America’s rare earths metals supply chain fragility is both dangerous and puzzling.

America was, not all that long ago, the world’s top producer of rare earths with its mine in Mountain Pass, California - now owned by MP Materials (MP), one of the better-known rare earth stocks.

Over the past few decades, China has become the Saudi Arabia of rare earths as the country’s low-cost labor and lax environmental standards allowed it to produce 70% of the global production of rare earth oxides. The real value of these rare earth elements is their unique electrical and magnetic properties that allow for miniaturization and much lighter, stronger, resilient, and efficient components.

The Japanese refer to them as “industrial vitamins” and the “oil of the 21st century.”

In short, China’s massive advance over the past three decades to become a mining and refining superpower while Washington slept, is a killer advantage in our age of U.S.-China rivalry.

[text_ad]

America has finally woken up and is working to strengthen its rare earth supply chain security, notably crafting a deal with the aforementioned MP Materials as part of a handful of federal investments into natural resource suppliers. To end this dangerous dependency on China for rare earth oxides, we need to meet this challenge through a joint effort in North America and beyond.

One of the companies seeking to end this dependency is a Canadian resource company with the ambitious goal of providing 10% of the global supply of two vital rare earths – neodymium and praseodymium (NdPr) – is Defense Metals (OTC: DFMTF, TSX: DEFN.V).

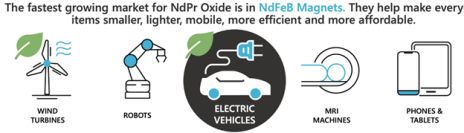

A key market driving demand for more rare earths is electric vehicles (EV). This is because an electric vehicle uses about 5kg worth of neodymium–iron–boron magnets.

EVs are expected to grow to 25% of all auto sales by 2030. This will require huge amounts of rare earths, most notably neodymium and praseodymium.

Every ten million new EVs requires about 10,000 tons of additional neodymium, or 20% of the current annual global supply.

Magnet rare earths are just what Defense Metals plans to produce from its 100%-owned Wicheeda Rare Earth Element Project. This is spread over 11,800 hectares located in British Columbia, Canada, and has very good road access and is close to critical infrastructure, including rail and power.

Once in production, Defense Metals targets to produce about 30,000 tons per year of rare earth oxides over a 15-year mine life, which would make the company a globally significant rare earths producer representing 10% of the current global production.

There are some other positive factors investors need to take into consideration.

While a speculative idea, it is well worth incremental positions at current prices. As Defense Metals follows its timeline to develop the project, its stock price should reflect progress as it moves towards production of these two strategic, key rare earths.

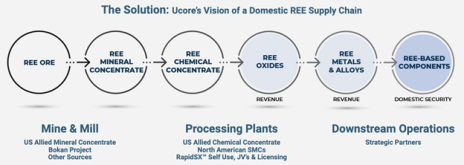

Another company worth considering is Ucore (OTC: UURAF, TSX: UCU.V).

Ucore has recently turned its focus to rare earths processing through Strategic Metals Complexes throughout North America. This RapidSX™ technology is modular, scalable, and cost-effective.

In addition, the company is developing a rare earths project located at Bokan Mountain on Prince of Wales Island, Alaska.

Finally, Colorado-based Energy Fuels (NYSE: UUUU, TSX: EFR) is a uranium producer play for nuclear energy and this gives it a leg up in processing monazite for rare earths. This is due to the content of thorium and uranium in monazite, a key feedstock for rare earths production.

In addition, Energy Fuels is the leading producer of vanadium. Vanadium is primarily used in alloys to strengthen steel and is increasingly important to clean energy as a key input for large-scale battery electrical storage from wind and solar energy.

These three stocks offer investors different risk/reward scenarios but are all worth a good look by aggressive investors.

[author_ad]

*This post has been updated from a previously published version.