Earnings growth (or the expectation of earnings growth) is the biggest determinant of stock price appreciation. Sure, you can find special circumstances when investors didn’t care much about earnings. Think about the tech boom and bust of the late 90s. But we also know what happened to those companies whose shares went into the stratosphere, despite having no earnings to show. Boom! They fell faster than they rose!

Consequently, companies whose earnings are growing—or anticipated to grow at a fast pace, all other market and economic factors being equal—should also enjoy above-market returns on their share prices. A couple of hundred years’ worth of data will back me up.

The average annual market gain for the S&P 500 Index (an index based on the market capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ) is about 10% over the past century.

[text_ad]

However, if you look at the table below, you’ll see that in the past decade, in seven years, the markets have outperformed the average returns.

S&P 500 Stock Market Returns By Year

| Year | S&P 500 Rate of Return |

| 2021 | 26.89% |

| 2020 | 16.26% |

| 2019 | 28.88% |

| 2018 | -6.24% |

| 2017 | 19.42% |

| 2016 | 9.54% |

| 2015 | -0.73% |

| 2014 | 11.39% |

| 2013 | 29.60% |

| 2012 | 13.41% |

Source: SeekingAlpha.com

Earnings growth does not guarantee market success, as so far in 2022, the companies in the S&P 500 index have seen their earnings rise by 5.1%. Yet, stocks in the index have fallen by almost 18% in that time.

However, as I said earlier, earnings—or the anticipation of earnings—are the best prediction for stock movements.

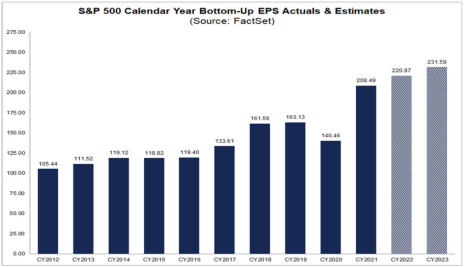

The first chart shows the S&P 500 companies’ 2022 and estimated 2023 earnings.

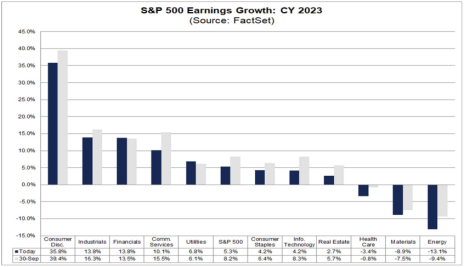

And this chart shows how the sectors in the S&P 500 have performed so far this year.

What’s Ahead in 2023?

Right now, high inflation, rising interest rates, and the threat of a recession are all on investors’ minds as we near the end of 2022. Recent reports indicate that inflation is moderating, the Fed made a smaller increase in rates in its last meeting, but recession fears continue to worry investors.

I hope we don’t see a recession. But if we do, I’d like to be prepared by peppering my portfolio with a few “recession-proof” stocks. Those are generally companies that are considered “inelastic”—essentials—things we cannot live without. They include utilities, healthcare, consumer staples, and maybe even technology.

But you can’t just throw a dart at those industries. The companies we select must have additional attractive characteristics, including earnings growth.

With that in mind, I ran a search to see which companies were forecast to have the most earnings growth in 2023.

Surprise! Most of them were biotech, consumer cyclical, and technology.

From there, I again narrowed my search, to find out which companies Wall Street was buying (both good indications of future gains).

I came up with 87 stocks. I further narrowed my search by reviewing the fundamentals (cash flow, debt, insider buying, etc.) as well as the technicals (moving averages and relative strength) to determine which companies looked like the best buys right now.

3 Attractive Stocks Heading into 2023

Aehr Test Systems (AEHR) provides test systems for burning-in semiconductor devices in wafer level, singulated die, and package part form worldwide.

Price: 22.25

52-week Range: 6.71 - 28.00

Market Cap: 611.858M

Analyst Ranking: Buy

Richardson Electronics, Ltd. (RELL) engages in power and microwave technologies, customized display solutions, and healthcare businesses in North America, the Asia Pacific, Europe, and Latin America.

Price: 21.12

52-week Range: 11.01 - 27.24

Market Cap: 293.582M

Analyst Ranking: Buy

TransMedics Group, Inc. (TMDX) engages in transforming organ transplant therapy for end-stage organ failure patients in the United States and internationally.

Price: 57.26

52-week Range: 10.00 - 64.36

Market Cap: 1.828B

Analyst Ranking: Buy

AEHR and RELL are both very small-cap stocks, which means they will be fairly speculative. TMDX is a biotech, and is also a speculative idea. So please don’t overload your portfolios with these shares, and remember—you must do your own due diligence to make sure any or all of them dovetail with your investing strategy and risk profile.

My best wishes for a wonderful holiday to you and yours!

For Nancy’s portfolio of stocks and ETFs, as well as other timely content about all things personal finance and investing, subscribe to Cabot Money Club today!

[author_ad]