I’m not going to spend a ton of time on market timing today – suffice it to say that the market is one week into a rally attempt at this point, and the setup coming into last week’s low area (hugely negative sentiment, serious oversold conditions, etc.) was solid, and at this early juncture, I generally like what I see. Everything has been rallying nicely (new highs were greater than new lows among the S&P 1500 for just the second day since September started), and I especially like the fact that we’re seeing some stocks that have held up well pop higher—a big characteristic of false rallies is that all the action is in beaten-down names (not leading growth stocks), so it’s a nice start.

Even so, from an intermediate-term standpoint, there’s more work to do—the trend of the major indexes and the vast majority of individual stocks (about 70%) is still down, the trend of interest rates (which has been the tail wagging the dog for a while now) is still up and, while some names are percolating, very few stocks are even close to new high ground.

Thus, simply put, it’s a solid first step, but the bulls have more to prove. So we’ll see how it goes.

And that brings me to the topic of my Wealth Daily today: You can never know for sure what the market is doing to do, but you can be prepared for whatever it does. So on that note, while we wait for confirmation that this rally is the real deal, smart investors are focusing on finding what could launch higher if the bulls truly take control.

[text_ad]

One method is something I wrote about in Cabot Growth Investor last week and relayed earlier this week in a Wealth Daily is using A-B-C relative strength—basically, with every index and nearly every sector etching a lower low in late September/early October, looking for stocks that etched higher lows (and still have decent overall charts and stories) is one way to home in on potential leading growth stocks.

In addition to that, there are two other methods I’m using right now to find what’s ready to go if the market allows it.

New Leading Growth Stocks and the New High List

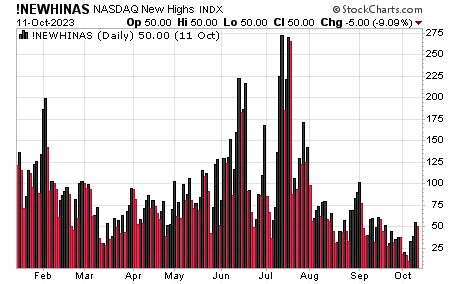

The first one is tried and true, been around for decades and is easily accessible, and that’s looking at the new high list each day. Before the internet had everything available at a few keystrokes, all of us in the Cabot office used to grab a newspaper in the morning and start marking or highlighting interesting names on the new high list. Of course, today, the list remains tiny; check out the chart below of the number of new highs on the Nasdaq, which picked up a tiny amount from bone-dry levels this week.

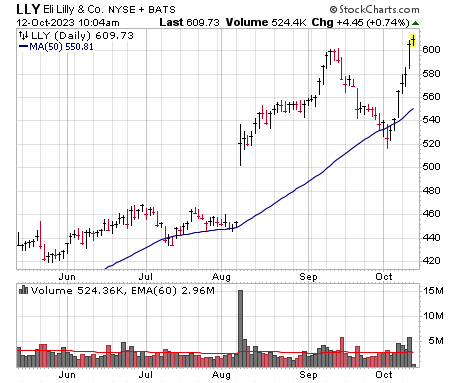

Even so, there are some morsels to be gleaned here. Just looking through the list the other day, I see that Eli Lilly (LLY) has snapped back right quick from its correction to test new high ground—the firm, of course, is a big play on the weight loss drugs that many feel will become massive blockbusters in the years ahead.

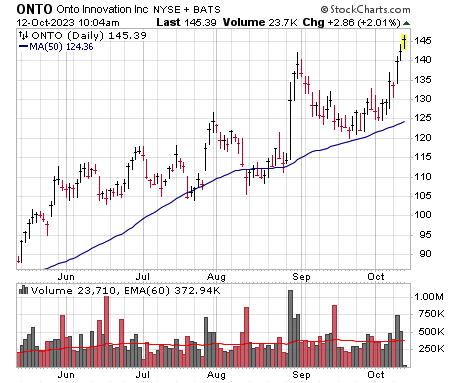

On the smaller side, there’s Onto Innovation (ONTO), which first came to my attention in Cabot Top Ten Trader a few weeks back—it’s starting to get orders for chip equipment that is well suited to testing AI-related chips. Its pullback was normal during September and it’s taken off in recent days.

Relative Performance (RP) Lines

The second method is good, old-fashioned relative strength analysis. I wrote about this in last week’s Cabot Growth Investor and in this space earlier this week: With the major indexes having hit lower lows (sometimes dramatically lower lows) in September/October, any stock that hasn’t completely imploded and hit a higher low is worth looking at. Of course, you still need a good story and numbers, etc., but chart-wise, this is an easy “screen” to run.

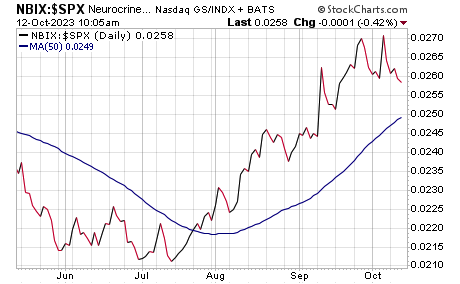

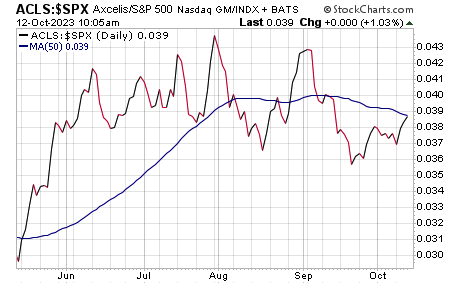

A related way to look at stocks you’re interested in is to use relative performance (RP) lines, which measure the performance of a stock to the S&P 500 on a daily basis and plots it—in a market correction, you’ll usually see the next wave of leaders hitting new RP peaks before they hit new price highs, a sign they’re outperforming and want to race ahead if the market allows it.

To see an RP line of a stock, you can use stockcharts.com—enter the symbol of the stock followed by :$SPX. Thus, for example, if you wanted to see the RP line of Neurocrine Biosciences (NBIX), you’d enter NBIX:$SPX. I usually then play with the chart options to make it a line chart and a log scale. You can see below that NBIX’s RP line has been trending sharply higher since mid-July, even nosing to new multi-month peaks late last month, despite the stock itself still having overhead—a good sign that perception has changed. You still want to see upside follow-through if the market heads higher, but it’s worth watching.

Using this method early in a potential rally (and after a multi-week correction that’s taken down most areas of the market) can give you insights into which stocks are really leading the market and which ones may simply be getting pulled up by the market at this point (like Axcelis Technologies (ACLS)). That can change (say, after an earnings report), but so far, it’s not showing any real juice.

Soon enough, the next rally will arrive, and new leading growth stocks will emerge. We’ll see if the ones mentioned above are among them.

[author_ad]