Gold has been a source of frustration for investors who bought it as a hedge against pandemic-related economic and political uncertainty. Its price has continually eroded in the last several months, prompting growing concern that perhaps the metal has lost its value as a safety hedge.

I’ll make the case here that gold’s value as a protection against both uncertainty and inflation should remain intact. I’ll also explain what is holding gold prices back and what likely needs to happen before the yellow metal can finally resumes its long-term rise.

[text_ad]

Investors who bought gold during last year’s “pandemic panic” bottom certainly have cause to celebrate. From its intraday low of around $1,450 in March 2020, the yellow metal’s price rose to nearly $2,100 by August in an eye-popping 45% rally. And while gold sagged in the months that followed, it still finished the year higher with a respectable 30% gain.

That rally continued into the beginning of 2022, when rising commodity prices and the war in Ukraine pushed prices back near 2020’s highs. Since then, however, gold has given back all of the year’s gains and has returned to 2021 price levels.

This has caused many investors to ask: “What is keeping gold from rallying?” and “What will it take for it to finally turn around?”

Why Gold Prices are Falling

The first question is the result of the puzzlement over gold’s currency factor. Since gold is priced in dollars, a decline in the dollar normally results in a corresponding advance in gold prices. Conversely, a strengthening dollar typically contributes to declining gold prices.

Adding to that pressure is a significant countervailing force. In this case, the force in question is the current trajectory of U.S. Treasury bond yields.

Gold, in fact, competes with Treasury bonds; and since gold doesn’t offer a yield, yield-seeking investors tend to favor bonds over gold whenever bond rates are rising. Indeed, the rising 10-year yield has convinced many investors to allocate more of their money to Treasuries at gold’s expense as they remain focused on chasing higher yields. The following chart illustrates the relative strength of TNX versus gold.

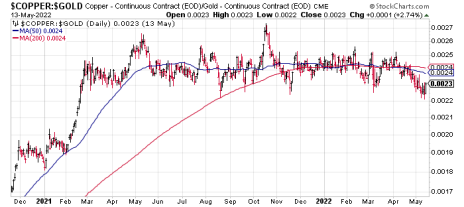

There is some evidence, in the short term at least, that the trend in rising treasury yields may be encountering resistance. The basis for this prediction is the copper-gold ratio, which is the quotient of the price-per-pound of copper divided by the price-per-troy-ounce of gold. Besides being an indicator of the global economy’s health, the copper-gold ratio is also an excellent predictor for the future direction of Treasury rates.

For instance, the copper-gold ratio predicted a 10-year Treasury yield between 2.8% and 3% about a year ago. (The comparison is made by comparing the current value of this ratio to where the Treasury yield stood the last time the ratio reached these levels) The last time the 10-year yield hit 3% was 2018, so it only made sense that we would see TNX reach 3% before the next “correction” in the 10-year yield.

How You’ll Know Gold is on the Rebound

All told, a significant T-bond yield decline is probably what it will take to kickstart the next extended rally for gold. Falling yields will cause investors to reevaluate their choice in safe-haven assets, and lower yields will naturally make owning Treasuries less attractive than owning gold. Moreover, assuming the dollar weakens, it should serve as an added enticement for participants to own the yellow metal as a hedge against future inflation.

Bottom line: Gold’s next extended upside move isn’t likely to commence until the rising trend in the 10-year yield has exhausted itself. Rising yields will likely continue to exert some downward pressure on gold prices. For short-term trading purposes, a sharp decline under the 50-day line in the TNX (below) will serve as a preliminary signal that gold is primed for a turnaround.

In the meantime, with industrial metals (like copper, steel and aluminum) and rare earth metals still outperforming, it’s my opinion that investors are justified in maintaining higher portfolio weightings in these base metals (via stocks and ETFs) versus precious metals. Just be sure to use a conservative money management discipline (or stop-loss strategy) whenever you’re trading the metals markets.

In our Cabot Top Ten Trader advisory, chief analyst Mike Cintolo has provided some highly profitable trading ideas for rare earths, base metal, and energy stocks recently.

Each week, Mike also covers a wide variety of stocks in several major sectors and industries. I highly recommend checking out Top Ten Trader. It’s a great resource for keeping your portfolio in the black until the next gold bull run comes along. And when that time finally arrives, you can rest assured the Top Ten Trader will be on top of some of the best-performing stocks in the precious metals arena.

To learn more, click here.

[author_ad]