Value stocks with insider buying are on the rise as growth stocks are stuck in the mud. Here are three that are worth your attention.

It has been a painful 10-year period for value investors, but their patience is finally starting to pay off.

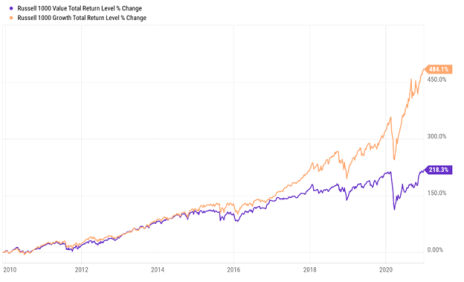

From 2010 through 2020, growth stocks crushed value stocks by 266%.

However, 2021 appears to be the start of a value run. So far this year, value has outperformed growth by 11%.

If your portfolio is heavily tilted towards growth, now is a good time to revisit it, and perhaps add a few value stocks. A good way to start is by looking at value stocks with insider buying.

As famed Fidelity manager Peter Lynch once wrote, “Insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.”

[text_ad]

Here are three value stocks that insiders are buying today:

Value Stock with Insider Buying: Arconic Corporation (ARNC)

One problem with value stocks is they often face secular headwinds. Think oil and gas companies (vs. renewable energy) or cable companies (vs. Netflix and others).

Arconic is a cyclical value stock, but it is not facing secular headwinds. It’s actually facing secular tailwinds. Let me explain.

The company manufactures global rolled products, aluminum extrusions, and building and construction systems. Think large customized sheets of aluminum for automobiles and airplanes.

Aluminum is viewed as more environmentally friendly (and stronger!) than steel. Thus, ESG (Environmental, Social and Corporate Governance) investors can get excited about the stock.

While ARNC has performed well (it was spun off at the start of the pandemic), it should benefit from a recovering economy in 2021, and looks attractive now. Further, it’s very cheap, trading at 5.0x forward EBITDA. Its closest peer, Kaiser Aluminum (KALU), trades at 10.5x forward EBITDA. On a forward P/E basis, ARNC trades at 15x, versus 24x for KALU.

Finally, four insiders have been aggressively buying the stock in the open market.

Value Stock with Insider Buying: Conduent Corp (CNDT)

Conduent operates in the business processes outsourcing industry. If you run a company and want to outsource tasks or services that are low margin and not part of you core competency, Conduent can probably help you.

The stock’s long-term chart doesn’t look pretty, but it appears that the company has been successfully turned around given that revenue has grown sequentially two quarters in a row.

From a valuation perspective, the stock looks very cheap. CNDT is trading at an EV/EBITDA multiple of 6.6x and an EV/Revenue multiple of 0.6x. Peers trade at 12x EBITDA and 1.5x revenue.

Insiders have been buying in the open market, and Carl Icahn owns 18% of the company.

Value Stock with Insider Buying: Riley Financial (RILY)

Riley is a diversified financial services company. It generates earnings through capital markets, financial consulting, and principal investing. It has historically grown very well yet trades at a cheap valuation (P/E of 8.0x).

I primarily focus on micro-cap stocks. When evaluating small companies, insider ownership is critical because it ensures that you are aligned with the people who are running the business.

Riley is not a micro-cap (it has a market cap of $1.6 billion, making it a small-cap stock), but insiders own ~28% of the company and have been buying recently in the open market.

This gives me high conviction that the outlook for Riley is bright.

[author_ad]