Year-end stock market thoughts are a good benchmark for the coming year. We’re in a healthy market environment now, and here’s what to look forward to in 2020.

It’s the week between Christmas and New Year’s, which means I’m hosting my in-laws for a few days, helping my son put together a couple of big Lego gifts he got (dragons!) and doing my best to win as many pinochle games as I can. (My mother-in-law pulled double pinochle twice in one game last year.)

But even as I transition from eggnog (Christmas) to champagne (New Year’s), I’m still keeping an eye on the market. A year ago at this time, I wrote a piece relaying all my year-end stock market thoughts on the then-horrific environment—while I wasn’t buying, I did write that many secondary “oversold” indicators were at historic extremes and a peak of downside momentum was at hand. That ended up working out pretty well.

[text_ad]

Thankfully, we’re in a much healthier environment today, so I figured I’d share a handful of thoughts that are on my mind as we head into 2020. (FYI, I’ll be doing a free webinar on January 23 with a detailed look at what I believe is in store for 2020 and a few stocks I believe are true market leaders—you can sign up for it HERE.)

1. First and foremost, I like to look at the charts of the major indexes every morning or two to keep me grounded. And while it’s obvious, it’s important to remember both the intermediate- and longer-term trends are strongly up; in fact, we could see a 3% to 4% retreat and still be in an intermediate-term uptrend by my measures. So just using the primary trends tells us that the odds favor higher prices going forward.

2. Another year-end stock market factor that has me optimistic looking further out is that the big-cap indexes got going from huge consolidation periods in October. I’ve written about this in Cabot Growth Investor, and here’s an updated chart—you can see the S&P 500 went nowhere from January 2018 through October 2019 (net-net), 20 months of no progress. That doesn’t mean we’re destined to go straight up for 20 months of course, but it does imply we’re more near the start of a larger move than the end of it.

3. There are also plenty of simple, straightforward studies that lean toward the bulls’ case. For instance, the NYSE Composite recently hit a new all-time high for the first time in more than a year—since 1980, that’s happened eight other times, and a year later, the NYSE Comp was up every time by an average of 14% or so. (Hat tip to Ryan Detrick of LPL Financial for the data.) It’s simply telling you the bull market is likely to continue.

4. And confirming that is the action among many individual stocks and sectors that have staged longer-term breakouts. One of the most impressive (even though it doesn’t really fall within my realm) is financial stocks—the Financial Sector Fund (XLF) looks a lot like the overall market, leaping out of a 20-month base recently. There are tons other examples, especially among individual stocks.

5. Finally, when I look at big-picture sentiment stuff, it certainly doesn’t seem like the man-on-the-street is buying (which is a good thing). Shown here is cumulative money flows out of equity funds and ETFs this year. Not exactly a buying panic!

cwd-122719.png (521x337, AR: 1.55)<

6. Those are many of the reasons I’m keeping my optimist’s hat on. That said, I’m also not leaving my brain at the door, as the short-term is looking increasingly likely to bring some rockiness.

7. First is the fact that I’ve brought up in my Cabot Weekly Reviews: The fact is the market and most stocks have been running now for about 13 weeks from the early-October low, and many are extended above moving averages. There’s nothing magical about 13 weeks at all, but the farther you get in the rally, the more vulnerable things are to potholes, shakeouts and random pullbacks.

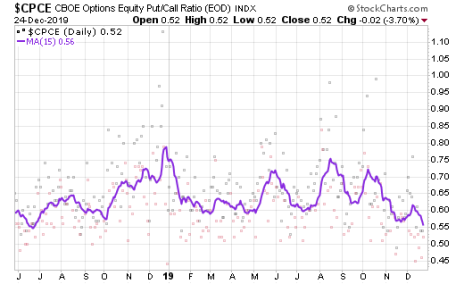

8. Second, there’s no question that shorter-term sentiment is heating up—telling me a lot of late buyers are jumping on the train. For instance, the equity put-call ratio (below), the 15-day moving average is nearing its lowest level since June 2018.

9. Throw in the fact that there’s not much to worry about in this year-end stock market (the Fed is thought to be on the sidelines for a while; U.S.-China Phase 1 deal is taken care of; recession seems off the table) and I wouldn’t be surprised to see some “unexpected” bad news hit the market in the near future.

10. So what do you do? Well, first, now’s probably a good time to get stricter with laggards, especially if they’ve recently popped higher with the market. Thus, if you own some duds—whether they’re recent buys or things that you have held on through deep corrections and they’ve come back some in recent weeks—you probably want to consider selling or putting in a tight stop.

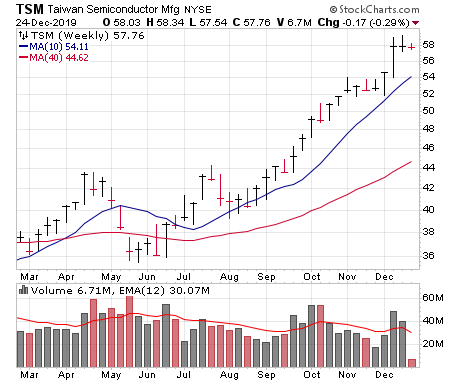

11. On the buy side, I’m more in favor of looking for pullbacks in stocks that (a) are clear leaders and (b) tighten up or pull back to their 50-day (or 10-week) moving average. We’ve already seen this play out with some stocks during this advance—look at Taiwan Semi (TSM), which kissed its 10-week line a month ago and immediately burst higher. My guess is if we see some market indigestion or rotation, strong performers will find support if they retreat.

12. On the flip side, I’m still open to fresh breakouts, especially if it’s part of a group move. And one group that actually looks like it might be setting up is the popular cloud software group—ServiceNow (NOW) popped above some resistance earlier this year, Coupa (COUP) remains wild but is perched near its peak and Anaplan (PLAN) had its biggest volume ever when it gapped up on earnings a month ago and has tightened up since. I’m still a bit suspect of the sector given that they had such huge runs (early 2018 through mid 2019), but sometimes you see rotation when we enter a New Year, so I’m keeping an eye on these names to see if they lift off in early 2020.

[author_ad]