Several Federal Reserve members in the last two weeks have made it clear that they remain worried about inflation. This hawkish stance, along with hotter-than-expected inflation data, has helped push many T-bill yields to levels not seen in years. So, the question becomes, why buy stocks, when you can safely collect 5% in bonds?

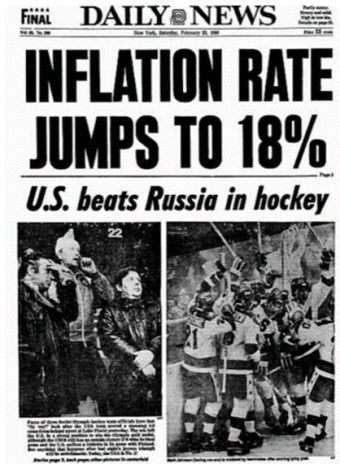

Let’s start with some perspective on the current state of inflation, versus where inflation was 33 years ago, as noted on the front page of the Daily News (also, a small hockey game got second billing that day):

Fast forward to today, and while there is no doubt that inflation is running hotter than it was in recent years (around 6%), several Fed members in the last two weeks have hinted that interest rates are going to continue to rise, as inflation is still a concern. Here are some comments from central bank members:

[text_ad]

Fed’s Lorie Logan: Must be ready to hike rates for longer than now expected.

Fed’s John Williams: Fed still has a way to go to control inflation levels. Current levels of inflation remain far too high. Will take several years to get inflation back to 2%.

Fed’s Jim Bullard: My overall judgment is it will be a long battle against inflation, and we’ll probably have to continue to show inflation-fighting resolve as we go through 2023.

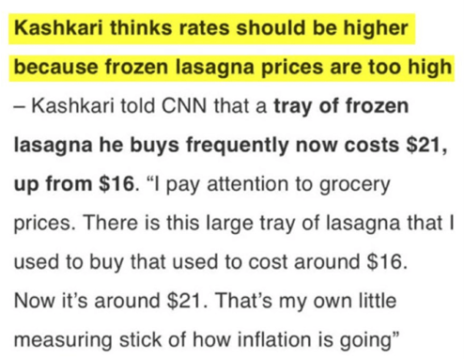

Fed’s Neel Kashkari: Risk of underdoing it is a much bigger risk for U.S. economy than overtightening.

And while all of the Federal Reserve members above have studied inflation in much greater detail than I have, let’s not forget that the central bank just over a year ago called inflation transitory, oh, and Neel Kashkari has a not-so-sophisticated measuring tool for gauging inflation, as noted below:

Stepping back, I do believe the Fed will continue to raise interest rates at their next two or three meetings. However, just because bonds are yielding 5% or more, that doesn’t mean the market can’t also perform well, as noted by @awealthofcs on Twitter:

“25 out of the past 89 years have seen T-bill rates average 5% or more …

In those 25 years, the S&P 500 has had average annual returns of 11%.”

That’s right, the S&P 500 has had an average annual return of 11% when T-bill rates are 5% or higher!

On top of that data, I would note that I’m very encouraged by the market’s action in the last several weeks as the Fed continues to talk tough, the bond market has had a MONSTER move, and while the indexes have given up some ground, they have hardly fallen apart.

Also, the Chicago Board of Options Exchange Volatility Index (VIX) is hardly screaming panic, having mostly traded below 20 for the past month.

With all that in mind, what could spur a market rally if bonds are yielding 5% or more?

I continue to think there is the potential for a Fear of Missing Out (FOMO) rally. Take, for example, this data from Cabot Growth Investor’s Mike Cintolo:

“Money flows into equity ETFs/mutual funds remained strong for all of Q1 (~$45 billion inflow) last year.

So far this year, we’ve seen about the $40 billion come OUT of funds despite a comparatively better start.”

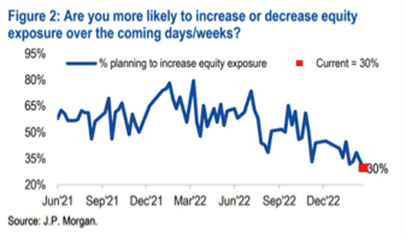

And on top of the selling this year, the JPMorgan Client Survey below highlights that clients were not planning on adding equity exposure in the coming weeks:

So, what does it all mean? I continue to think that the stock market is doing a good job of pricing in further rate hikes, and, should the indexes stabilize and start to trend higher, with so many traders underinvested, we could see a rip-roaring rally later this year.

[author_ad]