, from its current level of $23 billion in 2018 to $57 billion annually over the next 20 years.

As you can see, our infrastructure needs are exponentially growing.

With that in mind, I took a look at 32 infrastructure-related stocks to see which ones looked like they offered the most potential, in case of a Biden win. These included utilities, suppliers, engineering firms, railroads, and equipment rental companies. I narrowed that list down to three infrastructure stocks that look interesting.

3 Infrastructure Stocks for a Biden Win

Infrastructure Stock #1: NV5 Global (NVEE)

NV5 Global (NVEE) is a global engineering and consulting services firm that serves both public and private sector clients in the infrastructure, energy, construction, real estate, and environmental markets. Its services include site selection and planning, design, water resources, transportation, structural engineering, land development, surveying, power delivery, building code compliance; and construction materials testing and engineering, geotechnical engineering and consulting, and forensic consulting services. It also provides governmental outsourcing and consulting, and technical outsourcing services; and geospatial data analytic and mapping services. In addition, the company offers mechanical, electrical, and plumbing design; commissioning; energy performance, management, and optimization; building program management; acoustical design consulting; and audiovisual security and surveillance information technology data center services, as well as energy services. Further, it provides various services, such as investigating and analyzing environmental conditions, and recommending corrective measures and procedures; occupational health and safety services; hydrogeological modeling and environmental programs; water resource planning, monitoring, and environmental management of wastewater facilities; solid waste landfill investigations; permitting and compliance; storm water pollution; environmental impact statement support; agricultural waste management and permitting; and wetland evaluations.

The shares carry a fundamental analyst rating of ‘2’, which means ‘buy’, and a ‘strong buy’ technical rating. The company is expected to grow at an annual rate of 13.75% over the next five years.

Infrastructure Stock #2: Advanced Drainage Systems, Inc. (WMS)

Advanced Drainage Systems, Inc. (WMS) is a global manufacturer of thermoplastic corrugated pipes and related water management products, and drainage solutions for use in the underground construction and infrastructure marketplace. Its products include single, double, and triple wall corrugated polypropylene and polyethylene pipes; and allied products, including storm retention/detention and septic chambers, polyvinyl chloride drainage structures, fittings, and water quality filters and separators. It also purchases and distributes construction fabrics and other geotextile products for soil stabilization, reinforcement, filtration, separation, erosion control, and sub-surface drainage, as well as drainage grates and other products.

The shares carry a fundamental analyst rating of ‘2’, and a ‘strong buy’ technical rating. The company is expected to grow at an annual rate of 19% over the next five years.

Infrastructure Stock #3: Trimble Inc. (TRMB)

Trimble Inc. (TRMB) is a provider of technology solutions to improve or transform work processes worldwide for the buildings and infrastructure, geospatial, resources and utilities, and transportation industries around the world.

The buildings and infrastructure segment offers field and office software for route selection and design; systems to guide and control construction equipment; systems to monitor, track, and manage assets, equipment, and workers; software to share and communicate data; 3D conceptual design and modeling software; building information modeling software; integrated site layout and measurement systems; cost estimating, scheduling, and project controls solutions; applications for sub-contractors and trades; and an integrated workplace management software.

The geospatial segment provides surveying and geospatial products, and geographic information systems.

The resources and utilities segment offers precision agriculture products and services, such as guidance and positioning systems, automated and variable-rate application and technology systems, and information management solutions. This segment provides manual and automated navigation guidance for tractors and other farm equipment; solutions to automate application of pesticide and seeding; water solutions; Farmer Core, a software subscription that enables farmers to connect their farm operation; and forestry solutions for forest management, traceability, and timber processing.

The transportation segment offers solutions for long haul trucking, field service management, rail, and construction logistics industries, as well as transportation management, analytics, routing, mapping, reporting, and predictive modeling solution.

The shares carry a fundamental analyst rating of ‘2’, and a ‘strong buy’ technical rating. The company is expected to grow at an annual rate of 7% over the next five years.

We’ll (hopefully) know in a couple of weeks who is going to sit in the White House for the next four years. In the long run, it probably won’t make much of a difference to stock markets—they pretty much depend on the economic health of the country. But in the short term, there will be opportunities to make some fairly quick money on certain segments, and I’m betting on infrastructure.

[author_ad]