The Federal Reserve last raised interest rates in December 2015, when they nudged short-term rates up by a quarter of a percentage point. And in every Fed meeting since, market gurus have been looking for additional rate boosts. So far, that hasn’t happened, but it’s just a matter of time.

Of course, what all investors want to know is this: What effect will rising interest rates have on my portfolio?

And that is just what I’m going to discuss in my workshop at the World Money Show in Orlando in February.

Here’s a quick preview:

First of all, Don’t Panic!

Although GDP is finally on the rise, coming in at 2.9% for the third quarter, we are far from entering an inflationary period. Unemployment continues to improve, but consumer spending and confidence remain at laggard paces.

Consequently, while I do believe the Fed will begin raising interest rates around the first of the year, I do not see them embarking upon a fast-and-furious schedule of rate hikes. And a slow, but steady pattern of rate increases—historically—don’t tend to rattle the markets.

The Relationship between Rates and the Stock Market

Since 1983, according Allianz Global Investors, the S&P 500 has gained an average of 9.9% during rate hike cycles. And especially with interest rates under control and no inflation in sight, there’s no reason to believe that the historical pattern won’t hold.

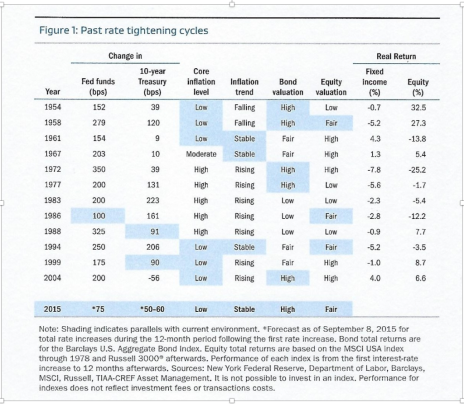

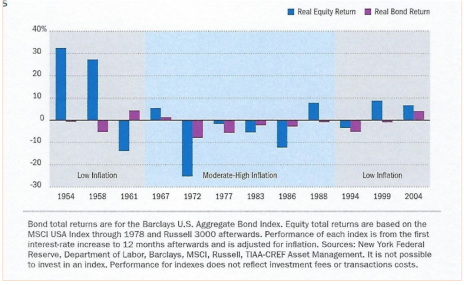

And the following chart from TIAA-CREF indicates that in the 12-month period following rate increases, equity returns have been more positive than negative.

Further confirming that trend, this graph also shows positive equity returns during periods of low inflation.

One point that TIAA-CREF makes is that each of these positive equity cycles included periods of good job growth, and with an unemployment rate that has declined to 4.9%, our job market meets that criteria.

Companies that Should Benefit from Rising Interest Rates

In general, businesses that have reasonable debt levels and plenty of cash stand to prosper as rates increase. Industries that should see increased investor interest include defensive sectors, large technology companies, and financials. Investors may want to avoid companies heavily dependent on debt, as defaults, eventually, will rise. As well, speculative ideas may be very volatile and risky.

Here are a couple of stocks that look interesting to me as we await our next rate hike.

GasLog (GLOG) provide maritime services for the transportation of liquefied natural gas (LNG). The company is currently trading at a forward P/E ratio of 24.92, pays a dividend of 3.73%, and carries an average analyst rating of 1.9 (Buy). Analysts expect triple-digit growth in the next five years from GLOG.

Northstar Asset Management Group (NSAM) is an asset management company with a forward P/E of 31.35. The company has a current dividend yield of 4.38%, and an analyst rating of 1.5 (Buy). NSAM is forecast for double-digit growth in the next few years.

As always, before purchasing any stock, please make sure you review your portfolio strategy to determine if the equities are a good fit for your investment goals.