If you are wondering how the S&P 500 index could be trading as high as it is with all that is going on in the world there is a simple answer (besides stimulus spending): cloud computing stocks.

Roughly 18% of the S&P 500’s weight is allocated to companies that are keeping the world connected though cloud computing.

These companies are Microsoft (MSFT), Amazon (AMZN), Apple (AAPL) and Alphabet (GOOG, GOOGL). If you add in Facebook (FB) you get almost 20% of the S&P 500. And if you move out of the 10 largest allocations in the index that percentage goes up even more.

[text_ad]

Collectively, these companies are critical providers of cloud infrastructure, productivity software, streaming entertainment services, mobile devices, computers and online retail and delivery services. I challenge anybody who says they would be able to get through this pandemic without these services.

In many ways (but not all) this group of companies benefits from a pandemic like COVID-19, at least in the short-term. Their services help people work and shop from home, stay connected with friends and loved ones and provide entertainment and education opportunities for out-of-school kids.

Equally, if not more important, they provide the critical infrastructure that allows thousands of other companies to provide similar services to people and organizations around the world.

Just about every software, digital health care, entertainment and fintech company I cover in my Cabot Small-Cap Confidential and Cabot Early Opportunities advisories discloses in its SEC filings that its platform runs on AWS, Azure or Google. Even Apple’s iCloud runs on AWS.

Strip away those platforms and what exactly are we left with? What companies, governments and health care organizations out there would be able to function?

COVID-19 is a health care crisis and it is scary as all heck. But think about what would happen if the backbone of cloud computing became infected and had to be shut down.

No more streaming entertainment, no more working from home, no more ordering whatever you want online. It is inconceivable what this world would look like without the cloud services provided by these companies.

The S&P 500’s performance through this pandemic illustrates that reality.

As if you need one more data point illustrating just how valuable cloud computing is to the world, consider that three of the companies – Microsoft, Amazon, and Apple – have market caps north of $1 trillion. They are the only ones in the index worth that much money.

If that does not convince you of the strategic importance of cloud computing, nothing will!

Cloud Computing Rules The World

I’ve been covering emerging cloud software stocks for years. The reason is simple: even before COVID-19 cloud software was one of the biggest technology trends ever.

It is reshaping commerce, communications, supply chains, corporate strategies, and even corporate and national security interests around the world.

Just about every company out there, regardless of industry, age, and growth profile, has embraced a cloud strategy, digital strategy, and/or a subscription-based business model of some sort, whether it be for services they provide or those they consume. Those that have not gotten on board yet have dubious futures indeed.

You can play the trend with the big boys in the S&P 500 that I mentioned earlier – Microsoft, Amazon, and Alphabet. Apple, as a provider of services and devices, is in a slightly different category as it does not run its own cloud, instead using AWS (at least for iCloud).

The Best Emerging Cloud Computing Stocks

But those are the established players; they’re big, relatively stable, and well known.

My primary focus is on the huge wave of younger companies that were founded on cloud strategies, software-as-a-service (SaaS) business models and online selling strategies and that have their best days ahead of them.

These are the up-and-comers, the companies that represent the best investment opportunities over the next decade.

They include a lot of younger companies you may have heard of but are not all that familiar with, and which might still seem risky as a result.

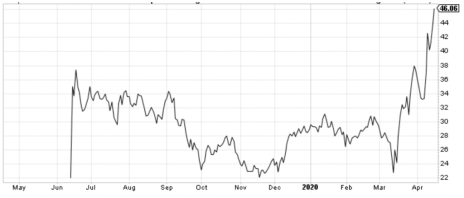

Companies like CrowdStrike (CRWD), which has a market cap of $13 billion and provides endpoint security software via its cloud-based Falcon platform.

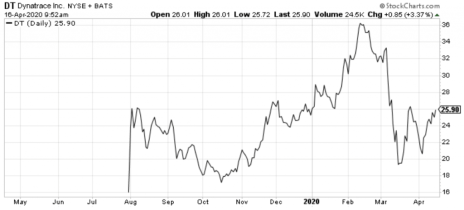

Or Dynatrace (DT), which has a market cap of $7 billion and provides solutions for monitoring applications that run in the cloud.

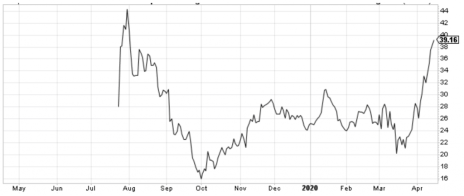

Or Smartsheet (SMAR), which has a market cap of $5.9 billion and offers a cloud-based collaboration platform that helps teams organize, manage, automate, and report on their work at a huge scale.

Then there is this surging cloud computing stock that is in Cabot Early Opportunities and which has grown into a specialized online retailer because of reliable cloud infrastructure.

And this one that’s approaching new all-time highs as its digital health solution gains adoption.

All these young companies, and dozens more, are positioned to grow despite COVID-19, and in some cases even benefit from it.

As I have said many times, cloud computing is a long-term trend of such immense importance and profit potential that investors must have exposure to cloud computing stocks. If you want to gain that through younger companies that are not yet on the radar of most investors, consider a subscription to Cabot Early Opportunities.

I will tell you which cloud computing stocks have the best chances of long-term success, why they do, and when it is time to buy them.

To learn more, click here.

[author_ad]