Interest rates are on the rise—finally. Because most income-generating investments have some relationship to interest rates, it’s important for investors who own high yield investments—even just dividend stocks—to understand how rising interest rates can affect their portfolios.

Typically, when interest rates go up, the prices of all existing fixed income investments—including treasuries, munis, corporate bonds and preferreds—will go down. That’s because newer debt issued with higher interest rates yields more, so investors are willing to pay less for old, low-yielding debt.

[text_ad use_post='119907']

But, over the past month, we’ve seen some interesting wrinkles in this relationship.

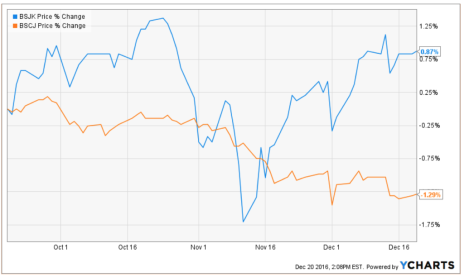

For example, the prices of high yield corporate debt—also called junk bonds—have declined by significantly less than other types of debt. You can see this relationship if you look at the movement of the funds in our bond ladder. BSCJ, one of the investment-grade ETFs, has declined 1.3% as interest rates have risen over the past three months. BSJK, one of the high yield ETFs, also fell early in this period, but has since rebounded, as you can see in the chart below.

You can see how unusual this divergence is in the longer-term chart below. High yield bonds, represented by the iShares iBoxx High Yield Corporate Bond ETF (HYG), are typically more volatile than investment-grade bonds, but generally move in the same direction as them. But since mid-November, junk bonds have risen even as investment-grade bonds (represented by the iShares iBoxx Investment Grade Corporate Bond Fund, LQD) have continued to decline.

Junk bonds have the same relationship to interest rates as all other bonds—when rates go up, prices of existing high yield debt should go down. However, the past month of interest rate appreciation has coincided with rapidly improving economic sentiment and rising oil prices.

How this affects junk bonds may not be immediately clear. But in addition to interest rates, there’s a second major influence on junk bond prices—the odds that the company that issued the bond will default on the debt. (This is almost a non-issue with big, AAA-rated companies.) Economic weakness raises these odds, as do falling energy prices, because small energy companies are some of the most prolific issuers of junk bonds.

So the low oil prices of the last two years significantly raised the default risk in the junk bond market, and the increasing prices of the last month have lowered it again.

Another interesting divergence in high yield investments appeared this month, between utilities and interest rates. Utilities typically move inversely to interest rates for two reasons. One, they’re heavily indebted, so higher rates raise their borrowing costs. Two, investors consider them “bond alternatives” because of their low volatility and high yields. And when interest rates are low, utility stocks are more competitive alternatives ... the thinking goes.

You can see this “normal” relationship in one-year the chart below. The blue line is a utility ETF (XLU); the orange line is the yield on AAA corporate bonds (like those issued by utilities).

But since mid-November, the relationship between yields and utilities has changed drastically. Yields are way up, but utilities are also higher!

As with high yield bonds, this is a likely a case of some other factor overpowering the relationship between utilities and yields. In this case, that factor is probably anticipation of regulatory changes affecting utilities. Many utility stocks, like current Cabot Dividend Investor portfolio holdings ConEd (ED) and Xcel Energy (XEL), are entirely domestic businesses that pay the top U.S. corporate tax rate of 35%. Some analysts expect this rate to be lowered under the new administration, which would boost profitability at these companies. Some of that extra cash may even be passed on to shareholders as dividends.

To learn more about high yield investments, and how interest rate hikes are affecting them, you can subscribe to my Cabot Dividend Investor advisory by clicking here.