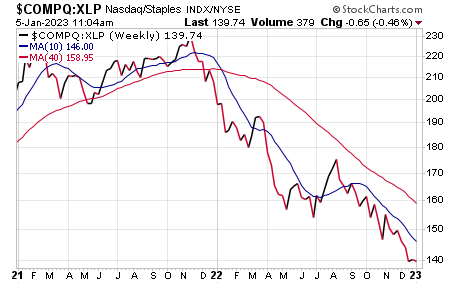

The calendar has flipped, but right now it’s the same market environment, with downtrends in the major indexes, selling on strength in most areas and growth stocks underperforming. One of my favorite “tells” for all of 2022 was my Aggression Index, which compares the growth-oriented Nasdaq with the defensive-oriented consumer staples fund (symbol XLP)—it remains in the dumps today, partly due to the weakness in mega-cap tech, but it’s a similar story no matter what growth index you look at.

With most of the evidence negative, Cabot Growth Investor’s Model Portfolio is still in a defensive stance as it was for nearly all of last year—we’re nearly three-quarters in cash, which isn’t exciting, but it beats owning a ton of stocks that are getting bombed.

So this Wealth Daily is going to be all about what’s wrong with the market, right? Wrong. With the new year upon us, and with the Nasdaq’s bull peak now nearly 14 months in the rearview mirror, I’m here to report on a couple of recent encouraging signs, what would mark the ultimate confirmation of a new bull move and a handful of areas/themes I’m watching closely as some winners are potentially bubbling up.

[text_ad]

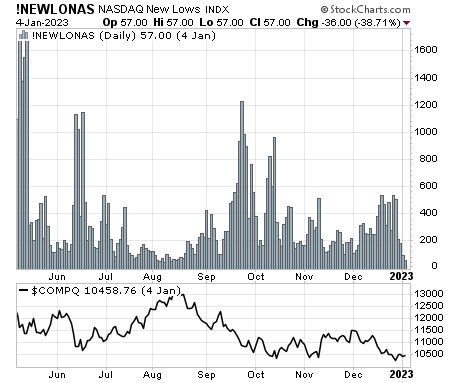

Let’s start with a couple of encouraging signs which involve the broad market—as mentioned above, the Apples, Microsofts and Amazons of the world have weighed on the market-cap-weighted indexes, but the broad market is actually showing some resilience. One of our favorite ways of telling this is the number of stocks hitting new lows—below is the chart of those figures on the Nasdaq, and you can see the readings were much smaller late last month on the index’s retest of its June and September lows, a sign that fewer stocks are “participating” on the downside.

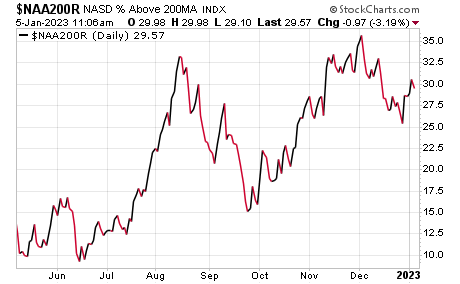

Another way of seeing it is simply looking at the percent of stocks above their respective 200-day moving averages—back in June, it was around 10% (very weak), while in September it was 15% and last month could “only” get as low as 25%. This makes sense as the Nasdaq itself is basically unchanged since its June lows, meaning a lot of consolidation has occurred as moving averages catch up.

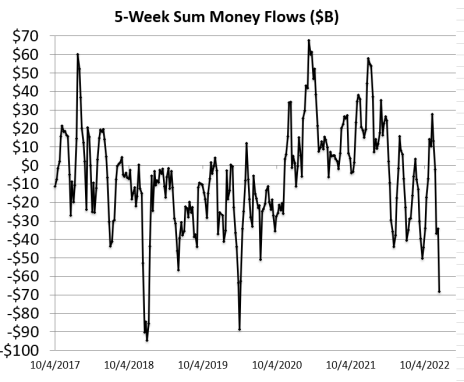

The other positive of late has been something I reported in last week’s Growth Investor: Individual investors may finally be throwing in the towel. Our Real Money Index measures total inflows/outflows into equity funds and ETFs during the prior five weeks, and the recent reading was the 3rd lowest of the past five years, eclipsed only by December 2018 and April 2020, both great buying opportunities.

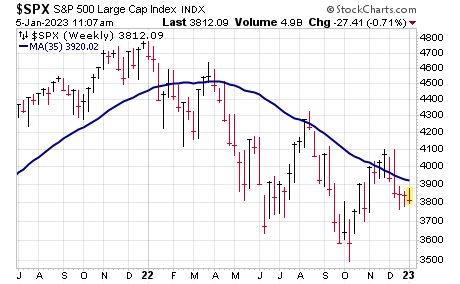

Of course, those are bullish breadcrumbs, but I still need to see the market itself get going. We have a few primary indicators, but our most reliable is our Cabot Trend Lines—there’s a few nuances, but we want to see the Nasdaq and S&P 500 get above their respective 35-week moving averages and stay there. This indicator turned bearish nearly a year ago, in late January 2022, and has remained so ever since—if that changes, it would be a great sign.

But then comes the question of leadership and … frankly, I don’t have much for you at this point, at least in the growth arena. That said, I do have two “themes” I’m keeping an eye on that aren’t in the traditional growth sectors (software, networking, chips, etc. etc.).

One is China—yes, I know, the government over there is as trustworthy as a snake-oil salesman, but that “sector” could be setting up as a follow-on play to the U.S.’s own post-vaccine rally back in November 2020: China had been implementing some super-strict Covid lockdowns in recent months, but it now looks to have basically thrown in the towel, with a re-opening trade underway.

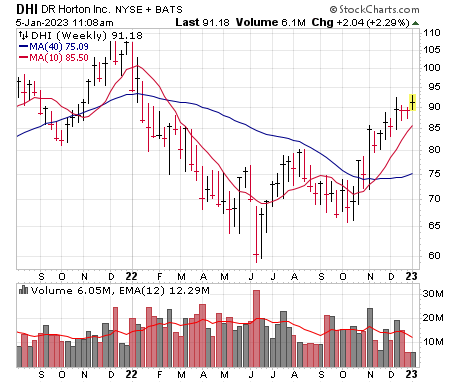

The other is one of the surprising things from last year: Homebuilders, which continue to seemingly look ahead to a less-restrictive Fed, and whose stocks have likely discounted what will be a tough housing recession. Indeed, analysts expect D.R. Horton’s (DHI) earnings to fall a whopping 41% in the current fiscal year (ending next September) … but the stock is trading at less than 10x those estimates even after the stock’s recent rally. Obviously, DHI and other homebuilders aren’t growth stocks, but they can trend when conditions improve, and it looks like the sector is anticipating better times ahead.

To discover which growth and momentum stocks we currently like best, subscribe to Cabot Top Ten Trader or Cabot Growth Investor today!

[author_ad]