Suddenly, it seems, inflation could be a problem for the stock market.

Perhaps it is hard to believe that inflation could be the thing that finally spoils this stock market party. After all, since the early 2000s, and especially since the global financial crisis in 2008, deflation has been the bigger fear—as in too little economic growth and not enough inflation.

Even the Federal Reserve, the world’s most powerful central bank, has for years complained about a lack of inflation. In fact, the Fed’s easy money policies in recent years, and especially since the pandemic, have been geared toward two things:

- Keeping interest rates lower for longer to stimulate the economy and ...

- Producing MORE inflation.

The Fed is on record saying that they want inflation above 2%. That has been their target for some time. But inflation has consistently fallen short of that mark. The Fed says they are OK if inflation “moderately exceeds 2% for some time.”

I say: Be careful what you wish for!

[text_ad]

Inflation on the Rise

In fact, several real-time measures of inflationary pressure are building already. It indicates that the Fed may be granted its wish much sooner than expected.

The U.S. Producer Price Index (PPI), for example, has risen for the last nine months in a row, posting a 5% year-over-year increase in January.

Granted, PPI is rebounding from a deep pandemic-induced hole early in 2020. But it is now at the highest level since November 2018, long before the Covid crisis began.

And then there’s this:

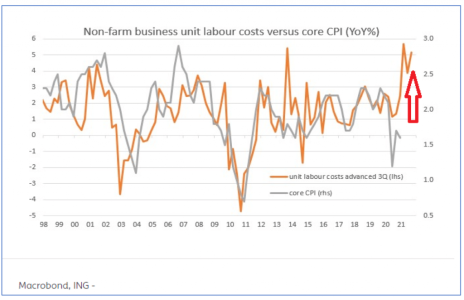

The U.S. is largely a service sector economy, which means that unit labor costs for U.S. businesses can be a big swing factor to fuel inflation.

And as you can see above, labor costs are rising at a yearly rate of more than 5% according to the latest data. That’s the highest level since 2012.

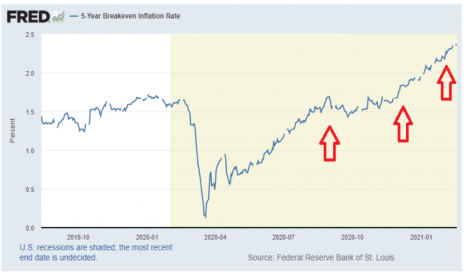

Perhaps the best inflation indicator of all is a market-based indicator. In other words, it tells you what real investors believe about future inflation, as measured by how they are actually investing their money right now.

The St. Louis Federal Reserve is a great resource. It tracks mountains of data on the economy, financial markets, interest rates and inflation. Among all this data is a real-team gauge of inflation called the 5-Year Breakeven Inflation Rate.

It tracks a measure of expected inflation over the next five years drawn from the price of actual Treasury securities that investors are buying and selling every day in the markets.

And its message is like the others above: Inflation fears are accelerating.

The five-year breakeven inflation rate has risen 42.4% year over year, currently forecasting an inflation rate well above the Fed’s 2% target.

This matters not just to bond investors but stock investors too.

That’s because stocks are valued based on a discounted cash flow of future earnings. The discount rate used in this equation is prevailing interest rates, which are still near record lows, but rising fast.

If inflation continues to accelerate, then you can bet interest rates will follow. And higher interest rates (i.e. a higher discount rate) could mean lower stock market values.

For stock investors who have grown accustomed to the market’s big gains over the past year, higher inflation is a wake-up call. But there are sectors of the market where you can hide out, because they benefit from rising rates and inflation.

Inflation Helping these 3 Stock Market Sectors

In fact, two of the best-performing sectors since the March 2020 low have been Energy, up 98.5%, and Materials, up 95.5%.

Both are cyclical sectors tied to natural resources. And companies that produce them (think oil & gas companies, or miners) have pricing power in an inflationary climate as commodity prices rise.

Another, perhaps less obvious beneficiary, is the Financial sector, big banks and credit card companies in particular. That’s because as interest rates rise, so does the rate at which they lend to businesses and consumers, which means fatter profit margins for financial stocks.

Bottom line: The Fed wants more inflation. And they’re willing to tolerate it above their 2% target for some time. Research from ING warns that “the only way is up” for inflation and that we “could see inflation push above 3.5% and possibly head close to 4% by May.” If that’s the case, I just don’t know if today’s lofty stock market is prepared for it. But forewarned is forearmed!

[author_ad]