Last year, the market saw a modest number of stock splits. But with shares surging since November, you can bet that number will rise in 2024.

Companies use splits to increase the number of their shares—primarily as a tool to provide more liquidity in the stock. But splits also create investor excitement because:

1. Investors often see an upcoming split as positive, thinking good news may be in the offing or that the split means the company is expecting to supercharge its growth.

2. Splits (not reverse splits) decrease the price of the shares, making them more attractive to many investors. After all, psychologically speaking, it’s much easier to load up on a $10 share than a $20 one, right—even though you still have the same dollar amount of shares!

3. Stock splits improve a company’s liquidity. A 2009 study published in the Journal of Financial Economics reported, “On average, liquidity improvements reduce the cost of equity capital by 17.3%, or 2.42% points per annum, suggesting that the economic benefits of stock splits are nontrivial.”

And while a split does decrease the price of the shares, theoretically, it doesn’t change the market value of a stock, as the formula remains the same: number of shares x price.

[text_ad]

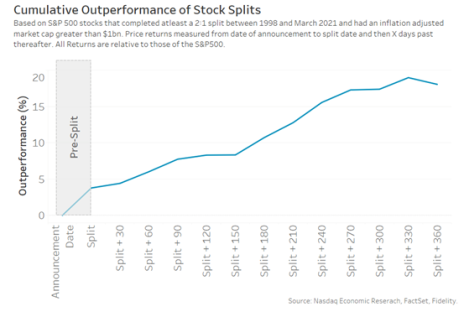

However, academic studies, over time, show that a split can actually boost the future value of a stock, as you can see in the graph below.

The most common split ratios are 2-for-1 or 3-for-1 (also shown as 2:1 or 3:1). Translation: For every share you held before the split, you will now have two or three shares, respectively, after the split. But a company’s board of directors can really choose any sort of ratio they want, such as 5-for-1 or even 100-for-1.

Here’s how it works, using the example from when Apple (AAPL) last split its shares 4-for-1in 2020:

Share price at split: $540

Share price after the split: 540/4 = $135

If you owned 100 shares of AAPL prior to the split, your stock’s value was 100 x 540 = $54,000

After the split, your shares would be worth the same amount: 400 x 135 = $54,000

Today, if you still own those 400 shares, they would be worth 400 x 188.09 (today’s price) = $75,236

And there’s also no limit on how many times a stock can split. Apple is the most-split company publicly traded, with five splits under its belt. Alternatively, Berkshire Hathaway A (BRK-A) shares have never split (that’s why they trade at $597,070.50 as I write this!).

But you should also know that there may be some disadvantages to a company that splits its stock, including:

· Splits are expensive to undertake, incurring legal and regulatory costs.

· They don’t inherently make the company worth more (maybe in the long run!)

· May attract the wrong sort of investors (folks that may not be as loyal and more prone to sell on news—unlike the Berkshire Hathaway investors who are Warren Buffett die-hard fans).

· There may be regulatory hurdles if the stock trades under the exchanges’ required levels.

Now, splits in which you receive more shares are known as forward splits. Companies may also do reverse splits where they shrink the number of shares, (a subject for another day, and also a cautionary tale!) One interesting fact, by the middle of 2023, there had been 164 reverse stock splits—a pretty high number).

It’s also good to know that stock splits have no effect on your taxes, as they don’t increase your taxable income.

So far in 2024, there were nine splits in January (mostly biotechs) and six thus far in February (healthcare, tech).

But there’s a big one on the horizon! Walmart (WMT) is scheduled to split its shares 3-for-1 on February 26. Investors are so excited about this that they have been bidding the shares of WMT up all month. Walmart has been a much-loved stock for many years of its existence. And in 2023, it became a Dividend King, which means the company has raised its dividends for 50 consecutive years.

WMT pays a dividend yield of 1.35% and is rated a Strong Buy by Wall Street.

One more upcoming split is The Cooper Companies (COO), due to split 4-for-1 on February 20. Cooper operates CooperVision and CooperSurgical, providing 1) contact lenses and 2) fertility products and services, medical devices, and contraception, as well as cryostorage. The shares pay a 0.02% dividend and are rated Buy.

If you are interested in keeping up with upcoming stock splits, here are a couple of useful sites:

https://www.nasdaq.com/market-activity/stock-splits

https://www.marketbeat.com/stock-splits/

My opinion is that splits are attractive, but are only one reason that may encourage you to buy the shares of a company. As you can see from the graph at the beginning of this article, any gains due to the splits alone are generally earned in the long term.

[author_ad]