Earnings season wound down this week with a raft of announcements from the beleaguered retail sector, and the latest numbers didn’t exactly improve matters for retail stocks.

10 Retail Stocks that Struggled

Most of the big department stores—the least popular kids in the retail class these days—reported late last week. Macy’s (M), Kohl’s (KSS) and Dillards (DDS) all reported Thursday, and mostly beat estimates … but their stocks dropped like rocks anyway.

Macy’s fell 10% on Thursday alone. While a broad market selloff certainly contributed, investors were also disappointed by the chains’ relentlessly falling same-store sales. (The CFO of Kohl’s underlined how bad things have gotten for department stores when he noted that “comp sales decreased 40 basis points for the quarter, a significant improvement over recent trends.”)

[text_ad]

Nordstrom (JWN) reported Thursday evening and actually rose slightly after reporting estimate-beating earnings and higher same-store sales. But the stock’s long-term chart still looks poor:

J.C. Penney (JCP) rounded out the week with EPS and comp sales misses Friday, which sent the stock plunging 17%.

This week kicked off with the Commerce Department’s July retail sales report on Tuesday. The monthly report showed a much larger-than-expected 0.6% increase in retail sales in July; economists were expecting 0.4% growth. However, a large portion of the growth came from online retailers, whose sales jumped 1.3% in July, thanks in large part to Amazon Prime Day. Other bright spots were building material stores, which saw sales rise 1.2%, and auto sales, which also rose 1.2%, their strongest month so far this year.

However, other retailers struggled: sales at electronics and appliance stores declined 0.5%, and sales at clothing stores fell 0.2%.

That mixed bag was reflected in Tuesday morning’s earnings reports. Coach (COH) dropped 15% after missing revenue estimates, and Dick’s Sporting Goods (DKS) plunged 23% after missing both earnings and revenue estimates. In an attempt to protect market share, the athletic equipment chain’s CEO said they would be “more promotional and increase our marketing efforts” in the second half. While it’s probably a necessary defensive move against Amazon (AMZN), lowering prices and spending more on marketing will damage margins, and investors should stay far away.

Home Depot (HD) and TJX Companies (TJX) were Tuesday’s bright spots. Home Depot beat EPS and revenue estimates, and comp sales rose 6%. TJX, the parent company of T.J. Maxx, beat estimates as well, and lifted their guidance. But TJX was rewarded with a measly 0.8% gain, and HD dropped over 2%, dragged down by the indiscriminate selling in the sector (the SPDR Retail ETF (XRT) fell 2.6%). It was a reminder of how dangerous investing in retail stocks can be today, even if you select quality companies.

After hours, Urban Outfitters (URBN) smashed estimates, and the stock popped 18% Wednesday. This could be the start of a new rally for URBN: the stock formed a nice double bottom at 16 in June and August (see chart). If there’s follow-through in the next few days, URBN could be attractive to bargain hunters. But it’s too early for the all clear: net income and comp sales both declined in the latest quarter, and analysts expect EPS to decline 24% this year.

Finally, the week ended with reports from the big box stores. Target (TGT) beat estimates and lifted guidance Wednesday morning, and the retail stock was rewarded with a 3.6% gain. And Wal-Mart (WMT) beat by a small margin yesterday, and reported higher same-store sales and 60% online sales growth, to finish out the week on a high note.

So which retail stock would I buy today?

The One Retail Stock Worth Buying

I was actually surprised when I found out which one stock of those mentioned above performed best on my scans. Sure, I’ve been to their stores several times in the past year, but can they really be doing that much better than their brick-and-mortar retail peers?

Turns out they can! My top retail stock today is TJX Companies (TJX), the parent company of T.J. Maxx, HomeGoods and Marshalls.

The company currently has 3,800 stores in nine countries. TJX’s “off-price” formula is one of the few retail concepts that still seems to be able to lure shoppers into stores. Merchandise is refreshed daily, and prices are usually 20% to 60% lower than at regular stores. Management describes their shopping experience as a “treasure hunt.”

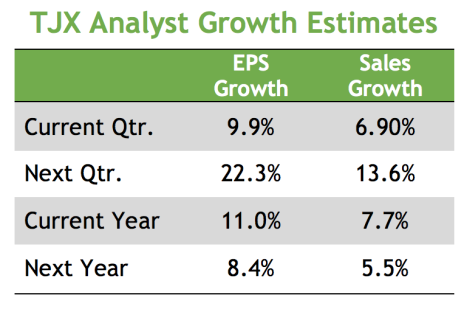

I do visit my local T.J. Maxx pretty often, but I was still skeptical that the concept is Amazon-proof. But the numbers tell the story! TJX’s revenues and EPS have grown steadily in each of the last five years. Same-store sales rose 3% last quarter, thanks to higher traffic. And analysts predict continued growth in both revenues and earnings going forward:

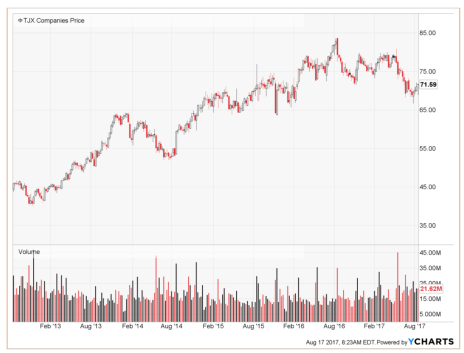

TJX doesn’t look bad technically either. Sure, the stock peaked a year ago, but the 13% pullback since then is still within normal correction territory, and is largely due to the larger retail selloff. (The Retail SPDR, XRT, has pulled back 14% over the same time period.) On a weekly chart, the correction looks pretty normal.

And management just raised their full-year guidance, which can be a good catalyst for gains in the stock.

Plus, TJX has a 20-year history of dividend growth, having increased their dividend every year since 1997. Today, TJX has a 1.8% yield, and a very reasonable 32% payout ratio.

In other words, the retail selloff has created a great opportunity for investors who like “treasure hunting” to pick up this good quality retail stock at a bargain price.

In Cabot Dividend Investor, we feature many high-quality dividend stocks. To check them out, click here.

[author_ad]