Gold is widely considered by investors to be one of the best safe haven investments for periods of economic and geopolitical turmoil. Indeed, that belief is validated by gold’s long-term track record of increasing in price during unstable times, making it one of the best assets to own in a tumultuous investing environment.

Surprisingly, however, gold disappointed investors’ bullish expectations during most of 2022, despite the metal having plenty of reasons—both economic and geopolitical—for rallying.

The metal’s underwhelming yearly performance has resulted in a fairly heavy outflow of money from gold-oriented ETFs in recent months. According to the latest data, for instance, global gold ETFs registered their seventh consecutive month of net outflows as of the end of November.

But there are compelling reasons why investors have likely bailed out of gold too early. Based on a key fundamental factor we’ll discuss here, gold looks poised to perform better in 2023 than it did this year.

[text_ad]

Probably the biggest reason for gold’s anticlimactic 2022 price performance was the relentless drive higher for Treasury bond yields. Historically, gold performs best in a falling bond yield environment—mainly because gold doesn’t offer a yield.

Moreover, when bond yields are falling it often means the economy isn’t reaching its full potential, which can become a reason for safety-oriented investors to allocate more money to gold as a hedge against economic weakness.

From that perspective, it makes sense that this year’s persistent rally in the 10-year Treasury bond yield was a major headwind for the price of gold. To wit, the steady march higher for yields was in lockstep with the sustained increase in inflation pressures during much of 2021-2022.

2 Bullish Catalysts for the Price of Gold

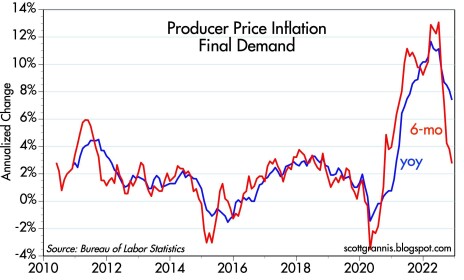

As Wall Street economist Scott Grannis has pointed out, inflation on the wholesale level peaked in June and has since plunged, as shown in the graph of U.S. producer price inflation (below).

A reduction in inflation pressures should result in lower bond yields going forward, which in turn should be good for gold prices in the coming months. Already we’ve seen 10-year yields decline by 20% since October, while gold has risen 13% in that period. This illustrates gold’s tendency to rally whenever bond yields are falling.

Another key consideration for the price of gold in 2023 is the recent inversion of a widely watched Treasury yield curve. The spread between the 10-year bond yield and the three-month yield went negative in October for the first time since early 2020.

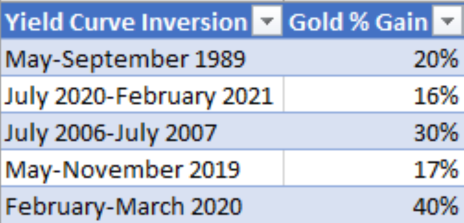

This is extremely significant not only because yield curve inversions have always preceded economic recessions, but also because they’ve anticipated meaningful gold rallies in every case without exception going back to at least 1989.

Here’s what happened to gold each time the yield curve inverted:

Specifically, in each of the above instances, the gold price rally followed the yield curve inversion as soon as the Treasury yield curve turned up again after inverting. The duration of each of the subsequent gold rallies was between three and five months.

The latest yield curve inversion occurred in October of this year, but it hasn’t reversed yet. When it does, though, investors should be prepared for an extended move higher in gold prices by owning some shares in an actively traded, gold-backed fund like the Sprott Physical Gold Trust (PHYS) or the GraniteShares Gold Trust (BAR).

[author_ad]