A steady dividend check is a wonderful thing, especially when it’s paid by a company with good long-term growth prospects.

One example of those types of top dividend stocks is Astec Industries (ASTE), the maker of asphalt paving equipment and other infrastructure machinery that pays a dividend of 0.6% and should thrive as America’s infrastructure is rebuilt. I wrote about it here last week. ASTE has had a normal pullback since then and is at a decent entry point now.

This week, I’m recommending two companies with higher dividends, but with those higher dividends come potentially lower growth. That’s the tradeoff you make when you invest in a dividend-paying company.

Still, these top dividend stocks are far better investments than bonds, particularly now that the downward trend of interest rates since 1981 is almost certainly over.

Since Donald Trump’s election, interest rates have surged higher as investors speculate that the President-elect’s actions will stimulate the economy.

And while this shift has been great for stocks, it’s a big sign of trouble for investors who have become accustomed to getting yield plus capital appreciation from bonds.

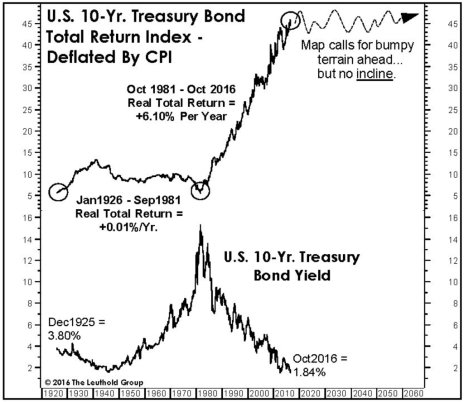

The following picture tells the story—and shows the risk of where we are headed.

From 1981 through October of this year, investors in 10-year Treasury Bonds beat inflation by 6.1% per year thanks to the long downtrend in rates that was spurred by growing productivity and the spending of baby boomers.

But in the 55 years before that tremendous run, investors in T-bills beat inflation by only 0.01%—which is almost nothing.

And now the farsighted minds at Leuthold Group, which produced this chart, are saying we’re once again about to embark on a similar long stretch.

They might be wrong, of course. Interest rates could reverse and plunge deeper into negative territory following the European market.

But the way the U.S. bond market is talking, I believe bond investors will soon be running around looking for safe places to get steady income.

My suggestion is dividend-paying stocks of quality companies, especially those with modest growth prospects.

In the short term, none of these top dividend stocks have the stability of bonds, but in the long-term, they not only provide decent yields, they also provide the potential for capital appreciation—and that can be especially valuable in the environment of increasing inflation that many investors see coming.

What’s the best way to find top dividend stocks?

Some people go for high yields.

Seaspan (SSW), for instance, was a tempting investment back in May when the stock’s generous dividend brought a yield of 9.2%. But the fundamentals behind that dividend were shaky; the international shipping market has been plagued by falling rates as new larger ships are built.

Since May, SSW has fallen from its high of 17 to a low below 9. That decline means the stock’s yield is now a very fat 15.7% (which I’m sure is even more tempting to some investors), but it also means the stock has lost 44% of its value, a loss that dwarfs that tempting dividend. Also, that decline increases the risk that the stock’s dividend will be cut or suspended! Clearly, buying a stock based on a high dividend alone is not smart.

A better approach is to buy Dividend Aristocrats, quality stocks that are listed in the S&P 500 and that have increased their dividends every year over the past 25 years. These companies include Aflac, Brown Forman, Clorox, Coca Cola, Johnson & Johnson and Lowes, to name a few.

[text_ad]

If you can diversify adequately and have time on your side, the Dividend Aristocrats will probably do the job.

But if you really want to beat the market, your best bet is to buy undervalued stocks that pay dividends, and hold until those stocks are fully valued or until the price chart tells you the stock is due for a rest.

Happily, Cabot has two services that steer you directly to those top dividend stocks.

Cabot Benjamin Graham Value Investor

Our oldest value-based service is Cabot Benjamin Graham Value Investor, led by Roy Ward, who every month updates his list of Top 275 Value Stocks.

In addition, Roy recommends two complete portfolios of undervalued stocks, telling investors exactly when to buy, when to hold and when to sell. Key to Roy’s system is his method of calculating Maximum Buy Prices and Minimum Sell Prices. It’s all based on value. (FYI, Benjamin Graham was the economics teacher of a fellow named Warren Buffett, who’s done pretty well with his adaptation of the system.)

For example, earlier this month Roy sent the following Sell Alert to his readers.

“Knight Transportation (KNX 33.85) reached its Minimum Sell Price of 33.84 on Friday, November 11. The recent surge in KNX’s stock price provides an excellent opportunity to take profits.

“Knight Transportation was first recommended in June 2015 at 28.63. The company was featured in the Cabot Value Model using the Modern Value Analysis. KNX has advanced 18.2% in the past 17 months compared to a gain of 4.1% for the Standard & Poor’s 500 Index during the same time period.

“I recommend selling your KNX shares now.”

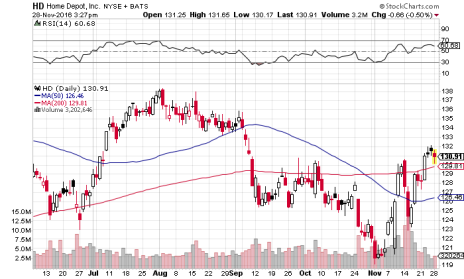

Since then, Roy has recommended buying Home Depot (HD), explaining that the U.S. housing market is expected to strengthen in 2017, and that Home Depot will see sales grow 6% in the year while earnings grow 15%. Home Depot, by the way, pays a dividend of 2.15%, and is almost certain to increase that dividend as the years go by.

When Roy first recommended Home Depot, we said he expected a gain of 28% in the next 12 to 18 months. I trust he’s right. Trouble is, since then, stocks have soared, and Home Depot is now trading a bit above Roy’s Maximum Buy Price.

That’s not a deal-breaker, but it does mean that if you buy HD now, you’re taking on more risk than Roy would. In short, you’re forgoing the Margin of Safety that is so important to true value investors.

To learn Roy’s Maximum Buy Price for Home Depot, and to get Roy’s complete advice on building a top-performing portfolio of undervalued stocks, click here.

Cabot Undervalued Stocks Advisor

Cabot’s newest value-centric service is called Cabot Undervalued Stocks Advisor, and your guide here is Crista Huff, who uses traditional value analysis supplemented by eagle-eyed chart-reading skills. Crista likes to recommend stocks when they’re down and sell them after they pop higher.

For example, Crista has been recommending the stock of Gamestop (GME) recently, pounding the table because the stock was so cheap. And last week after the company reported earnings, her efforts were rewarded.

Here’s what she sent her readers:

“Gamestop (GME – yield 6.1%) reported third quarter EPS of $0.49, beating analysts’ $0.47 consensus estimate. The company reiterated its targeted full-year 2016 EPS of $3.65-$3.80, with a current Wall Street consensus of $3.71. Revenue continues to decline in video games, while increasing in technology brands, collectibles and digital, which saw year-over-year revenue increases of 54.4%, 37.3% and 11.8% respectively. Future earnings growth is expected to come from the latter three categories, which produce higher gross margins than do video games. GameStop reiterated its intent to continue increasing dividends and share repurchases. The company repurchased $36 million of stock during the quarter, with $209.3 million remaining in the repurchase authorization.

“GME rose 6% this morning, which means that the market is finally losing its obsession with the video game portion of GameStop’s business, and focusing on the total package, which is clearly delivering strong product growth and profitability. The 6% dividend yield is expected to grow, as is the ridiculously cheap share price. The best-case scenario for the share price this winter will be retracement of 2016 highs around 31/32. Buy.”

If you’d like to join Crista’s readers, and get regular advice on investing in Gamestop and the other stocks in Crista’s three portfolios, you can learn more here.

A Note on Thanksgiving

Last Thursday, I celebrated Thanksgiving at my house. We had 20 people at the table—16 relatives and four friends, aged one to 91.

And all went swimmingly, despite the fact that we didn’t all vote the same way in the recent Presidential election.

My main job—after figuring out how to create a table that seated 20—was smoking the outdoor turkey. I call it the outdoor turkey because there were also two indoor turkeys—which my brother-in-law used to make a turkey roulade and a turkey confit cooked in duck fat.

He’s a surgeon by trade but a gourmet cook on the side, and his efforts were supplemented by the work of four other cooks in the family (not counting me—I hardly call smoking a turkey cooking.)

Along with the turkeys, we had stuffing (two kinds), salad, mashed potatoes, squash, carrots, peas, Brussels sprouts, red sauerkraut, onions, cranberry sauce (both canned and homemade), cornbread, apple pie, pumpkin pie, mince pie and chocolate pie.

Yes it was excessive, but that’s part of the tradition.

And that canned cranberry sauce, bought especially for my 91-year-old father-in-law, was the only dish that wasn’t homemade. We kid him about it, but gently. After all, the main goal of the day was to give thanks for each other’s company, and that we most certainly did.

[author_ad]