Shares of Chipotle Mexican Grill (CMG) have long carried the distinction of being the highest-priced fast-food restaurant shares on the market, having traded north of 1,000/share since mid-2020.

Following the approval of a 50-for-1 stock split effective after the market close on June 25, 2024, that will no longer be the case, as shares, which are currently trading near 3,000, will begin trading near 60 the next day (share prices are at the time of writing and will vary based on market movement in the interim).

While high share prices are (or should be) entirely irrelevant for investors, there has always been something incongruous about CMG shares trading for around 100 or 200 times the cost of a single Chipotle burrito.

[text_ad]

Incongruity aside, it’s not as if CMG shares have suffered as a result of the high share prices. They’re up over 80% in the last year (and up 7% intraday after the split approval).

So why the stock split? After all, it’s one of the “largest” in history. (Largest here meaning biggest forward split ratios; Alphabet (GOOGL) and Amazon (AMZN) both underwent 20-for-1 stock splits in 2022. There have been a number of larger splits in the other direction where low-priced issues reverse split 1-for-100 to try and stabilize share prices.)

Chipotle’s (CMG) Reasoning for the Stock Split

Per the company’s press release announcing the split, it’s intended to facilitate ownership by employees:

“This is the first stock split in Chipotle’s 30-year history, and we believe this will make our stock more accessible to employees as well as a broader range of investors,” said Jack Hartung, Chief Financial and Administrative Officer, Chipotle. “This split comes at a time when our stock is experiencing an all-time high driven by record revenues, profits, and growth.”

Two takeaways from those talking points: 1) The split is irrelevant as far as “record revenues, profits, and growth” are concerned; those record returns are just going to be distributed (split as it were) among a larger number of shares. 2) Employee accessibility to shares isn’t nothing.

From a practical standpoint, low-wage fast-food workers participating in a stock purchase plan are likely to feel materially better about doing so when a quarter’s worth of contributions is now buying whole shares rather than fractional shares.

An employee earning $15 an hour, working 40 hours per week and investing 15% of their pay in a stock purchase plan (which appears to be the cap for CMG’s plan per a cursory online search) could set aside $360 a month, or $1,080 a quarter. That translates to roughly one-third of a single share. From a purely psychological perspective, it must be frustrating to allocate as much as you possibly can into a stock purchase plan and to see the fruits of your labors translate into just over one share per year.

It’s not hard to imagine low employee participation or at least grumbling by low-level employees about their employee stock purchase plan (ESPP). The split does a meaningful job of addressing those issues without any material changes to the company’s operations, ESPP or compensation.

We could, in all fairness, take the company’s press release at face value. It offers a psychological benefit (if not a financial one) for employees without costing the company a dime.

Or…

… we could dig a little deeper and focus on their stated goal of making shares “more accessible” to a “broader range of investors.”

Perhaps this is the cynic in me speaking, but I suspect that after offering a stock purchase plan for nearly 13 years (SEC filings indicate that the first ESPP was approved in May of 2011), there may be more to the stock split decision than improving employee participation in a decade-old plan.

Again, we can take the explanation at face value and see this as a fix for a slow-burn problem that is being exacerbated by the high share price. The calculation above would have been less frustrating for employees in 2019, say, when shares were trading at a fifth of their current value (even with lower wages, employees may have been able to buy a full share each quarter).

But I suspect this is more of a response to a modern investing dynamic than an employee dynamic: options.

Options Traders: Another Possible Explanation for Chipotle’s (CMG) Split

The retail share of options trading skyrocketed during the pandemic, rising from about 35% of options contracts in November of 2019 to nearly 50% of options contracts now (high was 48% in May 2020, consistently near 45% in the years since).

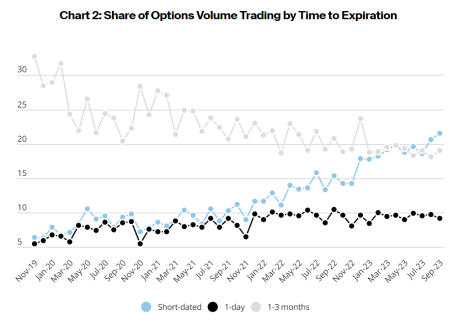

And those retail options traders are gravitating to shorter-dated contracts, as you can see in the chart below (both the figures above and the chart below are from the NYSE):

High-priced shares are largely irrelevant if you’re a long-term investor that can afford to allocate $3,000 or more to a single position. But they’re prohibitively expensive if you’re a small-stakes trader looking for short-term options contracts because even an at-the-money call with a one-week expiration may be more than you can afford to trade (CMG March 28, 2024, 2,990 strike calls are $42, or $4,200 per contract).

The growing casino-ification of the markets by retail investors using quick-hitting options trade has been undeniable since the pandemic and subsequent meme stock frenzy. It’s not a stretch to imagine that this decision could have been made in service to those traders.

I’m not saying that Chipotle saw the GameStop (GME) saga and thought they’d be the next stock to go “to the moon,” but trader sentiment matters and it’s tough to foster positive trader sentiment if your expensive shares price them out of participation.

Perhaps this is all unwarranted speculation and employee frustration with the stock purchase plan is actually the primary motivator for the share split (that, and the market loves stock splits), but I suspect that the company saw how the market winds were blowing and felt like they were being left behind by fresh market dynamics that are favoring lower-priced options on already popular stocks.

[author_ad]