All the rage in telecommunications these days is around 5G. It’s an advertising catchphrase. It has its own FAQ page on every major telecom website. Professional sports stadiums offer 5G connectivity. It pops up on the nightly news and in community meetings. But what is 5G, and should you learn how to invest in 5G stocks or is it just another marketing gimmick?

5G is short for fifth generation. This next-generation mobile broadband technology should negate latency issues, dramatically increase wireless speeds, and will be able to support more simultaneous users. It will launch the world into another level of the digital age and bring transformative new technologies in self-driving cars, artificial intelligence and smart cities as well as game-changing applications in healthcare and the military. This 5G revolution will likely be a level of technological change we haven’t seen since the arrival of the internet in the 1990s.

[text_ad]

How to invest in 5G stocks without taking a big risk

As far as determining how to invest in 5G stocks, there are some different things to consider. First of all, 5G is a communications technology. As smartphones with 5G hit the market, they will need a much higher degree of internet connectivity through cellular networks. Naturally, these communications companies will be able to charge higher fees per smartphone, as they will offer more and better services. The Internet of Things involving all things connected to the internet like autonomous cars, smart cities, health monitoring services, and a wide range of other things will ring the register as well. And many of these telecom companies can lock in customers for long-term contracts.

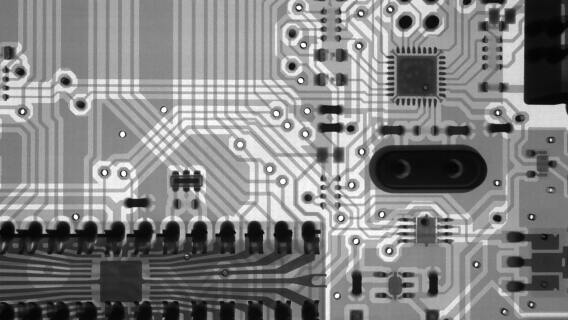

Don’t overlook devices, either. All those smartphones need chips in order to work. A chip is part of the processor that is essentially the brain of a computer, smartphone or device that controls other devices in the system. These chips are the cutting edge of computer technology and determine the power, speed and function.

5g smartphone sales were estimated to be 20% of the total sold in 2022 and are expected to rise to a 69% share this year. Analysts estimate that the 5G chipset market will grow from $2.1 billion in 2020 to over $23 billion by 2026.

Needless to say, the 5G investment opportunities will be immense, with scads of cutting-edge companies debuting new products, and eventually, being gobbled up by their larger competition, but those days are still in front of us. For now, if you’re trying to figure out how to invest in 5G stocks without taking on the big risk of a new IPO or speculative business, investing in the larger companies is the way to begin your 5G investing.

Who is building the 5G network?

Here’s where we get into some interesting opportunities. The obvious answer here is that companies like Verizon Communications (VZ) and T-Mobile US Inc (TMUS) are building out 5G networks. But...there’s the little issue of 5G infrastructure.

Every new generation requires more and better cell towers and supporting structures. This new generation requires even more because, although it provides great speeds and power, it doesn’t have the cell signal range of previous generations. A 5G signal only travels about half a mile, compared to several miles for earlier generations. Therefore, it requires more towers and supporting technologies to increase the range and relieve congestion.

Aside from the major cell phone providers, there are some other big players in 5G technology, and they’re all REITs (Real Estate Investment Trusts). It’s a business that provides both growth, with the 5G rollout, and defense, as the rollout will continue rain or shine, in a good economy or a bad one.

Have you invested in any companies specifically because of 5G technology? Share your experience in the comments below.

[text_ad]

*This post has been updated from an original version, published in 2020.