Everyone is getting in on the electric vehicle craze these days. But which electric vehicle stocks are actually worth investing in?

Electric vehicle stocks have become hot, as growing numbers of investors come to recognize the major shift going on in the industry, both in the U.S. and abroad. Electric vehicles are more efficient, better for the environment, deliver better performance and cost less to maintain.

Further below, I have a list of pure electric vehicle stocks that might deserve a spot in your portfolio.

But first let’s take a look at the established big players, to see if any of them have a chance, starting with the most valuable market capitalizations and working our way down.

[text_ad]

The Established Automakers

Toyota (TM) was the most valuable automaker in the world until 2020, in part because of its leadership in the hybrid car market. But while Toyota was working on making electricity from fuel cells, Tesla was selling cars running on batteries, and the result was that Tesla blew past Toyota in the market capitalization race without even blinking. Like most of the big old automakers, Toyota suffered in the pandemic; quarterly revenues fell from $70.0 billion to $67.8 billion over the past two years. But that’s still roughly double Ford and GM’s revenue. As for the stock, it’s climbed from 110 at the pandemic bottom to a recent high of 188, but has been underperforming the market for a long time—and unless the company steps up its electrification efforts, it’s likely to continue losing market share.

BYD (BYDDF) is the Chinese automaker long owned by Warren Buffett—and the third-most valuable auto company in the world, with a market capitalization of $109 billion. And the reason is growth. Quarterly revenues have more than doubled over the past two years, from $4.0 billion to $8.6 billion. The company’s vehicles include internal combustion and hybrid vehicles, but there’s no question the company is pushing hard to serve the market for electric cars. The price/sales ratio (PSR) is now 3.6, and the stock has recently hit a record high.

Daimler (DDAIF) saw quarterly revenues slip from $52.8 billion to $36.7 billion over the past two years, but the company is definitely heading in the right direction technically; it’s sold off its fuel cell assets and is now intent on catching up to Tesla by focusing on electric vehicles. Its new EQS, a battery-powered counterpart to its S-class sedans, can be ordered for over $119,000, and following that will come a wide range of more affordable models. As for the stock, it’s rallied from 23 at the bottom to a recent high of 100, and has been performing roughly in line with the market since March. DDAIF has a relatively low price/sales ratio of 0.58.

General Motors (GM) has seen quarterly revenue fall from $30.8 billion to $26.8 billion over the last two years, but GM has an aggressive plan to go electric, aiming to spend $35 billion to launch a range of EVs powered by new low-cost, lithium-ion Ultium batteries (predicted to reduce battery cell costs to under $100 per kilowatt-hour) while selling off underperforming assets around the globe (like a factory in Russia). Then there’s GMC’s newly unveiled all-electric Hummer truck, billed as the world’s first all-electric “super truck” (first year production is already pre-sold). As for the stock, it’s rallied from 15 to 65 since the March 2020 bottom, but has been underperforming the market since March. Its price/sales ratio is just 0.66, which is cheap enough. But the dividend was eliminated in early 2020 and is yet to be reinstated.

Ford (F) has seen quarterly revenue fall from $39.7 billion to $35.7 billion over the last two years, but that’s not bad considering the pandemic. And Ford has a chance in the electric car race, even though it’s not spending as heavily as GM. Its all-electric Ford Mustang, which is actually a four-door crossover that looks nothing like any previous Mustang, is selling strongly, and coming next year is the electric F-150 pickup that should be a huge seller. As for the stock, it’s rallied from 4 to 20 since the March 2020 bottom, and is one of the strongest stocks in this group. The stock is cheap for this group, with a price/sales ratio of 0.58. Plus, you get a yield of 2.0%!

BMW (BMWYY) saw revenues fall from $32.9 billion per quarter to $31.8 billion over the past two years. As for the stock, despite having risen from 14 at the March bottom to a recent high of 30, it’s still not expensive; its price/sales ratio is just 0.44—and the dividend of 3.7% adds a little sweetener. But the stock, like many in this group, has been underperforming the market since March.

Stellantis (STLA) is the result of the merger of FiatChrysler and PSA Group, which includes Peugeot and Citroen, and all told, has 14 vehicle brands. But it has big plans, including a Ram pickup and a Dodge muscle car, as well as EVs for every other of the company’s brands. The stock has a price/sales ratio of 0.36, but has been underperforming the market slightly since June.

Ferrari (RACE) stands out in this group with a price/sales ratio of 9.91, telling us investors value this company highly. And why not? Ferrari has a solid niche and is very profitable. Furthermore, quarterly revenues are up over the past two years, from $1.04 billion to $1.22 billion. Ferrari has a very capable hybrid plug-in vehicle now and expects its first fully electric car to be available in 2025. As for the stock, it’s one of the few in the group that’s hit a recent high!

Honda (HMC) is slowly going the wrong direction. Not that the company is doing terribly. Revenues have only dipped a bit over the past two years, from $34.5 billion in a quarter to $30.6 billion. But there’s no momentum here, and no electric future, given that Honda also went down the fuel cell road. The stock has rallied from 20 at the March bottom to an August high of 33, and that means it’s a real underperformer.

Volkswagen (VWAGY) had the greatest revenue of any automaker over the past year. Still, its revenues fell from $74.0 billion per quarter to $65.9 billion over the past two years. Valuation-wise, it’s the cheapest of this group, with a price/sales ratio of 0.14, but technically, the stock has been underperforming the market since March. VW is actually selling electric cars (made in Germany) in the U.S. now, and expects to have EVs made in Tennessee sometime in 2022.

Tata Motors (TTM) has now owned the Jaguar and Land Rover brands for 13 years—but the past two years have been rough at the company (which also sells plenty of cheaper, more utilitarian vehicles in India), with revenues falling from $10.2 billion per quarter to $8.4 billion. Both the company’s iconic brands have dabbled in electric models, but a new effort to invest $2 billion in electrification is expected to focus on the company’s mass-market vehicles. Valuation-wise, the stock is selling at a price/sales ratio of 0.59—and the stock is up from 4 at the bottom to a recent high of 35. Quite strong.

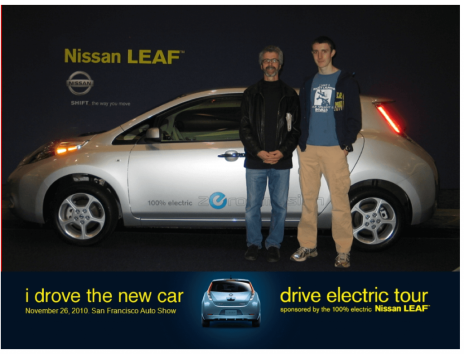

Nissan (NSANY) has been making electric cars for more than 10 years. I drove one of the first Nissan Leafs with my son at the San Francisco Auto show.

Note: I’m not a short guy, but my son is 6’5”.

But Nissan hasn’t parlayed that early start in the electric vehicle world into any kind of success. Quarterly revenues have plunged from $23.1 billion to $17.4 billion over the last two years. As for the stock, it’s cheap, with a price/sales ratio of 0.24, but it remains in a long-term downtrend.

Subaru (FUJHY) is the smallest of the Japanese automakers. Revenues have dropped from $8.1 billion per quarter to $6.4 billion over the past two years, and the stock is in a long-term downtrend.

The New Electric Automakers

Tesla (TSLA) is the company that every automaker is trying to emulate today in some way. In 2020, the company delivered nearly 500,00 vehicles, up 36% from the year before. Over the past two years, quarterly revenues have swelled from $7.4 billion to $13.8 billion. Earnings continue to boom. And the company continues to raise cash, which enables the production of new Gigafactories (in Austin, Berlin and China) which will enable continued production growth. So fundamentally, all is well at the company. The problem for me lies with the stock, which is up more than 3,000% from its 2019 low and more than 1,200% since the start of 2020. The result is a market capitalization of $1.2 trillion and a price/sales ratio of 25, which is a sign of how much investors love this stock today. And as all investors know, stocks bottom when they are least loved, and top when they are most loved. I’m not saying it should be sold; I also know that trends can go farther than expected. My Cabot Stock of the Week readers have owned TSLA since late 2011, and the trend has been very good to them. So for long-term investors with big profits, my rating today is still hold. But for new buyers, I think there are better opportunities among electric vehicle stocks.

Rivian (RIVN) is the youngest electric vehicle stock in this whole group; it only came public in November, so it has no real trend. And the company has no real revenues yet. But the market capitalization of $106 billion tells you expectations are very high. Focusing on trucks, Rivian has 100,000 orders from Amazon and more than 55,000 preorders from individual buyers.

Lucid (LCID) is targeting Tesla with a luxury EV that just won Motor Trend’s Car of the Year award. The car has substantially greater range than Tesla’s Model S, but for some potential buyers that advantage may not compensate for the lack of a Supercharger network. Deliveries have just started, and the market capitalization of $90 billion tells us investors have great expectations. But now the company needs to ramp up production at its Arizona plant (it has roughly 20,000 preorders) while managing cash. As for the stock, it came public in September 2020, peaked at 65 in February 2021, and after a big correction, is now very close to that old high, primed to either break out or break down.

Nio (NIO) makes “premium smart electric vehicles” for the Chinese market. Quarterly revenues have grown from $409 million to $1.5 billion over the past two years, and even though there are no profits yet, the company has a market capitalization of $63 billion, a sign of great expectations. That’s a price/sales ratio of 12. As for the stock, it was very hot through the second half of 2020, hitting a peak of 67 in January 2021, and correcting normally since.

Xpeng (XPEV) targets the Chinese mass market and is growing fast; the latest quarter saw revenues of $887 million, up 203% from the prior year. It has a market cap of $43 billion and a price/sales ratio of 18, telling us investors are optimistic. As for the stock, the company came public in August 2020, XPEV peaked at 75 in November 2020, corrected into May 2021, and has been trending up since.

Li Auto (LI) is young; the company only started making electric cars in China in late 2019. But it’s growing fast by serving the strong demand for affordable EVs. The latest quarter saw revenues of $1.2 billion, up 226% from the prior year. With a market cap of $34 billion, and a price/sales ratio of 10.8, LI is less pricy than XPEV, but its stock chart is quite similar (the company only came public in July 2020). It’s currently building a base in the low 30s prior to its next advance.

The Smaller Electric Automakers

Fisker (FSR) is led by Henrik Fisker, who has a legacy of designing strikingly beautiful vehicles (for BMW, among others). But out on his own, while he’s produced some very expensive cars, he’s not yet made a profit at it, nor quite succeeded (yet) in making cars in volumes to serve the mass market. Now he’s promised the Fisker Ocean, an SUV that’s billed as “The World’s Most Sustainable Vehicle,” featuring a solar roof, recycled carpeting and vegan interior among other attractions. With no production yet and no revenues, the market capitalization of $6.5 billion tells us investors are expecting good things. But the chart is no better than a market performer.

Nikola (NKLA) is a Utah startup with dreams of building electric semi-trucks powered by hydrogen fuel cells, but it has no real revenues, and the stock is a disaster, down 83% since its June 2020 peak as several potential deals have collapsed.

Canoo (GOEV) is a Los Angeles-based company with dreams of vehicle membership instead of ownership, fashion-forward urban vehicles and multi-purpose electric delivery vehicles—but there are no revenues yet. From my east coast perch, it appears that Canoo risks letting style take precedence over substance. A market capitalization of $2.9 billion tells us there’s some market interest, but the electric vehicle stock’s performance has been unimpressive.

Faraday Future (FFIE) is another company with dreams but no vehicles yet, and while the market capitalization is $1.6 billion, the dream is fading fast. As I write, the company has failed to file its quarterly report, and the stock looks terrible, hitting new lows.

Workhorse (WKHS) was born from an old GM business unit, taken over by Navistar, and then acquired by AMP Electric Vehicles, which changed the name. The company has made a small number of electric delivery vans in partnership with Ryder (and others) at a plant in Indiana, but revenues are minimal so far, targets have not been met, cash is low, there’s been a management change, and the stock has been in a strong downtrend since its February peak.

Lordstown Motors (RIDE) plans to use an old GM factory to build light duty electric trucks for fleet owners, emphasizing the lower maintenance costs of electric vehicles. But it has no revenues, and its market capitalization of $895 million is shrinking fast, as the stock hits new lows.

ElectraMeccanica (SOLO) has a market capitalization of just $550 million, so we’re in small-cap stock territory here—and we’re talking about a small electric car as well. In fact, the Solo seats only one person—and has only three wheels! Currently imported from China, the Solo’s price is $18,500, but the company’s plan is to open an assembly plant in either Arizona or Tennessee—and drop prices as scale grows. The stock, which has been public since August 2018, has made no progress since then and is now heading down.

Greenpower Motor (GP) is a Canadian company focused on the electric bus market. Revenues in the latest quarter were $4.4 million, up 56% from the year before. The market capitalization is $288 million. And the chart is unimpressive.

My Favorite Electric Vehicle Stocks to Buy Now

This is a great sector to invest in, as revolutionary developments challenge the old guard of the industry. And it’s becoming increasingly clear which of these contenders will thrive and which are on their way to death or acquisition (most of those smaller electric manufacturers). But which ones are worth considering for new investors in the sector today?

My first picks are the four established companies with strong charts: Ford (F), Ferrari (RACE), BYD (BYDDF) and Tata (TTM). Interestingly, they also provide global diversification through four different countries. These four, I would buy in this area.

Among the newcomers, the only truly strong chart today belongs to Lucid (LCID), but it may be at a double top, so I wouldn’t buy here. I would also keep an eye on newborn Rivian (RIVN), to see if the market’s high expectations are met, and I would watch the charts of the three young fast-growing Chinese companies—Nio (NIO), Xpeng (XPEV) and Li (LI)—to see which electric vehicle stocks develop real strength from here.

What electric vehicle stocks do you own - and how have they performed?

[author_ad]

*This post has been updated from an original version.