Each January, I send out an invitation to 200+ contributors to my Wall Street’s Best Dividend Stocks and Wall Street’s Best Investments newsletters, asking for their Top Pick for the coming year.

And then, every July, I update those Top Picks. I’ve just finished both issues and am very pleased to announce that our Top Picks of 2018 are handily beating the broad market indexes!

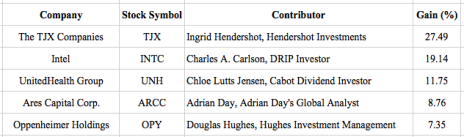

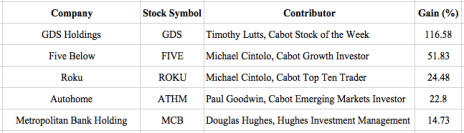

Here are the five best gainers from each newsletter (so far):

Wall Street’s Best Dividend Stocks: Top Picks of 2018

Wall Street’s Best Investments: Top Picks of 2018

As you can see, our contributors have done a fabulous job for our subscribers! The Dow Jones Industrial Average has gained about 1.4% so far in 2018, and our experts have trounced those numbers!

That’s no surprise, as most of our contributors have been honing their investment craft for decades. I’ve known many of them from my association with the Money Show and writing investment newsletters for many years, and I have the utmost respect and admiration for their hard work, and excellent track records.

While some of them may be traders—and more short-term-oriented, and others long-term investors, they share many of the same characteristics: integrity, curiosity, willingness to continue learning, and they all feel incredible responsibility for the recommendations they make.

And year after year, they share their winning investment ideas with our subscribers.

[text_ad]

Here are just a few comments about their 2018 selections, from the Top Five winners:

First-place winner from Wall Street’s Best Dividend Stocks was Ingrid Hendershot of Hendershot Investments, who recommended The TJX Companies (TJX). When recommending this company, Ingrid said, “Long-term investors shopping for a bargain should consider The TJX Companies, a well-managed HIquality business with strong brand loyalty, outstanding cash flows, steadily growing dividends and substantial share repurchases.”

In second place is Intel (INTC), recommended by Charles A. Carlson, editor of DRIP Investor. Here’s what Charles had to say about Intel: “Intel (INTC) is remaking itself. Wall Street is starting to catch on to the transformation at the company, but there is still plenty of upside remaining in these shares. I look for the transformation to continue in 2018, which should be reflected in better growth rates and higher profits. The yield enhances the stock’s total return. It is my top pick for conservative investors over the coming year.”

Chloe Lutts Jensen, Chief Investment Officer of Cabot Dividend Investor, picked UnitedHealth Group (UNH), currently the third-best gainer for our 2018 dividend stocks.

Chloe had multiple reasons for selecting UnitedHealth, saying, “United Health Group (UNH) has recently diversified into pharmacy benefit management, running its own health centers, and providing health care-related services and technology. UnitedHealth’s vertical and horizontal integration give the company an advantage in delivering healthcare profitably. UnitedHealth’s operating margins are a rock solid 7%, and the company’s balance sheet is strong. Revenue growth is high and steady—revenues have increased in each of the past 10 years, by an average of 9% per year.”

Adrian Day, of Adrian Day’s Global Analyst, has continued to like Ares Capital (ARCC) as his favorite stock pick, for several years now. Here’s why: “Ares Capital Corporation (ARCC) is the largest and one of the most conservative Business Development Companies, lending money to small and mid-sized companies, which, like REITs, distribute essentially all of their net income to shareholders. It also has among the best returns over the years and yet is one of the cheapest right now.”

Rounding out our five Top Picks of 2018 is Oppenheimer Holdings (OPY), selected by Douglas Hughes of Hughes Investment Management. In his recommendation, Douglas noted, “Oppenheimer Holdings (OPY) now makes up over 60% of all funds, and while many may think that is too much, the only way to get rich is to not diversify; you only diversify when you are rich.

“OPY is under the radar. But the relative strength is building quickly each week. The company is so small a deal is the only thing that makes sense in this low interest rate world. Someone could buy OPY for almost nothing. So, while the stock is certainly trading more like a deal could come any day, it is steal cheap.”

And here are the comments for our Wall Street’s Best Investments five Top Picks of 2018 contributors:

Our number one pick, GDS Holdings (GDS), was recommended by both Paul Goodwin, Chief Investment Analyst, Cabot Global Stocks Explorer, and Tim Lutts, Chief Investment Analyst, Cabot Stock of the Week. When he recommended the company, Paul said, “GDS has been building data centers and courting big clients since 2009, and it now has nearly 78,000 square meters of data center space in usage (that’s apparently how the industry discusses size/capacity), which is up 59% from a year ago.”

Tim added, “GDS Holdings’ enjoyed revenue growth of 47% in 2015, 42% in 2016 and 56%, 40% and 43% (to $64 million) in the first three quarters of 2017, respectively. The focus here is growth; the profits will come later.”

Five Below (FIVE)—our second-place winner—was the pick of Mike Cintolo, Chief Investment Analyst, Cabot Growth Investor. Mike commented, “Five Below is probably our favorite retail story from a fundamental perspective, and the stock is strengthening as the weak hands have been worn out over many years and investors head back to the sector. The company is boosting its store count by about 20% this year (it had 625 locations at the end of October), with 15% to 20% store growth likely for years to come. The company has notched 11 straight years of comparable store growth, and last quarter’s tally (up 8.5%) was one of its strongest in years.”

Mike Cintolo also took third place, with his choice of Roku (ROKU) in his Cabot Top Ten Trader newsletter. Mike had this to say about Roku: “Roku is a direct play on the cord-cutting and TV streaming movement. The stock is moving higher because Q3 results topped estimates by a mile. Revenue was up 40%, while EPS of -$0.10 beat by $0.19. Analysts expect 2018 revenue growth to hit 30%, while red ink will likely be slashed from -$1.80 in 2017 to -$0.43 in 2018. If management continues to make the right moves, the potential is huge as millions more users use its platform.”

Paul Goodwin also picked our fourth-place stock, Autohome (ATHM), saying, “There aren’t many genuinely conservative picks among Chinese stocks, but Autohome is my best guess about a beaten-down company with excellent credentials. China is the biggest, fastest-growing automobile market in the world. ‘Revenue was up 62% in 2016 and analysts are expecting 21% earnings growth in 2018. I think 2018 will see a strong recovery and a resumption of the stock’s advance.”

Our fifth-place winner was Metropolitan Bank Holding Corp. (MCB), selected by Doug Hughes of Hughes Investment Management. Douglas noted, “The company has a book value of $26 and fast growth from Bitcoin—over 100% in deposits and more than 30% in loans, in half a year. Net income is also up 165%, in the third quarter. If you want a bank with a bitcoin play and 50 times cheaper than say, Overstock.com, I believe there is some real value here, since it’s unlike many other Bitcoin plays that have zero earnings or any real prospects to make money. Insiders bought a ton of stock, under $40 a share. If Bitcoin gets mentioned in relation to this bank, the stock could possibly go to $90 to $100, and then we would be out.”

Congratulations to all our Top Picks of 2018 (so far) winners and contributors. And if you’d like to see more ideas like these, I invite you to join our community of subscribers by clicking here.

[author_ad]