Recent Fed commentary is reiterating the idea that we have transitory inflation, but consumer prices are increasing and not expected to slow until next year.

Over the last several months the Fed has repeatedly reassured investors that what we’re experiencing is transitory inflation, presumably to continue justifying rock-bottom interest rates and a ballooning balance sheet (more on that below). Unfortunately for consumers, the Fed’s talking points aren’t the signal that the average news reader might expect.

When most consumers think about inflation and how it affects them, they’re thinking about the price of gas at the pump, the cost of vehicles, food and other normal household expenditures. So seeing headlines promising transitory inflation conveys the idea that prices are increasing now, but will retreat at some point in the future.

Per recent comments made by the Fed’s Chair, Jerome Powell, what they’re actually signaling is that the rate of inflation is transitory, not the inflation itself. Put another way, the price increases we’re all experiencing now will likely stick around (Powell did indicate that some prices will likely return to pre-inflation levels) but price growth is only expected to slow in the future.

[text_ad]

Transitory Inflation: Investors vs. Consumers

So, where does that leave us? The answer is very different depending on whether you’re approaching the question as an investor or as a consumer. For investors, specifically equity investors, the Fed’s practices are a boon to the stock market while simultaneously dragging down bond market yields.

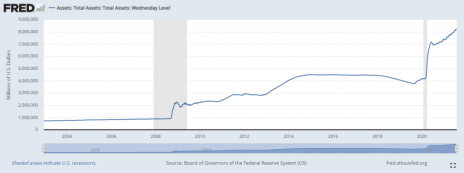

As you can see in the chart below, courtesy of the St. Louis Federal Reserve, the Fed’s holdings have skyrocketed over the last two decades.

You can see a spike in 2009 when the Fed began buying Treasuries and government-backed securities in response to the Great Recession, which doubled the balance sheet to roughly $2 trillion and gradually grew to about $4 trillion before beginning to taper and then more than doubling again with the arrival of Covid.

This glut of bond buying drives down yields on the safest and most liquid government bonds which, in turn, pushes institutional buyers into other riskier assets in search of returns, such as highly rated AAA corporate bonds. As you can see in the chart below, that bond buying has significantly reduced yields in those securities as well (bond prices and yields move in opposite directions).

When institutions and investors are no longer able to find safe, or relatively safe, returns in those markets they’re forced into even riskier assets like high-yield bonds and equities.

At this point, even high-yield bonds are offering returns like AAA bonds were paying just a few years ago.

The Fed’s liquidity firehose is broadly forcing down yields, causing “transitory inflation,” and artificially ballooning equity valuations because investors have nowhere else to go to find returns. That practice is fine for stock investors as long as it continues. The problems begin to arise if and when that firehose turns off.

If the Fed begins liquidating Treasuries and government-backed bonds, yields head higher and institutional investors will begin retreating from equities and reversing the cycle above, which is bad news for retail investors who are generally left holding the bag during market corrections.

As a consumer, you’re seeing the effects of this easy money supply, coupled with pandemic shortages, every day. The Consumer Price Index (CPI-W, which is used for Social Security adjustments) has experienced a 6% year-over-year increase, with a nearly 1% jump between May and June (the most recently published figure, and the largest month-over-month increase since 2008).

That will translate to a sizeable raise for Social Security recipients but just ongoing higher prices for everyone else.

Ultimately, if you’re an equity investor your net returns are likely enough to offset those higher prices for as long as the firehose is on. But until the Fed makes changes to its buying practices, bond investors and consumers are going to keep feeling the pinch of low yields and high prices from so-called transitory inflation.

[author_ad]